The first quarter of 2022 turned into an almost perfect bullish storm for the traditional energy commodities. Fossil fuel prices soared as Russia invaded Ukraine, and the US and Europe leveled sanctions against the Russians. Meanwhile, the energy commodity had already been rising, trending higher since the April 2020 lows. Coming into 2022, rising inflation, expanding economic conditions, and US energy policy that supports alternative and renewable fuels at the expense of hydrocarbons weighed on output as the demand increased. The shift in US energy policy handed the pricing power in the petroleum market back to the international oil cartel and Russia. After decades of striving for energy independence, OPEC+ returned to its position as the world’s most significant factor in global production.

A composite of the energy sector rose 34.88% in Q1 2022 after a 54.13% gain in 2021.

Crude oil and products post substantial gains in Q1

After moving 55.01% higher in 2021, NYMEX crude oil futures rose 33.33% in Q1 2022.

The long-term chart shows that nearby NYMEX futures reached $130.50 per barrel in March, the highest price since 2008. Even though the price dropped by over $30 by the end of the quarter, it was still 33.33% higher than the price on December 31, 2021.

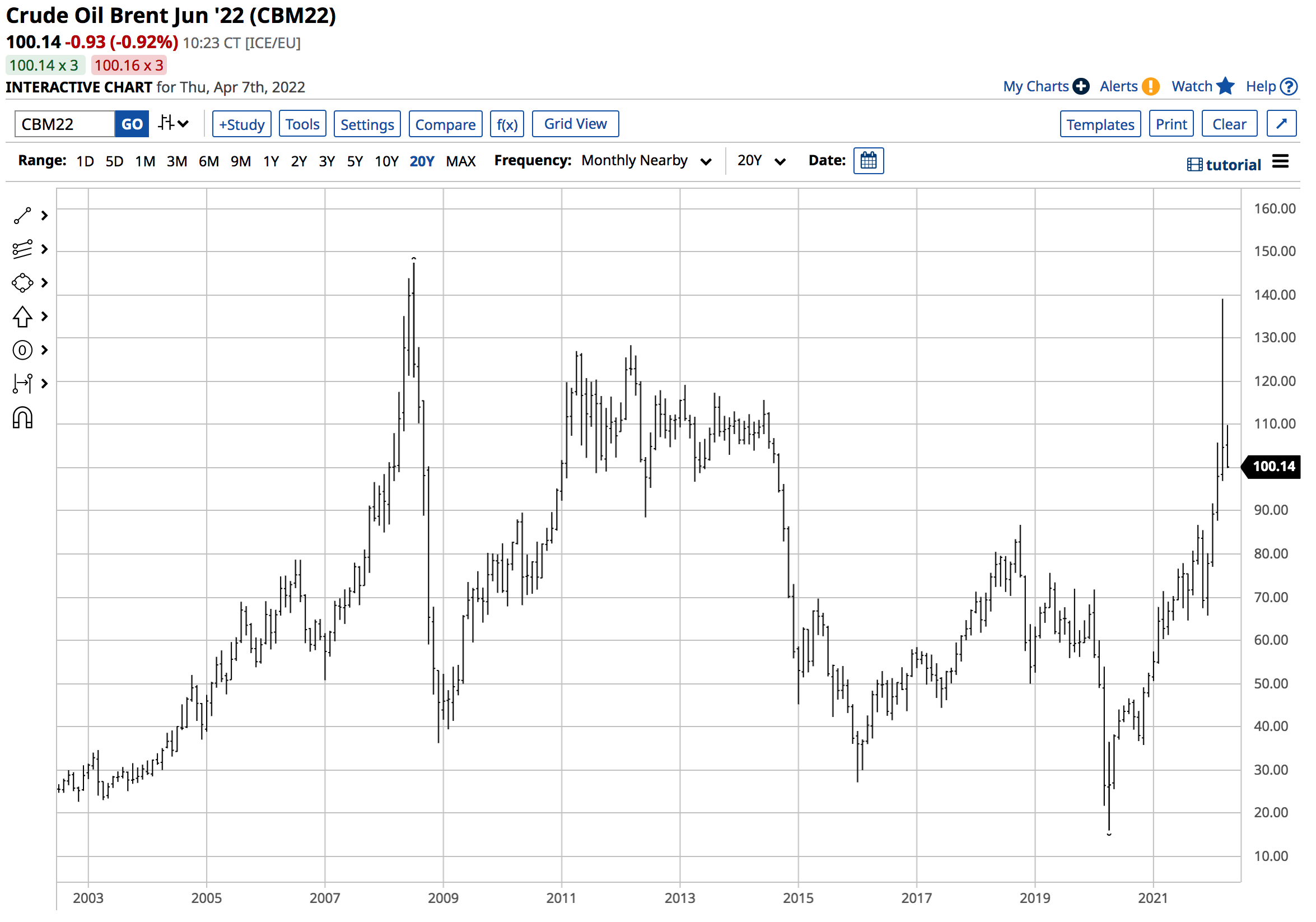

While WTI crude oil is the benchmark for around one-third of the world’s producers and consumers, Brent crude oil is the leading benchmark as it reflects prices in

Europe, Russia, North Africa, and the Middle East. ICE Brent futures rose 50.02% in 2021.

The chart shows Brent futures reached a peak of $139.13 in March before correcting. However, the leading oil benchmark price slightly outperformed the NYMEX futures rising 33.47% in Q1.

While the benchmark petroleum prices stopped short of the 2008 highs, gasoline and heating oil futures moved to new all-time peaks in March. Nearby NYMEX gasoline futures reached $3.8904 per gallon wholesale, eclipsing the 2008 $3.6310 high. Gasoline moved 57.76% higher in 2021 and another 41.64% to the upside in Q1 after falling by nearly 74 cents per gallon from the high on March 31. Nearby heating oil futures, a proxy for other distillates, including diesel and jet fuels, moved 56.69% higher in 2021 and another 44.54% to the upside in Q1. Heating oil reached a high of $4.6674 per gallon wholesale in March. The previous all-time high was at $4.1450 in 2008. The distillate fuel fell over $1.30 per gallon from the high but was still over 44.5% higher over the first three months of 2022.

Cracks tell us that the demand for products remains strong at higher prices

Crack spreads reflect the refining margin for processing crude oil into products; gasoline and distillates. The gasoline crack spread rose 69.78% in 2021 and was 73.41% higher in Q1. The distillate refining market moved 63.24% higher in 2021 and exploded 79.52% to the upside in Q1 2022.

The appreciation of the crack spreads tells us that the demand for oil products is rising as gasoline and distillate fuel prices rose more than crude oil prices in 2021 and Q1 2022.

Natural gas soars

In June 2020, natural gas prices fell to the lowest level in twenty-five years. In 2021, the energy commodity exploded higher to the highest level since 2008 when it traded to $7.346 per MMBtu in January when February futures were rolling to March futures.

Natural gas prices moved 46.91% higher in 2021.

The long-term chart shows nearby NYMEX natural gas futures rose 51.26% higher in Q1 2022, closing at the $5.642 per MMBtu level on March 31. Meanwhile, the price was higher at the $6.25 level on April 7.

Rising natural gas prices in Asia and Europe are pushing US domestic prices higher as the US now exports LNG to consumers beyond the pipeline network. Rising international prices now have far more impact on US domestic gas prices.

The explosive moves in oil and gas prices occurred as Russia invaded Ukraine and the US, Europe, and other countries put sanctions on the Russians. Meanwhile, prices were already trending much higher as the shift In the US energy policy reduced fracking and drilling and lowered fossil fuel output.

Coal is the leader

Coal has been a four-letter word in the energy complex for environmentalists. Over the past years, climate change initiatives reduced coal production in the US and worldwide. Meanwhile, coal is a less expensive energy alternative than oil and gas. China and India continue to consume coal, and rising energy prices pushed coal higher in 2021 and Q1. Last year, coal’s price increased by 70.89%.

The chart shows that ICE coal futures for delivery in Rotterdam, the Netherlands reached a record high of $465 per ton in March. Even though coal corrected from the high and settled at the $273 level on March 31, it still posted a 132.54% gain in Q1.

Ethanol swaps post a small gain and could have upside room

The quest for cleaner energy supported ethanol prices, pushing the biofuel 58.41% higher in 2021.

Nearby Chicago ethanol swaps rose 5.07% in Q1 2022, lagging behind the other energy commodities. Corn is the primary ingredient in US ethanol production, and the coarse grain rallied 22.34% in 2021 and 26.21% in Q1. Given the price action in energy and the corn markets, we could see higher ethanol prices over the coming months.

While the world moves towards alternative and renewable energy sources, hydrocarbons remain the dominant energy source. The explosive moves in oil, natural gas, and coal fuels inflationary pressures. The war in Ukraine and sanctions on Russia are likely to keep prices high throughout 2022 and perhaps beyond.

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)