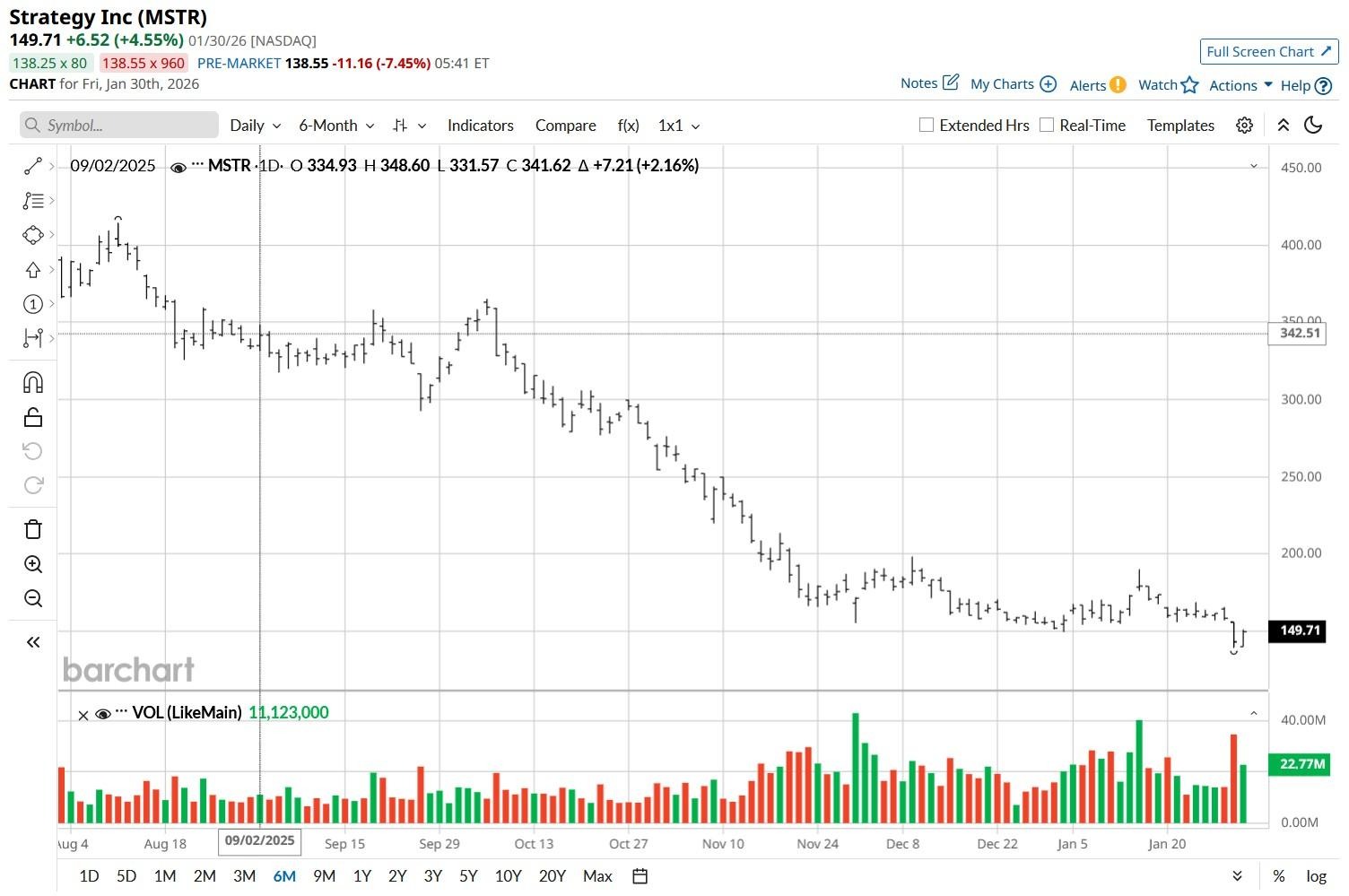

MicroStrategy (MSTR) shares tanked in the second half of January, reinforcing investor skepticism in the company’s ability to remain an outperformer over the long-term. The recent selloff has pushed MSTR market capitalization below its net asset value (NAV) again, meaning its stock is now trading at a discount to the market value of its massive Bitcoin (BTCUSD) holdings.

At the time of writing, MicroStrategy stock is down an alarming 68% versus its 52-week high.

Why Has MicroStrategy Stock Crashed?

Investors bailed on MSTR stock in recent weeks as Bitcoin crashed decisively below a key support at the $80,000 level, a psychological floor and the estimated cost based for many Spot ETFs.

This sharp decline was accelerated by a “deleveraging event” and shifting macro expectations after President Donald Trump nominated Kevin Warsh to be the next chairman of the Federal Reserve.

Investors are concerned that Warsh’s hawkish stance on inflation could signal a “higher for longer” interest rate environment, draining liquidity from high-risk BTC proxies like MicroStrategy.

Note that MSTR even slipped below its 20-day moving average (MA) last week, signaling bearish momentum could sustain in the near-term.

Why MSTR Shares Aren't Worth Buying

MicroStrategy’s increasingly precarious financial engineering makes it a speculative bet in 2026.

With more than 712,000 BTC on its balance sheet, the company faces annual interest and preferred dividend obligations totaling about $800 million, far outstripping the cash flow from its stagnant software business.

Additionally, MSTR used heavy share dilution last month to increase its Bitcoin exposure at prices above $90,000, which skeptics further point to as a major red flag.

All in all, investing in MicroStrategy shares is a high-risk proposition since the Nasdaq-listed firm may be forced to sell its assets to meet debt obligations if BTC fails to reclaim its momentum.

What’s the Consensus Rating on MicroStrategy?

Despite continued weakness, however, Wall Street analysts remain super bullish on MicroStrategy.

According to Barchart, the consensus rating on MSTR shares currently sits at “Strong Buy,” with the mean target of about $464 indicating potential upside of more than 200% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)