Investor excitement around artificial intelligence (AI) has been sky-high over the past year, lifting a wide range of stocks. And among the biggest beneficiaries is Teradyne (TER), a semiconductor testing and robotics company that has quietly become a major AI winner. The company’s shares have surged by well over 100% in the past year, powered by strong demand tied directly to the AI boom.

Although Teradyne operates behind the scenes, it still plays a crucial role in the AI supply chain. The company makes sophisticated equipment used to test semiconductors and electronic circuits, exactly the kind of components found in today’s high-performance AI chips. That places Teradyne in a favorable position, with momentum across multiple fast-growing AI chip categories, including both compute and memory.

Now, the stock is back in the spotlight thanks to its latest blockbuster fourth-quarter earnings results published this month. The results revealed remarkable growth, easily beating Wall Street estimates. The company said this performance was driven by “strong AI-related demand in compute and memory” and backed that up with solid forward guidance. As AI data centers continue popping up across the country, demand is rising for the advanced testing solutions Teradyne provides.

So, with the stock already up massively and attention building again after these results, does Teradyne still have room to run from here?

About Teradyne Stock

Founded in 1960 and based in Massachusetts, Teradyne develops automated test equipment and advanced robotics systems used across the tech and industrial landscape. Its semiconductor and electronics testing tools help manufacturers ensure their products meet stringent performance and reliability standards.

Beyond testing, Teradyne operates a growing robotics business that includes collaborative robots designed to work safely alongside people, as well as mobile robots that assist with manufacturing and warehouse tasks. Together, these businesses place the company at the intersection of chip production and industrial automation.

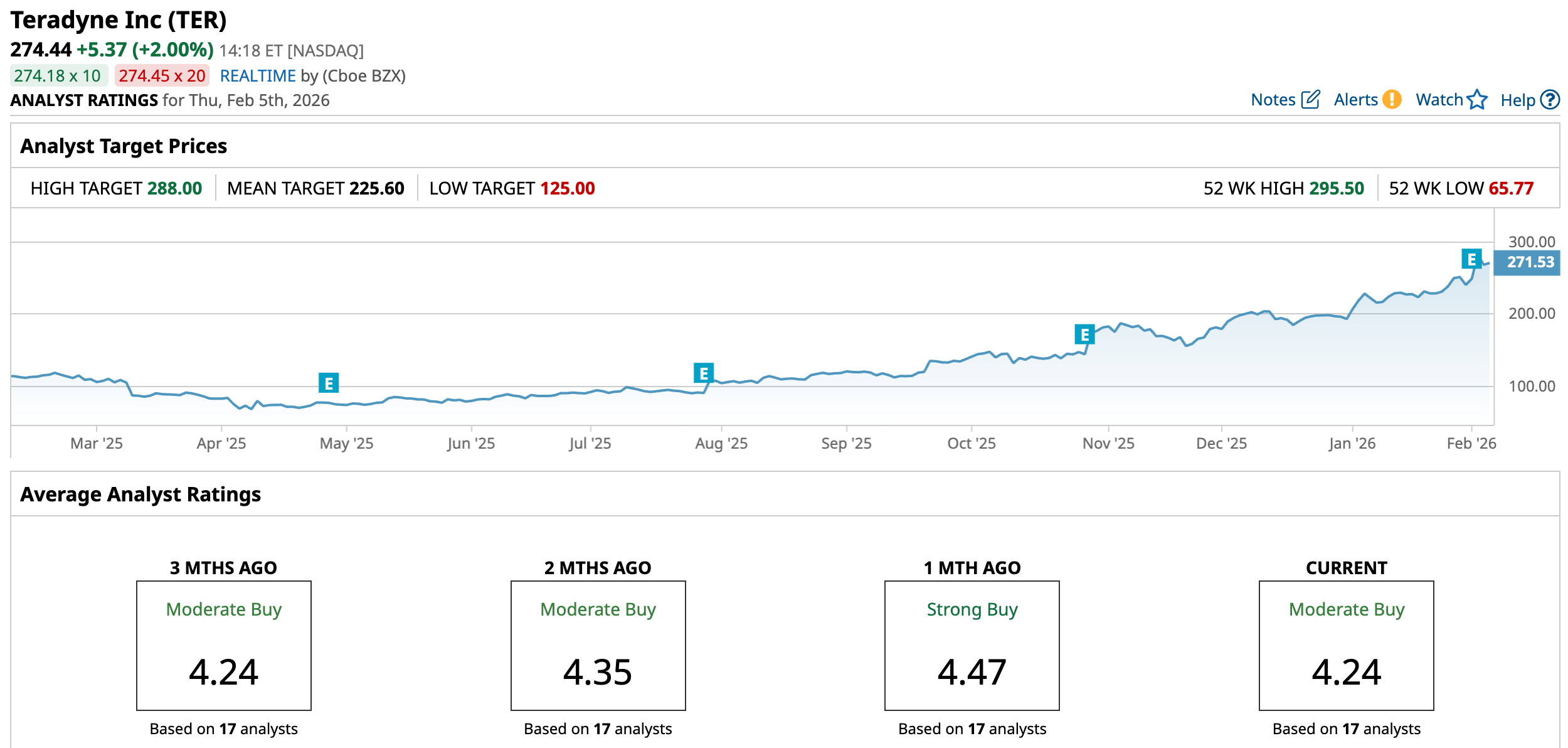

Currently valued at a market capitalization of about $42.1 billion, Teradyne has been riding the AI wave over the past year, with shares up a stunning 142.35%, dwarfing the broader S&P 500 Index ($SPX), which has climbed 12.38% over the same period. And the rally hasn’t cooled off. In 2026, the stock is already up an impressive 41%, while the broader market has barely moved in comparison.

Inside Teradyne’s Q4 Earnings Results

AI demand is clearly hitting Teradyne, right where it counts, and the company’s latest earnings proved it in a big way. When Teradyne reported fiscal 2025 fourth-quarter results on Feb. 2, investors wasted no time responding, sending the stock up nearly 13.4% in the following session. The numbers were hard to ignore.

Revenue surged 44% year-over-year (YOY) to $1.08 billion, blowing past Wall Street’s $975.6 million estimate. Profit growth was even more dramatic, with adjusted earnings of $1.80 per share, up 89.4% from a year ago and exceeding expectations by a hefty 32.4% margin. Both the top and bottom lines came in above the high end of Teradyne’s own guidance, underscoring the solid strength of the quarter.

The momentum came primarily from computing, networking, and memory demand within the company’s semiconductor test division. That segment alone delivered $883 million in revenue, marking a 57.4% YOY jump. The Product Test segment also grew, posting $110 million in revenue, up 17%, while Robotics generated $89 million in sales, lower than $98 million a year ago but improving from $75 million in the previous quarter, showing sequential progress.

While reflecting on the Q4 performance, CEO Greg Smith highlighted the company’s steady growth across all of its business groups, Semiconductor Test, Product Test, and Robotics, and achieved 13% overall growth in 2025. He added that Teradyne expects YOY growth throughout all of its businesses in 2026, supported by strong momentum in compute-driven by AI.

On the earnings call, Smith also noted that AI contributed to more than 60% of fourth-quarter revenue and said the company expects that figure to rise to over 70% next quarter, highlighting AI’s growing importance to Teradyne’s overall performance. Looking ahead, Teradyne guided for first-quarter 2026 revenue to land between $1.15 billion and $1.25 billion, with GAAP net income projected at $1.82 to $2.19 per diluted share and non-GAAP net income of $1.89 to $2.25 per diluted share.

How Are Analysts Viewing Teradyne Stock?

Stifel has recently turned even more bullish on Teradyne, raising its price target to $325 from $280 while keeping a “Buy” rating. The boost comes after Teradyne issued upbeat guidance indicating that AI applications now account for over 70% of its semiconductor test business in the first quarter, a clear sign that deep AI demand is shaping results.

Analyst Brian Chin pointed out that management expects 2026 revenue to be weighted toward the first half of the year. Looking ahead, that first-half weighting may seem conservative at first glance. However, Stifel believes it mainly reflects typical quarterly swings in AI-related sales and still leaves room for broader strength, including increased activity tied to Nvidia (NVDA) GPU qualification.

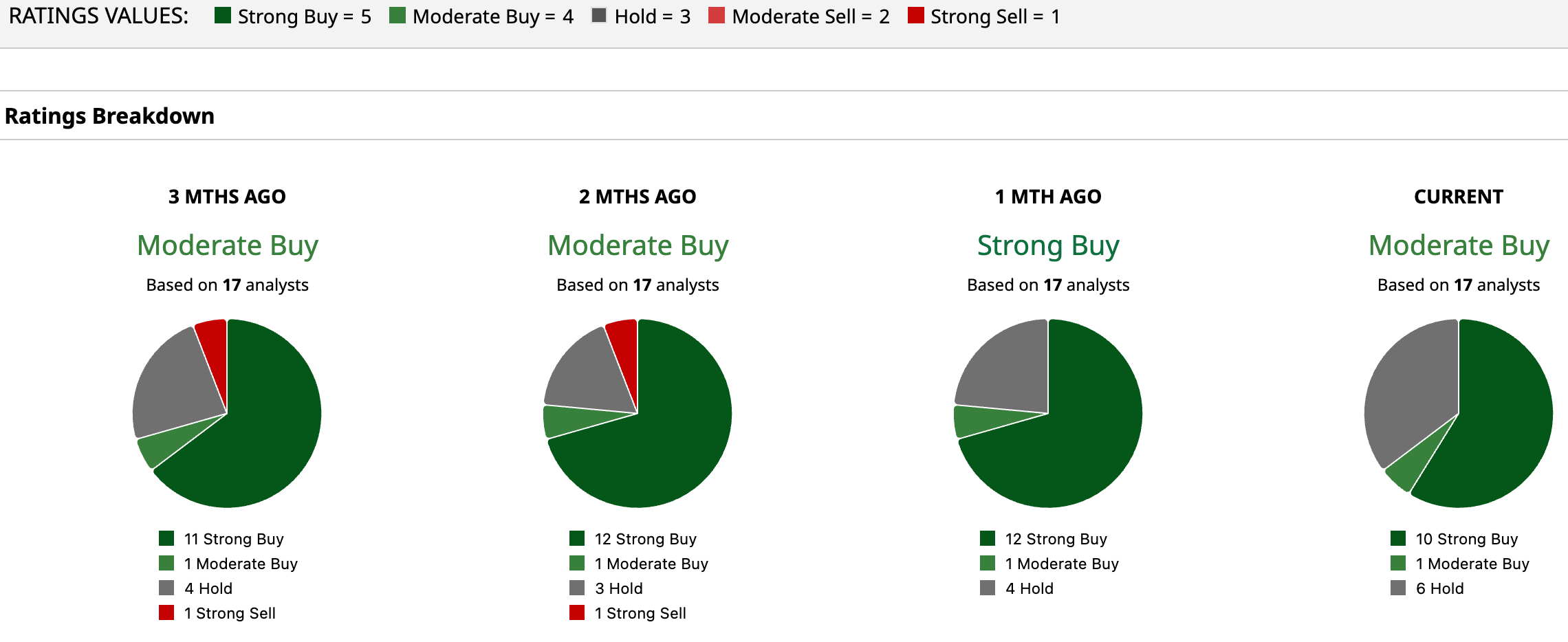

Overall, Wall Street is still firmly in Teradyne’s corner, with the stock carrying a consensus “Moderate Buy” rating. Out of 17 analysts covering the company, 10 call it a “Strong Buy,” one rates it a “Moderate Buy,” and six recommend “Hold,” showing that optimism continues to outweigh caution.

Even though TER has already raced past the average price target of $225.60, Stifel’s newly raised $325 target implies the shares could still climb another 18.4% from current levels, a sign that some on Wall Street believe the AI-driven momentum may not be over just yet.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)