Nancy Pelosi is a veteran politician and one of the most well-known names in U.S. Congress, having served multiple terms as Speaker of the House. Her tenure ranks among the longest in modern U.S. history, although it is set to end next year as Pelosi has announced she will not seek re-election. However, what has made Nancy Pelosi an unlikely investment icon has little to do with legislative maneuvering and everything to do with her husband's portfolio.

Paul Pelosi's investment returns have outpaced even those of Warren Buffett over recent years. Because he is married to a sitting member of Congress, his trades are subject to federal disclosure requirements and filed under Nancy Pelosi's name, given that their assets are intertwined under California community property law. Throughout this article, we will use both names interchangeably when discussing portfolio holdings and trading activity.

Nancy Pelosi herself has stated that she does not personally trade stocks and that Paul Pelosi manages the investments independently. Regardless of who executes the orders, the portfolio has beaten the S&P 500 ($SPX) by such a wide margin that ignoring these disclosures means leaving money on the table.

Here are three stocks Pelosi has made moves on recently. The recent repositioning “could lead to $10 to $20 million in combined realized and unrealized gains under fairly conservative market assumptions,” per Capitol Trades. Let's take a closer look.

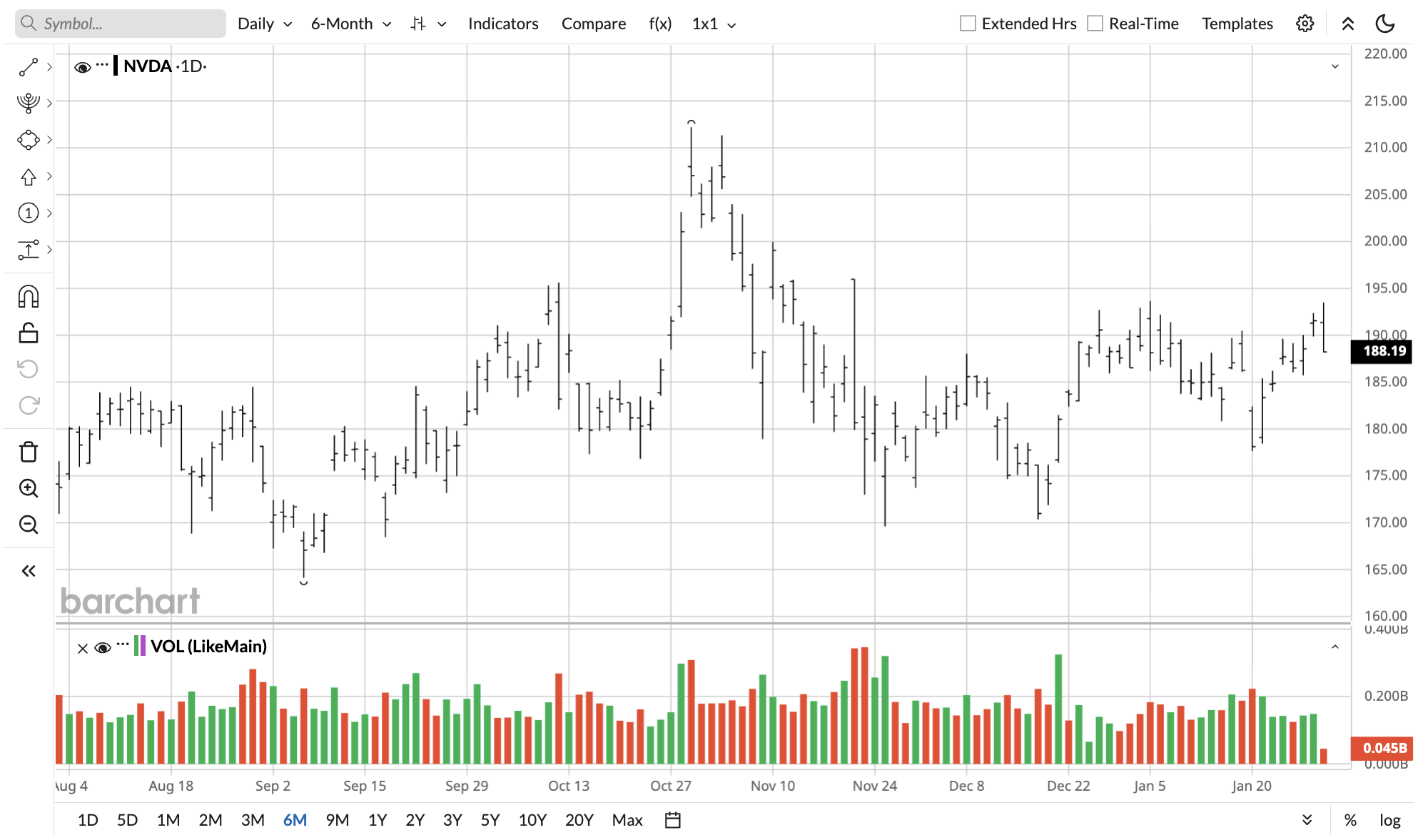

Stock to Buy #1: Nvidia (NVDA)

The Pelosis have a long history with Nvidia (NVDA), well before it became the frontrunner among AI companies. There's a clear pattern of bullish option bets timed ahead of major growth phases. Pelosi bought 50 call options back in November 2023 before the stock went on an explosive rally.

Nvidia implemented a 10-for-1 stock split in June 2024. Pelosi bought right after that went into effect, and NVDA stock has gained significantly since then, too.

Pelosi's latest moves with Nvidia are more complicated, as she actually sold 20,000 shares of NVDA on Dec. 24, 2025. She took profits on hefty gains from earlier, then repositioned by buying 20 long-dated call options on NVDA with a $100 strike, expiring January 2027. These are deep in-the-money (ITM) LEAPs that act like leveraged stock bets.

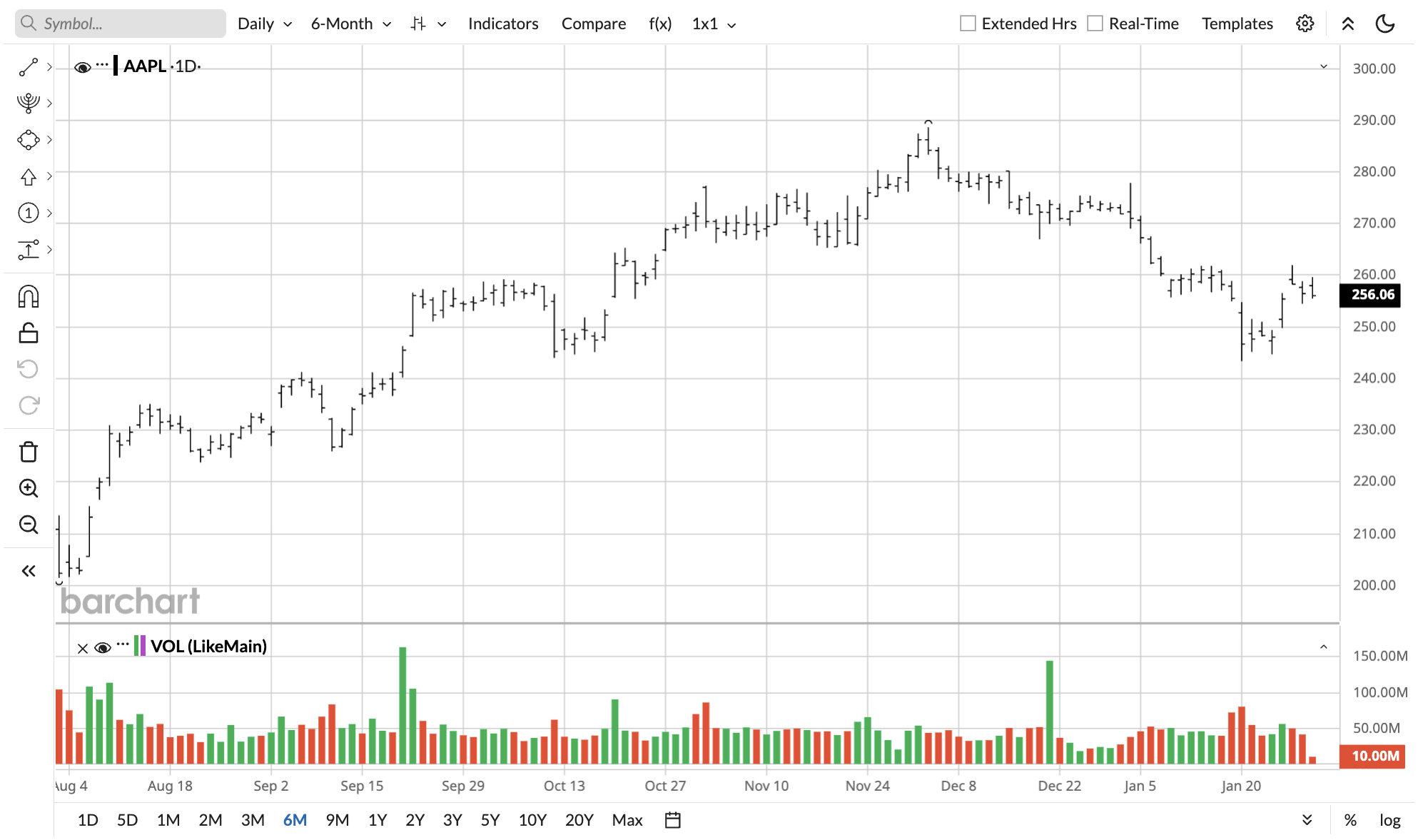

Stock to Buy #2: Apple (AAPL)

Pelosi made similar moves with Apple (AAPL). She sold 45,000 shares of AAPL stock in two phases. The first one was a direct sale on Dec. 24, followed by a 28,200 share "contribution" to a donor-advised fund on Dec. 30. Then, just like NVDA, Pelosi bought 20 ITM call options, with a $100 strike, expiring in January 2027.

In essence, Pelosi is just taking profits and keeping leveraged exposure to future gains through these call options. Pelosi is betting that AAPL stock won't go below $100, so you can take that as a floor price. When you take the premium paid into account, the breakeven is likely much higher, so the outlook is still bullish.

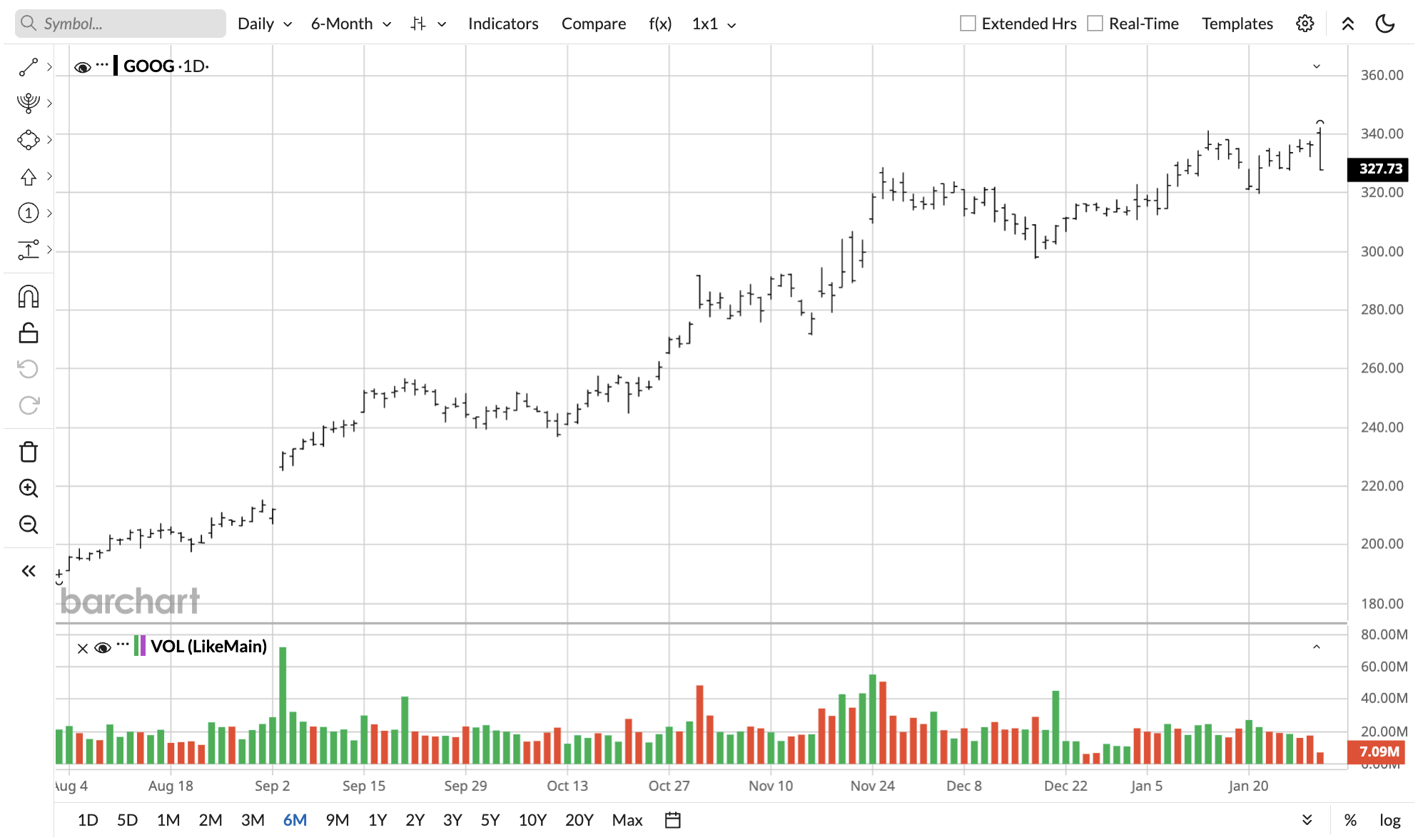

Stock to Buy #3: Alphabet (GOOGL)

Last on this list is Alphabet (GOOGL) stock. Pelosi didn't directly sell any Alphabet shares and seems the most “bullish” here. This is because she made a contribution of 7,704 shares to a donor-advised fund, then bought 20 ITM call options on GOOGL stock. The strike price on these call options is $150 with a January 2027 expiry.

Alphabet's performance has been terrific in recent quarters and has led to blockbuster gains for Pelosi. So, it makes sense why there hasn't been any major direct offloading of the shares.

Pelosi's position here is still smaller. The call options bought on GOOGL stock are valued between $250,000 and $500,000, whereas the shares transferred are valued between $1 million and $5 million. To be more precise, the value should be around $2.42 million, as GOOGL stock closed at $313.85 on Dec. 30.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)