/Keycorp%20location-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Based in Cleveland, Ohio, KeyCorp (KEY) runs a diversified banking franchise with a national footprint. Valued at roughly $23.5 billion, the bank spans retail, commercial, and institutional finance, offering deposits, lending, wealth management, capital markets, advisory, payments, treasury, and trust services to clients of every size.

That breadth has translated into tangible shareholder gains. Over the past 52 weeks, KEY stock delivered a 19.4% return, decisively outpacing the S&P 500 Index's ($SPX) 14.3% jump during the same period. The momentum has carried into the year as well, with shares up nearly 4.3% year-to-date (YTD) versus the index’s 1.4% gain.

KEY stock’s relative performance appears more nuanced when viewed against its peers. The iShares U.S. Regional Banks ETF (IAT) rose 8.5% over the same 52-week period and is up 5.2% YTD. KeyCorp’s stronger long-term return highlights differentiated execution within the regional banking space.

Markets reacted favorably to fundamentals in the last month. On Wednesday, Jan. 21, KeyCorp’s shares climbed 2.8%, just a day after its Q4 2025 earnings topped Street’s expectations. Revenue rose 131.8% year over year to $2.01 billion, exceeding the $1.97 billion Street's expectations. Meanwhile, EPS came in at $0.41, beating the analyst estimates of $0.39.

Management attributed the upside to strong momentum in commercial banking and fee-based businesses. Building on this visibilty, KeyCorp has guided for roughly 7% revenue growth in fiscal year 2026. The company also accelerated capital returns, repurchasing $200 million of common shares in Q4 while sustaining peer-leading capital ratios.

For fiscal year 2026, ending in December, analysts project diluted EPS of $1.79, representing growth of 19.3%. Importantly, KeyCorp has exceeded EPS estimates in each of the past four quarters, reinforcing credibility around management’s execution and forward guidance.

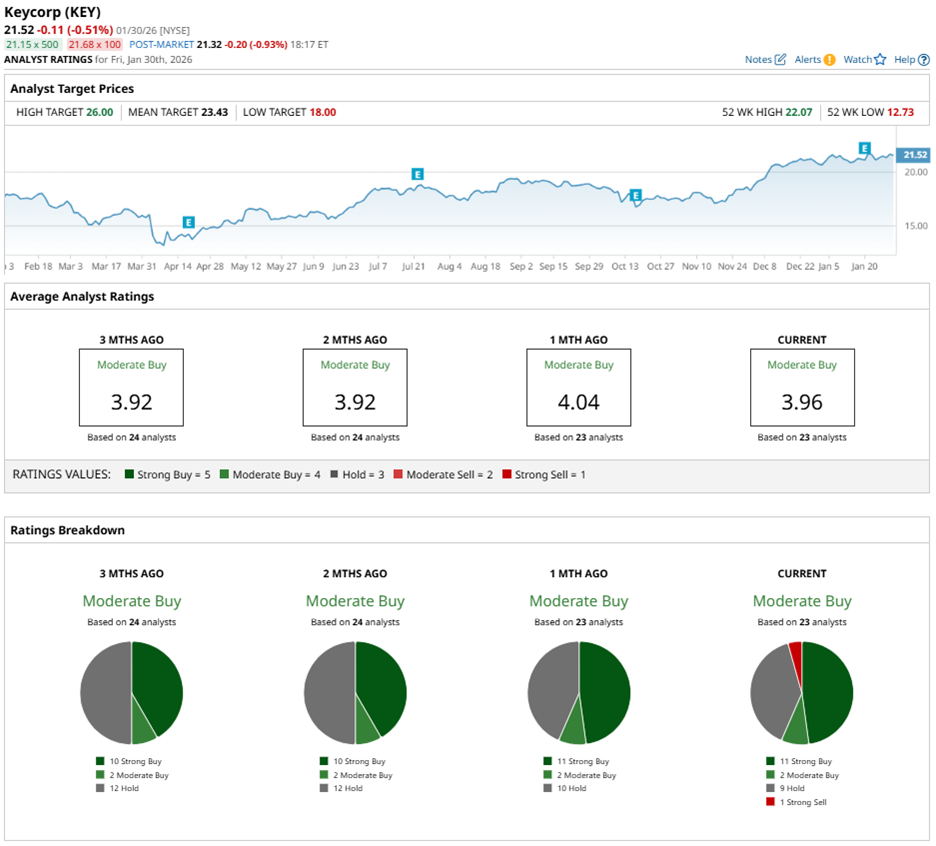

Wall Street maintains a largely positive outlook on KEY stock. Among the 23 analysts covering the stock, the consensus rating stands at “Moderate Buy.” The breakdown includes 11 “Strong Buy” ratings, two “Moderate Buy” recommendations, nine “Hold” calls, and a single “Strong Sell.”

Analyst sentiment has edged slightly in the past three months, when 10 analysts assigned KEY stock “Strong Buy” ratings.

Price targets have followed suit, reflecting the recent earnings beat. On Thursday, Jan. 22, Argus raised its price target from $21 to $25, reaffirming its “Buy” rating on the stock. The adjustment came in response to KeyCorp’s Q4 2025 earnings, which surpassed Wall Street expectations and signaled robust operational momentum.

At present, the average price target of $23.43 represents potential upside of 8.9%. Meanwhile, the Street-high price target of $26 suggests a gain of 20.8% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)