Not long ago, electric vehicles (EVs) were heralded as the inevitable successors to gas-powered cars, promising a green revolution on wheels. Automakers dove headfirst into the hype, unveiling ambitious blueprints for fleets of battery-powered models and pouring billions into factories, batteries, and tech to spearhead the shift.

Yet, consumer enthusiasm never matched the buzz—range anxiety, high costs, and charging woes kept buyers at bay. The tipping point came when U.S. government subsidies evaporated under policy changes, leaving the EV market parched. Sales plummeted, forcing giants like Ford (F) and General Motors (GM) to swallow massive losses and retreat. Now, Stellantis (STLA) joins the wreckage, its EV dreams derailed in a costly crash.

About Stellantis Stock

Stellantis is a global automotive powerhouse formed from the 2021 merger of Fiat Chrysler Automobiles and PSA Group. It designs, manufactures, and sells vehicles under iconic brands like Jeep, Ram, Dodge, Chrysler, Fiat, Alfa Romeo, Peugeot, Citroën, and Opel, spanning luxury, mainstream, and commercial segments. Headquartered in Amsterdam, the company operates worldwide, with strong footholds in North America, Europe, and emerging markets, producing everything from compact cars to heavy-duty trucks.

Originally, Stellantis aimed high on EVs under former CEO Carlos Tavares, targeting 100% electric sales in Europe and 50% in the U.S. by 2030. It invested heavily in four battery EV (BEV)-native platforms (STLA Small, Medium, Large, and Frame) and battery tech to roll out dozens of models. However, EV sales lagged; in 2025, U.S. deliveries totaled just 1.2 million vehicles overall, with BEVs capturing a meager share amid broader market slowdowns.

So far in 2026, STLA stock has tumbled 34% year-to-date, far underperforming the S&P 500's ($SPX) modest 1.2% gain over the same period. It is crashing 25% today, and over the past year, shares are down 45%, versus the S&P's 12.16% advance. Valuation metrics paint a bargain picture: forward P/E at 6.35, below the auto industry average of 8 to 10; forward P/S at 0.17, half the sector's 0.4 to 0.6; P/B at 0.36, versus the industry's 1.2 to 1.5; and P/CF around 1.9, under historical norms of 4 to 6. These ratios suggest undervaluation—a low P/S indicates cheap revenue multiples, P/B shows assets exceed market cap, and P/CF highlights strong cash generation relative to price—making STLA appealing for value investors despite headwinds, at least on the surface.

How Stellantis Wrecked Itself

Stellantis stunned investors this morning with a colossal 22.2 billion euro ($26 billion) write-down, primarily tied to its EV retreat, marking the largest such hit in auto history. The charges cover canceled products like the Ram 1500 BEV, impaired platforms, supplier compensations, and resized battery operations, including 14.7 billion euros for axing U.S.-focused EVs and 2.1 billion euros for supply chain cuts.

CEO Antonio Filosa blamed "overestimating the pace of the energy transition," admitting the push alienated buyers with mismatched needs. As a result, Stellantis is slashing production, suspending its dividend, and pivoting to hybrids and combustion engines to align with demand. STLA's stock lost a quarter of its value on the news, erasing billions in market value.

This debacle echoes industry-wide missteps. Ford announced a $19.5 billion EV writedown in late 2025, canceling models like the all-electric F-150 Lightning and shifting factories to gas pickups amid lost tax credits and sluggish sales. GM followed with $7.6 billion in charges across 2025, including $6 billion for unused EV equipment and supplier payouts, plus $1.1 billion for China restructuring, as it dialed back ambitions while forecasting lower 2026 losses.

These retreats stem from policy shifts under the Trump administration, which axed subsidies, softened mandates, and favored fossils, compounding weak consumer uptake—EV sales dipped 43% for GM in Q4 2025. Analysts call it the "biggest capital allocation mistake" in auto history, with total write-downs potentially topping $100 billion as legacy makers grapple with Chinese competition and tariff threats.

Stellantis, now projecting mid-single-digit revenue growth in 2026, must rebuild U.S. share through $13 billion in investments for new models.

What Do Analysts Expect for STLA Stock?

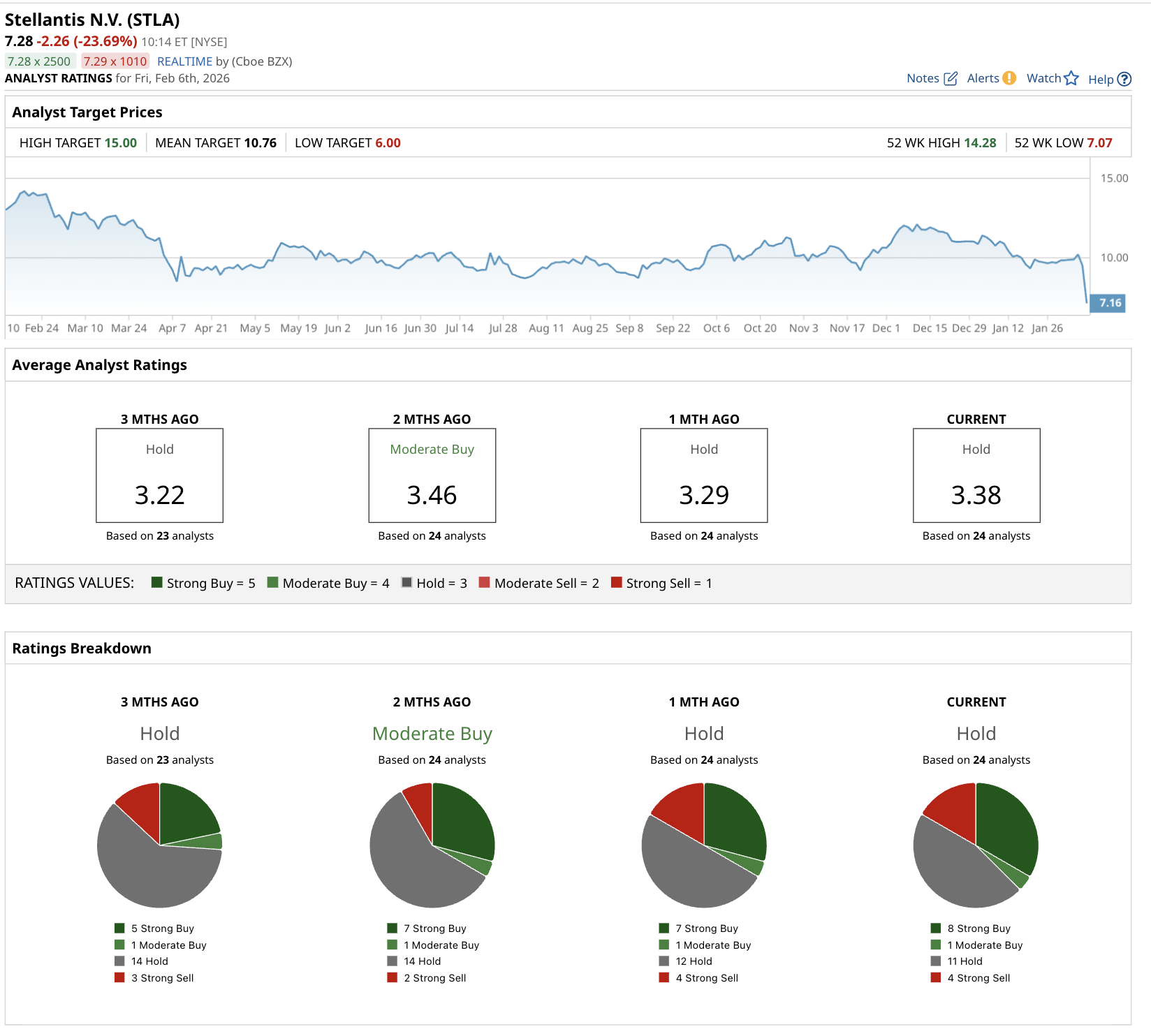

Consensus from Barchart pegs STLA at a "Hold" rating, based on 24 analysts. The breakdown sees eight analysts with a "Strong Buy" rating, one with a "Moderate Buy," 11 "Hold" ratings, and four "Strong Sell" ratings. Recent months show slight shifts, but with the write-down and EV news today, there could be major downgrades coming. Its mean target of $10.76 represents potential upside of 50% from the current $7.15 share price, but analysts may revise their targets lower after today.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)