Broadcom (AVGO) powers the digital world with cutting-edge semiconductors and software. The company produces chips for data centers, networking, broadband, wireless devices, and infrastructural solutions connecting everything from your smartphone to massive cloud systems. Key products include Wi-Fi chips, Ethernet switches, optical transceivers, and custom controllers, fueling AI growth and high-speed connectivity.

Founded in 1991, Broadcom is headquartered in Palo Alto, California, with operations spanning across 25 countries.

Broadcom Stock Performance

AVGO stock trades around $325 levels and faces short-term headwinds amid broader market dips. Over the past five days, it has risen 4%, against the S&P 500 Information Technology Index's ($SRIT) flat performance. The one-month performance shows AVGO down 5% versus SRIT’s 2% loss, while year-to-date (YTD) figures stand at -3% for Broadcom against -1% for the index.

Longer-term, Broadcom shines brighter. Its six-month gain hit 10%, and 52-week returns reached 55%, significantly topping SRIT 25%. AI-driven chip demand fuels this resilience, positioning AVGO as a sector outperformer despite recent volatility.

One big-name investor is taking note and diving into AVGO stock in a big way: Cathie Wood.

Broadcom Beats Analysts

Broadcom released stellar Q4 2025 earnings on Dec. 11, 2025. Revenue hit a record $18.0 billion, up 28% year-over-year (YoY), beating analyst estimates of $17.45-$17.5 billion by 3%-4%. Adjusted EPS came in at $1.95, topping forecasts of $1.87 by 4.28%.

Digging into finances, adjusted EBITDA reached $12.12-$12.22 billion (68% margin), up 34% YoY. Gross margin stood at 77.9%, and operating margin at 66.2%. Free cash flow surged 36-39% to $7.5 billion, and cash reserves ended at $16.2 billion. Operating income hit $11.9 billion (up 35%), with AI semiconductors driving $11.1 billion in segment revenue (35% growth).

For Q1 2026, Broadcom guides $19.1 billion in revenue (up 28% YoY), including $8.2 billion in AI semiconductors (doubling YoY) and $6.8 billion in infrastructure software. Full-year 2026 sees accelerating AI growth, stable non-AI semis, and low double-digit software gains; adjusted EBITDA at 67%.

Cathie Wood Snaps up AVGO

Cathie Wood’s ARK Invest ramped up its focus on AI, semiconductors, autonomous tech, and crypto last week, with Broadcom emerging as a standout buy amid portfolio rotations away from defense, genomics, and ad platforms. ARRK (ARKK) scooped up 72,200 shares of Broadcom, while ARKW added 9,236 shares on Friday, totaling about $26 million in fresh exposure to the AI chip powerhouse. The move underscores ARK's bet on Broadcom's dominance in data center chips and networking gear, fueled by explosive AI infrastructure demand.

The buys align with ARK's broader pivot. ARKQ (ARKQ) loaded 1.04 million shares of self-driving firm WeRide (WRD) ($9 million) and 29,600 Kodiak AI (KDK) shares, while crypto plays like Circle (CRCL) (129,000 shares, $9.24 million, total exposure $259 million), Bullish (BLSH) (88,500 shares, $3.23 million), and Coinbase (COIN) (42,000 shares, $9 million) gained traction. ARKX (ARKX) grabbed AMD (AMD) shares too, reinforcing semis enthusiasm.

Healthcare (via ARRK) saw Tempus AI (TEM) adds, to the tune of 154,000 shares, but sells of 297,000 shares of Beam (BEAM), 10x Genomics (TXG) (315,000), Illumina (ILMN) (56,000), and Twist Bioscience (TWST) (59,800). In the defense sector, Cathie Wood sold off 184,000 shares of Kratos (KTOS) at $19 million, and software/ad names including Meta (META), Pinterest (PINS), Roku (ROKU), GitLab (GTLB), and Unity (U) faced trims, except Netflix (NFLX) (83,000 shares, $7 million) for its subscription strength. ARK eyes disruptive growth over legacy plays.

Should You Buy AVGO Stock?

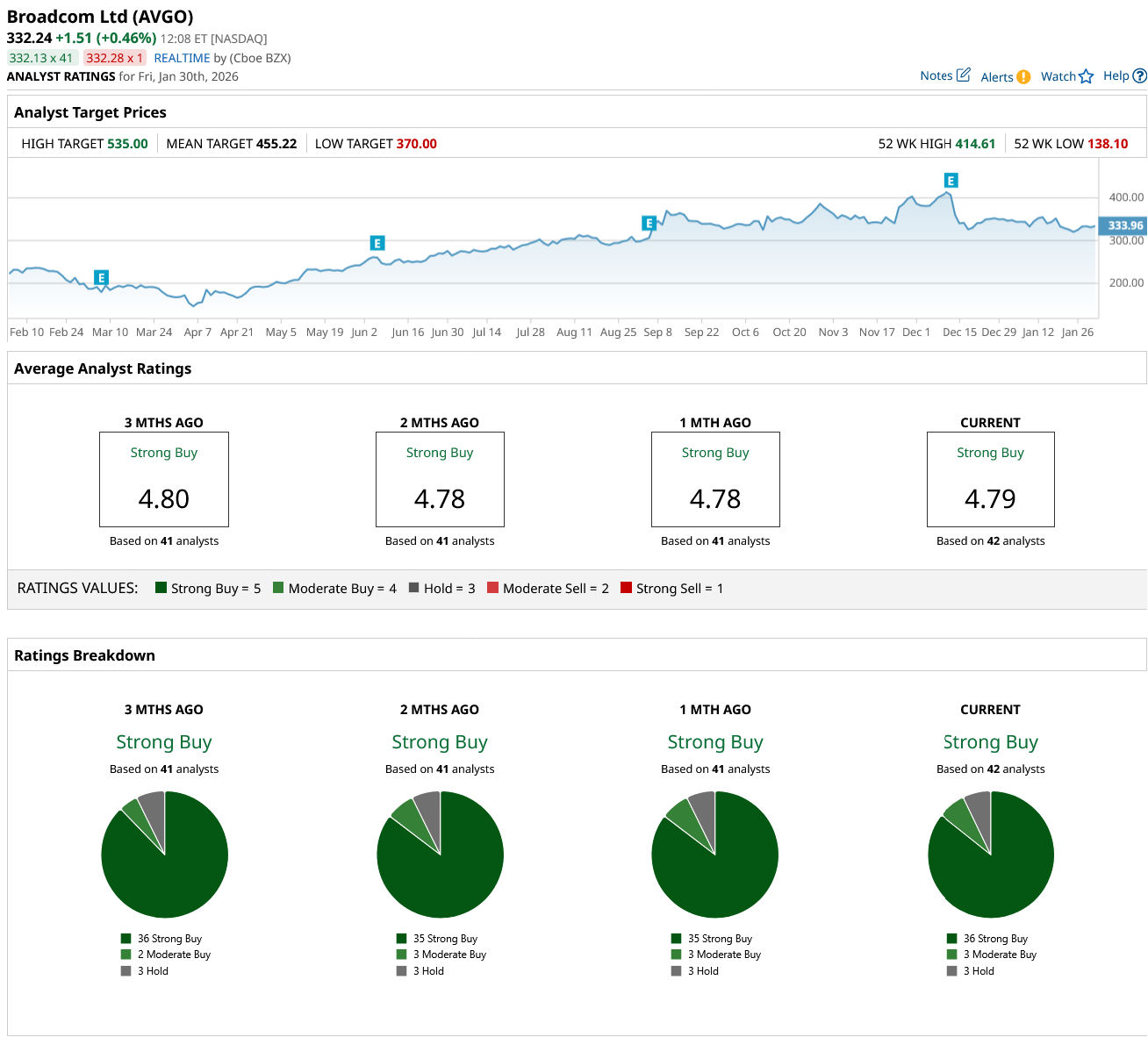

Apart from Cathie Wood, Broadcom has plenty of further support on Wall Street, with analysts ranking AVGO stock a consensus “Strong Buy” with a mean price target of $455.22, reflecting an upside potential of 40% from the market rate.

The stock has been rated by 42 analysts so far, receiving 36 “Strong Buy” ratings, three “Moderate Buy” ratings, and three “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)