Valued at a market cap of $19.9 billion, Albemarle Corporation (ALB) provides energy storage solutions. The Charlotte, North Carolina-based company serves grid storage, automotive, aerospace, conventional energy, electronics, construction, agriculture and food, pharmaceuticals and medical device industries.

This specialty chemicals company has significantly outpaced the broader market over the past 52 weeks. Shares of ALB have rallied 95.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.2%. Moreover, on a YTD basis, the stock is up 10.6%, compared to SPX’s marginal downtick.

Zooming in further, ALB has also notably outperformed the State Street Materials Select Sector SPDR ETF (XLB), which rose 13.4% over the past 52 weeks and 11.4% on a YTD basis.

On Nov. 5, Albemarle reported better-than-expected Q3 results, yet its shares closed down marginally in the following trading session. Due to lower pricing in its energy storage segment, the company’s net sales declined 3.5% year-over-year to $1.3 billion. However, its topline came in 1.6% ahead of analyst estimates as the pricing impact was partially offset by volume growth in both the energy storage and Ketjen segments. On the earnings front, its adjusted loss per share narrowed by 87.7% from the year-ago quarter to $0.19, topping analyst estimates by a notable margin.

For the current fiscal year, ending in December, analysts expect ALB’s loss per share to narrow by 61.5% year over year to $0.90. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

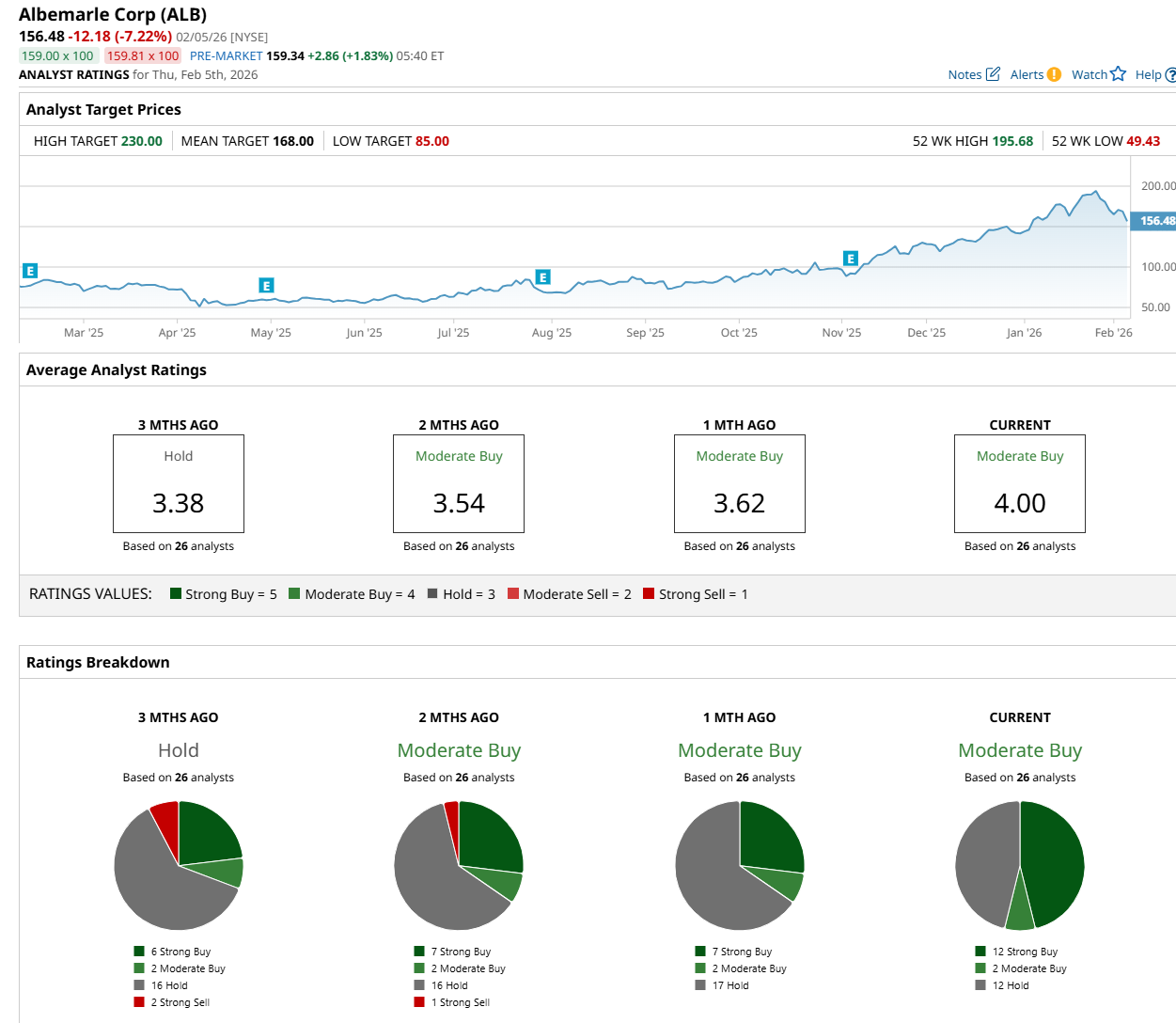

Among the 26 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 12 “Strong Buy,” two "Moderate Buy,” and 12 “Hold” ratings.

The configuration is notably more bullish than a month ago, with seven analysts suggesting a “Strong Buy” rating.

On Jan. 27, Jefferies Financial Group Inc. (JEF) analyst Laurence Alexander maintained a “Buy” rating on ALB and set a price target of $230, the Street-high price target, indicating a 47% potential upside from the current levels.

The mean price target of $168 represents a 7.4% premium from ALB’s current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)