/Gen%20Digital%20Inc%20logo%20on%20building-by%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

Headquartered in Tempe, Arizona, Gen Digital Inc. (GEN) is a global consumer cyber-safety heavyweight. With a market cap near $14.8 billion, it delivers cybersecurity, identity protection, and privacy tools through well-known brands including Norton, Avast, LifeLock, Avira, AVG, CCleaner, and MoneyLion.

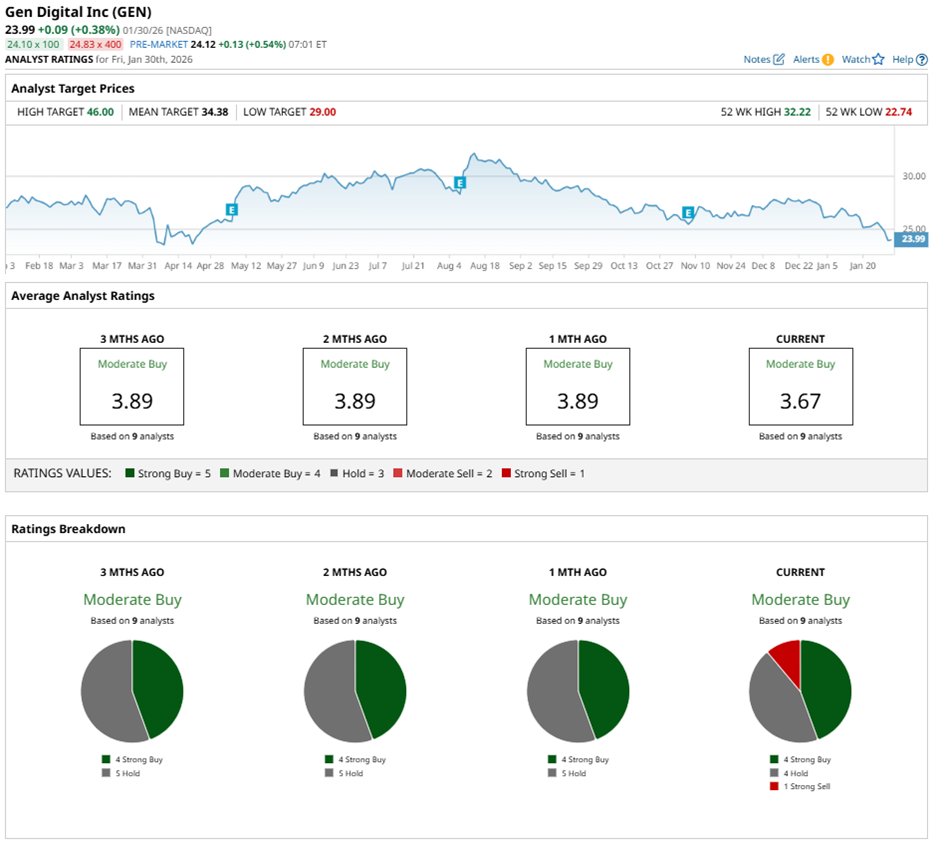

Over the past 52 weeks, Gen Digital’s shares declined nearly 14%, clearly lagging the S&P 500 Index ($SPX), which advanced 14.3% over the same span. The underperformance has extended into 2026, with the stock down 11.8% year-to-date (YTD), while the benchmark index posted a modest 1.4% gain.

GEN stock has also trailed the State Street Technology Select Sector SPDR ETF (XLK) which gained 23.9% over the past year and sits only marginally lower YTD.

However, GEN stock found short-term lift on Nov. 7, 2025, rising 1.3% intraday, just a day the company delivered its Q2 fiscal 2026 earnings print. Revenue reached $1.22 billion, topping the $1.19 billion estimate. Non-GAAP EPS came in at $0.62, beating expectations with a 15% jump and extending the firm’s streak of meeting its 12%–15% growth target to eight consecutive quarters.

Furthermore, bookings surged 27% to $1.22 billion during the quarter, underscoring durable customer demand. Management’s outlook has leaned confidently forward as they expect Q3 non-GAAP revenue of $1.22 billion to $1.24 billion and non-GAAP EPS of $0.62 to $0.64, implying 12%–15% growth.

The company has also lifted its fiscal year 2026 guidance, now forecasting revenue of $4.92 billion to $4.97 billion and non-GAAP EPS of $2.51 to $2.56, reaffirming its long-term earnings discipline.

Analysts model a slightly more conservative path. For the fiscal year 2026, ending in April, they project diluted EPS of $2.30, representing 14.4% year-over-year growth. However, recent results show uneven execution, with Gen Digital exceeding earnings expectations in just one quarter while missing estimates in the other three.

Wall Street is optimistic with the stock carrying an overall rating of “Moderate Buy.” Among nine analysts covering the stock, four have assigned it a “Strong Buy” rating, four call for “Hold,” while one recommends a “Strong Sell.”

The current analyst sentiment remains unchanged from the last three months, when four analysts also labeled the stock a “Strong Buy.”

Gen Digital drew mixed reactions from Wall Street in January. On Jan. 16, RBC Capital’s Matthew Hedberg maintained a “Hold” rating with a $29 target. Earlier, UBS reiterated a Buy rating on Jan. 13 and lifted expectations with a $36 price target.

That being said, GEN stock’s average price target of $34.38 implies potential upside of 43.3%, while the Street-high target of $46 suggests a gain of 91.7% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)