Grains and oilseeds was the third-leading sector of the commodities market from January through March 2022, behind energy and base metals. Rising inflation and population, the war in Ukraine, and the ever-increasing demand for food pushed prices higher over the first three months of 2022 as farmers in the northern hemisphere prepared to plant the crops that feed the world. In Q1, the global population grew by over 20 million to the 7.887 billion level. In 2022, the world will require more agricultural products than in 2021 and less than 2023.

Grains and oilseeds provide nutrition and energy as corn and soybeans are critical inputs in ethanol and biodiesel production. As the world addresses climate change, the demand for alternative and renewable fuels rises. Wheat led the way higher in Q1, with corn and soybean futures posting impressive gains. Wheat moved to a new all-time high, while the corn and soybean futures markets traded at the highest prices since 2012, the year the coarse grain and oilseed reached their record peaks. Rising input prices continue to push prices higher as we move into the 2022 planting and growing seasons in Q2. The geopolitical landscape is also pushing prices higher as supply concerns are at the highest level in many years, if not decades.

Soybeans remain in the teens

Nearby CBOT soybean futures rose 21.79% in Q1 2022, after a 1.03% gain in 2021.

The chart highlights the bullish price action that took nearby May soybean futures to a high of $17.65 per bushel in Q1. The contract settled at $16.18250 on March 31 and was above the $16 level on April 5. While the beans corrected from the high, they remain in a bullish long-term trend in early Q2.

Soybean products moved higher, with soybean oil outperforming the raw oilseed with a 24.23% gain. Soybean meal futures rose 13.55% in Q1. Oil is used for cooking and biodiesel production, and it gained 32.78% in 2021. The meal is a critical ingredient in animal feeds, and it moved higher in Q1 after slipping 4.12% in 2021.

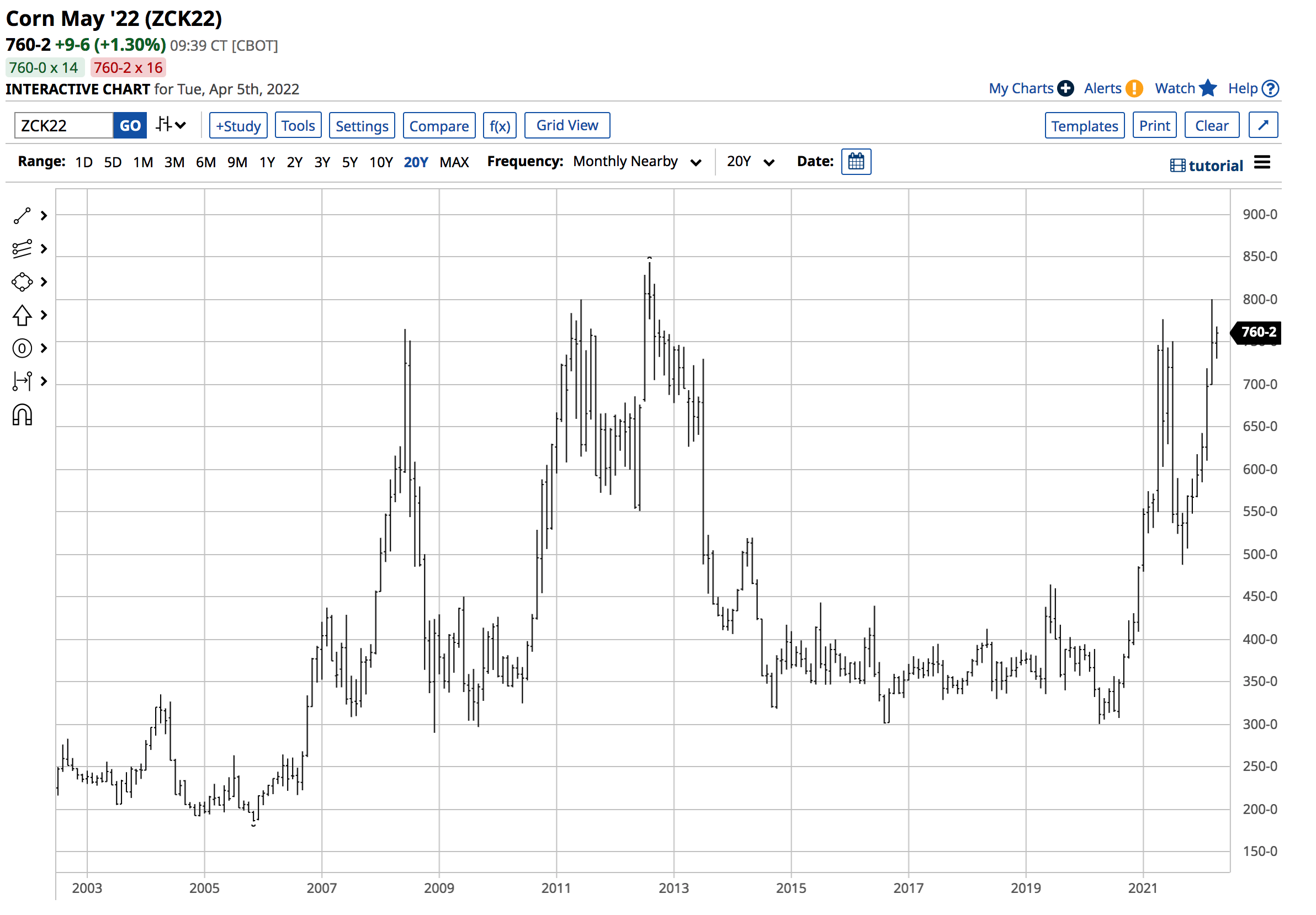

Corn makes a higher high

Corn futures posted a 26.21% gain in Q1 after rising 22.57% in 2021.

The monthly chart shows that corn futures reached a high of $8 per bushel in March 2022, the highest price since 2012. May corn futures settled at $7.4875 on March 31 and were around that level on April 5.

Corn is the primary ingredient in US ethanol production. Nearby Chicago ethanol swaps moved 5.07% higher in Q1 after rising 58.41% in 2021. Rising energy prices put upward pressure on corn futures.

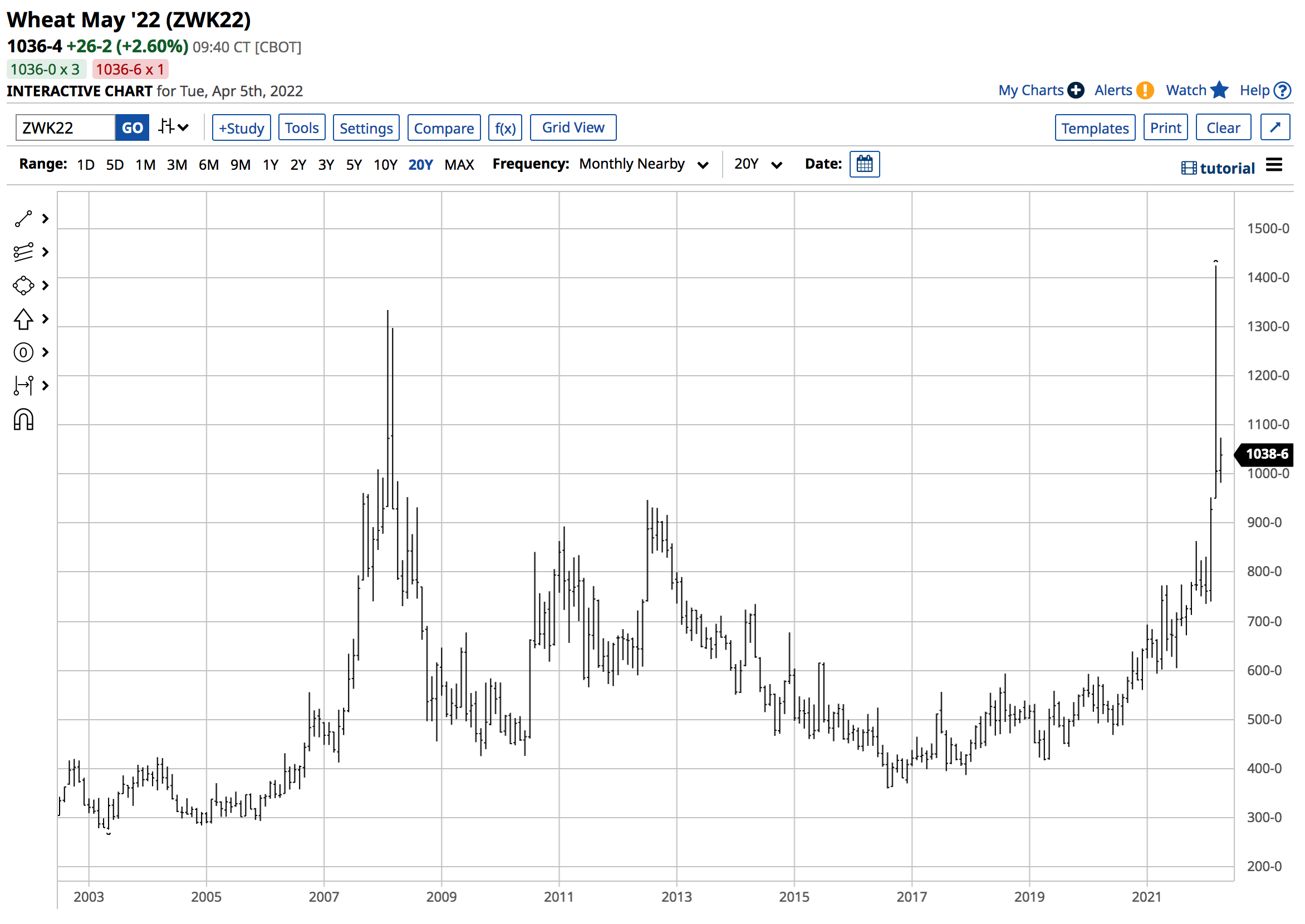

CBOT wheat rises to a record price

The CBOT soft red winter wheat futures contract is the worldwide benchmark for wheat. Russia and Ukraine export around one-third of the world’s wheat and are Europe’s breadbasket. The war in Ukraine caused supply concerns for the coming months and years, pushing wheat prices higher. CBOT wheat rose 30.52% in Q1 after a 20.34% gain in 2021.

The monthly chart highlights the move to a new all-time peak in March when CBOT wheat futures traded to $14.2525 per bushel. The May contract settled at $10.06 per bushel on March 31 and was just over the $10 level on April 5, the highest price since 2008.

KCBT and MGE Wheat futures post double-digit percentage gains

KCBT hard red winter wheat is a US domestic market, and the price moved 28.48% higher in Q1 2022 after posting a 32.81% price increase in 2021. The KCBT wheat futures settled at $10.2975 on March 31 and were near that level on April 5.

MGE spring wheat futures moved 10.18% higher in Q1 after gaining 63.5% in 2021. Last year, dry conditions lit a bullish fuse under the spring wheat futures. The MGE wheat closed Q1 at $10.7950 per bushel and was hovering around that price on April 5.

Oats and rice futures move higher

Oat futures were the worst-preforming sector member, posting a 6.52% gain. However, in 2021, the oats were the leading on the upside with an 89.33% price increase. Nearby oat futures settled at $7.2750 per bushel on March 31 and were slightly higher on April 5.

Rough rice futures gained 9.43% in Q1 2022 after rising 15.29% in 2021. The rice futures closed Q1 at the 16.01 level and were just below 16 on April 5.

The highest inflation in over four decades is increasing land values, rents, energy prices, labor, seed, and equipment prices in 2022. Moreover, fertilizer costs have soared. The war in Ukraine has turned a significant part of Europe’s breadbasket into a mine and battlefield. The Black Sea ports, critical for exports, are a war zone. Russia, a leading supplier, has “temporarily” banned fertilizer exports. Each April, uncertainty over the weather conditions determining crop sizes tends to peak. In 2022, the grain and oilseeds futures markets have a lot more to worry about than Mother Nature.

The trends in the grain and oilseed futures markets remain higher as we head into Q2 and the 2022 planting season in the commodities that feed and increasingly fuel the world.

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)