At its latest meeting, the Reserve Bank of Australia decided to raise the cash rate target by 25 basis points to 3.85 per cent. Although inflation has dropped significantly since its peak in 2022, it rose again during the second half of 2025. The Board has been watching economic trends closely and believes that increasing capacity pressures are partly responsible for this renewed inflation, which is expected to remain above target for a while.

These capacity pressures stem from stronger demand in recent months, as private spending and investment have exceeded expectations. The housing market is also seeing increased activity and higher prices. Financial conditions became more relaxed throughout 2025, but it is unclear if they continue to be restrictive. Households and businesses have easy access to credit, and the impact of previous interest rate decreases has not yet fully affected overall demand, prices, and wages. Recently, increases in the exchange rate, money market interest rates, and government bond yields have followed higher market expectations for the cash rate.

Labor market indicators suggest conditions are still somewhat tight, with stabilization occurring alongside rising economic activity. The unemployment rate has been slightly lower than anticipated, and measures of labor underutilization remain low. While growth in the Wage Price Index has slowed down from its peak, broader wage measures remain strong, and unit labor costs continue to grow.

Uncertainty surrounds both domestic economic prospects and inflation, as well as how restrictive monetary policy truly is. If demand grows faster than expected while supply capacity remains constrained, capacity pressures may intensify further. Global uncertainty remains high, but so far, it has not negatively affected the Australian economy; in fact, recent growth and trade among Australia's key trading partners have been unexpectedly robust.

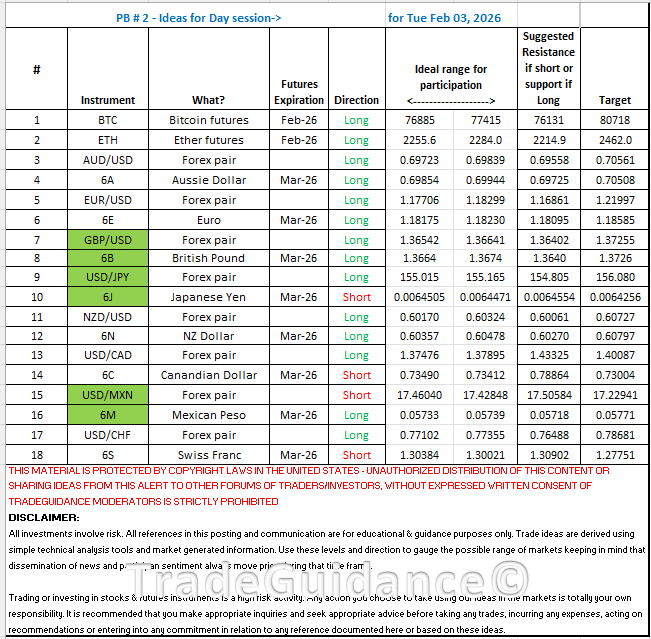

Here are our thoughts on a whole host of forex and currency futures plays for the day: [Highlighted instruments are those that tagged targets from the prior session playbooks]

(USDJPY) (GBPUSD) (EURUSD) (NZDUSD) (AUDUSD) (USDCHF) (USDCAD)

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)