/Global%20Payments%2C%20Inc_%20logo%20on%20laptop-by%20monticello%20via%20Shutterstock.jpg)

Valued at a market cap of $17.6 billion, Global Payments Inc. (GPN) is a leading worldwide provider of payment technology and software solutions. Headquartered in Atlanta, Georgia, the company offers a broad suite of services that enable merchants, financial institutions, and consumers to process digital payments seamlessly and securely.

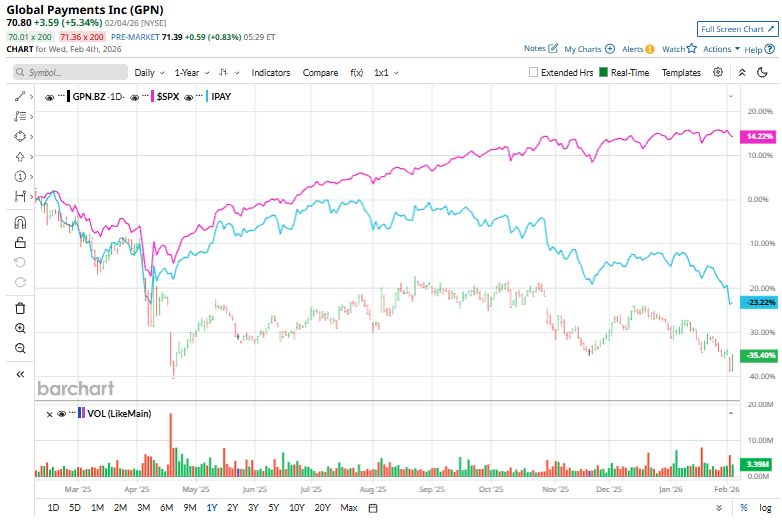

The payments solutions provider has significantly underperformed the broader market over the past year. GPN stock prices have tanked 35.7% over the past 52 weeks and 8.5% in 2026, notably lagging behind the S&P 500 Index’s ($SPX) 14% gains over the past year and marginal rise on a YTD basis.

Narrowing the focus, GPN has also underperformed the industry-focused Amplify Digital Payments ETF’s (IPAY) 22.7% decline over the past year and 10.4% dip year-to-date.

On Jan. 12, Global Payments announced the completion of its acquisition of Worldpay from FIS and GTCR, along with the divestiture of its Issuer Solutions business to FIS, thereby transforming the company into a pure-play commerce solutions provider. The transaction creates a globally scaled platform serving over 6 million merchant locations, processing $3.7 trillion in payments and about 94 billion transactions annually across 175+ countries.

For FY2025 that ended in December, analysts expect GPN to deliver an adjusted EPS of $11.72, up 6.1% year over year. On a positive note, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

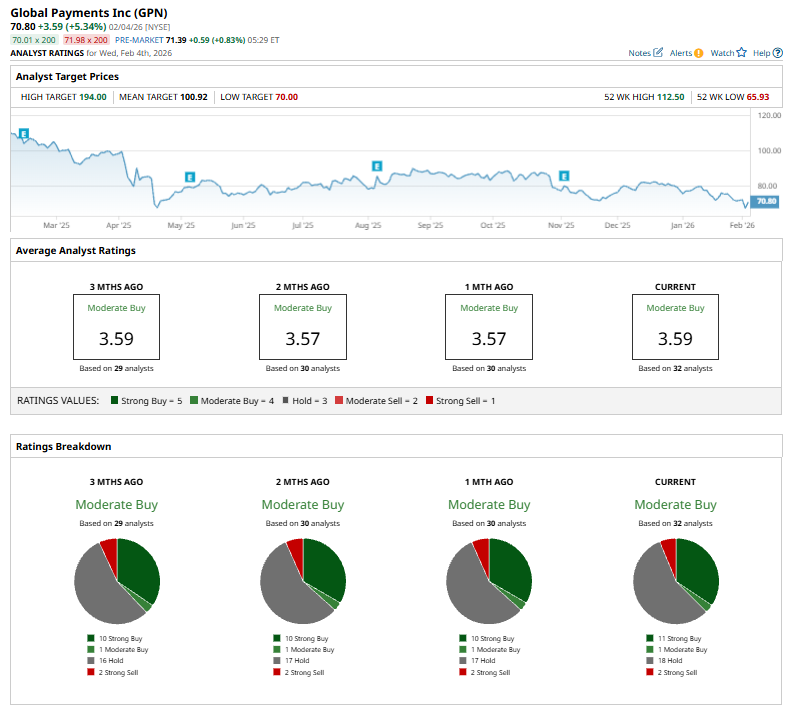

Among the 32 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buys,” one “Moderate Buy,” 18 “Holds,” and two “Strong Sells.”

This configuration is slightly more optimistic than a month ago, when 10 analysts gave “Strong Buy” recommendations.

On Jan. 27, Cantor Fitzgerald initiated coverage on Global Payments with a “Neutral” rating and an $80 price target, noting that the company has reshaped itself into a pure-play merchant acquirer after acquiring Worldpay and divesting its Issuer Solutions business. The firm highlighted GPN’s “divest and refresh” strategy, selling non-core assets and streamlining platforms to improve customer service, which has helped drive 22.33% revenue growth over the past year.

GPN’s mean price target of $100.92 represents a notable 42.5% premium to current price levels. Meanwhile, the Street-high target of $194 suggests a staggering 174% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)