/Abbvie%20Inc%20logo%20and%20stock%20chart-by%20IgorGolovniov%20via%20Shutterstock.jpg)

AbbVie Inc. (ABBV) is a worldwide biopharmaceutical company based in North Chicago, Illinois. It conducts research, develops, and supplies advanced medicines for the treatment of challenging conditions in immunology, cancer, neuroscience, ophthalmology, and aesthetics. The company has a market capitalization of $386.47 billion.

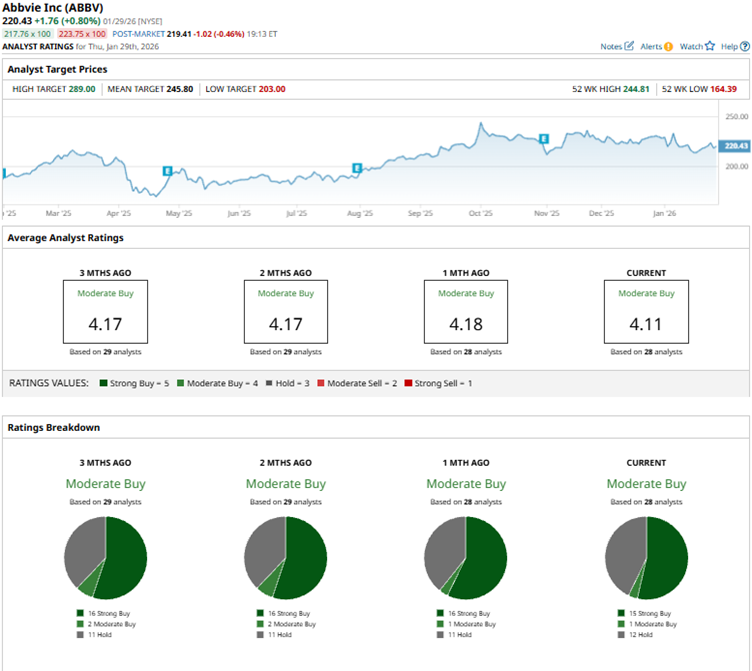

Strong sales from immunology blockbusters Skyrizi and Rinvoq offset Humira’s patent cliff decline. Growth in neuroscience and a diversified portfolio fueled revenue in 2025. Over the past 52 weeks, AbbVie’s stock has gained 25.8%, while over the past six months, it has risen 15.3%. The company’s shares reached a 52-week high of $244.81 in October 2025, but are down 10% from that level.

On the other hand, the broader S&P 500 Index ($SPX) has gained 15.4% and 9.4% over the same periods, respectively, indicating that the stock has outperformed the broader market. Next, we compare the stock with its own sector. The State Street Health Care Select Sector SPDR ETF (XLV) has increased 5.6% over the past 52 weeks and 14.4% over the past six months, underperforming AbbVie’s stock.

On Oct. 31, AbbVie reported solid third-quarter results for fiscal 2025, beating Wall Street analysts’ expectations, as Skyrizi and Rinvoq reported robust double-digit growth even though Humira fell off. In addition, the company has expanded its operations through the acquisitions of Capstan Therapeutics and Gilgamesh Pharmaceuticals.

This month, AbbVie signed a definitive agreement to acquire a device manufacturing facility in Tempe, Arizona. It also signed an exclusive licensing agreement with RemeGen for the commercialization of a bispecific antibody for advanced solid tumors.

For the fourth quarter of 2025 (to be reported on Feb. 4, before the market opens), Wall Street analysts expect AbbVie’s EPS to grow 22.7% YOY to $2.65 on a diluted basis. Moreover, EPS is expected to increase 43.9% annually to $14.32 in fiscal 2026. The company has a solid history of surpassing consensus estimates, topping them in all four trailing quarters.

Among the 28 Wall Street analysts covering AbbVie’s stock, the consensus is a “Moderate Buy.” That’s based on 15 “Strong Buy” ratings, one “Moderate Buy,” and 12 “Holds.” The ratings configuration has become less bullish over the past month, with 15 “Strong Buy” ratings, down from 16 previously.

Wolfe Research analysts downgraded AbbVie from “Outperform” to “Peer Perform,” noting that the shares already reflect gains from Skyrizi and Rinvoq. Analysts are now waiting for greater visibility.

AbbVie’s mean price target of $245.80 indicates an 11.5% upside over current market prices. The Street-high price target of $289 implies a potential upside of 31.1%.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)