/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

With a market cap of $472.9 billion, Oracle Corporation (ORCL) is a global enterprise technology company that provides cloud software, infrastructure, databases, hardware, and consulting services to businesses, governments, and educational institutions worldwide. It delivers solutions spanning cloud applications, industry-specific platforms, and advanced technologies such as AI, machine learning, and autonomous databases.

Shares of the Austin, Texas-based company have lagged behind the broader market over the past 52 weeks. ORCL stock has declined 5.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.5%. In addition, shares of Oracle have decreased 17.9% on a YTD basis, compared to SPX's 1.9% rise.

Looking closer, shares of the software maker have underperformed the State Street Technology Select Sector SPDR ETF's (XLK) 25.9% return over the past 52 weeks.

Oracle reported strong fiscal Q2 2026 results on Dec. 10, including adjusted EPS up 54% to $2.26, total revenue increasing 14% to $16.1 billion, and cloud revenue up 34% to $8 billion. The company reported a $2.7 billion pre-tax gain from the sale of its stake in Ampere and highlighted robust growth in its Multicloud database business, which surged 817% in Q2. However, the stock tumbled 10.8% the next day.

For the fiscal year ending in May 2026, analysts expect ORCL's EPS to grow 36.8% year-over-year to $6.02. The company's earnings surprise history is promising. It beat or met the consensus estimates in the last four quarters.

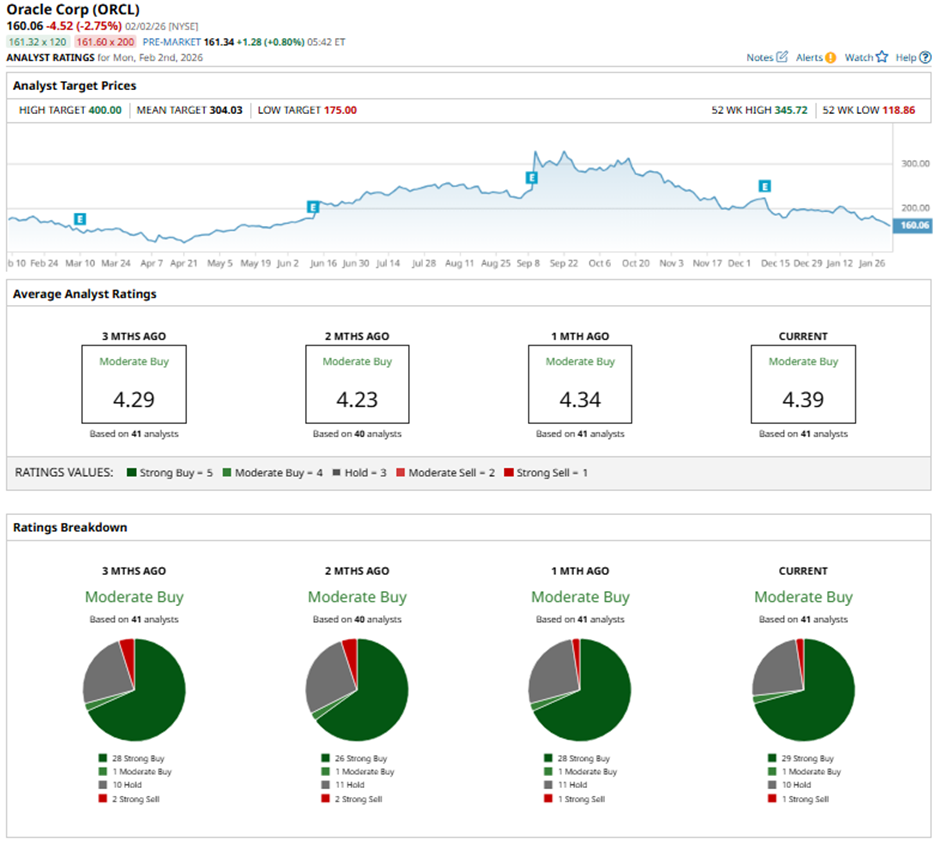

Among the 41 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 29 “Strong Buys,” one “Moderate Buy” rating, 10 “Holds,” and one “Strong Sell.”

On Feb. 3, Piper Sandler lowered Oracle’s price target to $240 while maintaining an “Overweight” rating.

The mean price target of $304.03 represents a 89.9% premium to ORCL’s current price levels. The Street-high price target of $400 implies a potential upside of 149.9% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)