The volatility market of 2026 is a far cry from the calm, suppressed environment of the late 2010s. We have entered what analysts call a high-floor era. That’s where the CBOE Volatility Index ($VIX) rarely dips below 15 and frequently spikes toward 30. While many DIY investors reflexively reach for short-term VIX products like VXX (VXX) or VIXY (VIXY) during a market dip, these funds are notorious for their rapid value erosion.

To address this, the ProShares VIX Mid-Term Futures ETF (VIXM) offers a more stable, strategic way to hedge a portfolio. Rather than betting on what the market will do in the next 30 days, VIXM tracks a portfolio of VIX futures with a weighted average of five months to expiration. This is what makes it an under-the-radar and underappreciated way to hedge volatility, without feeling like you have to constantly watch it like a near-term options trade.

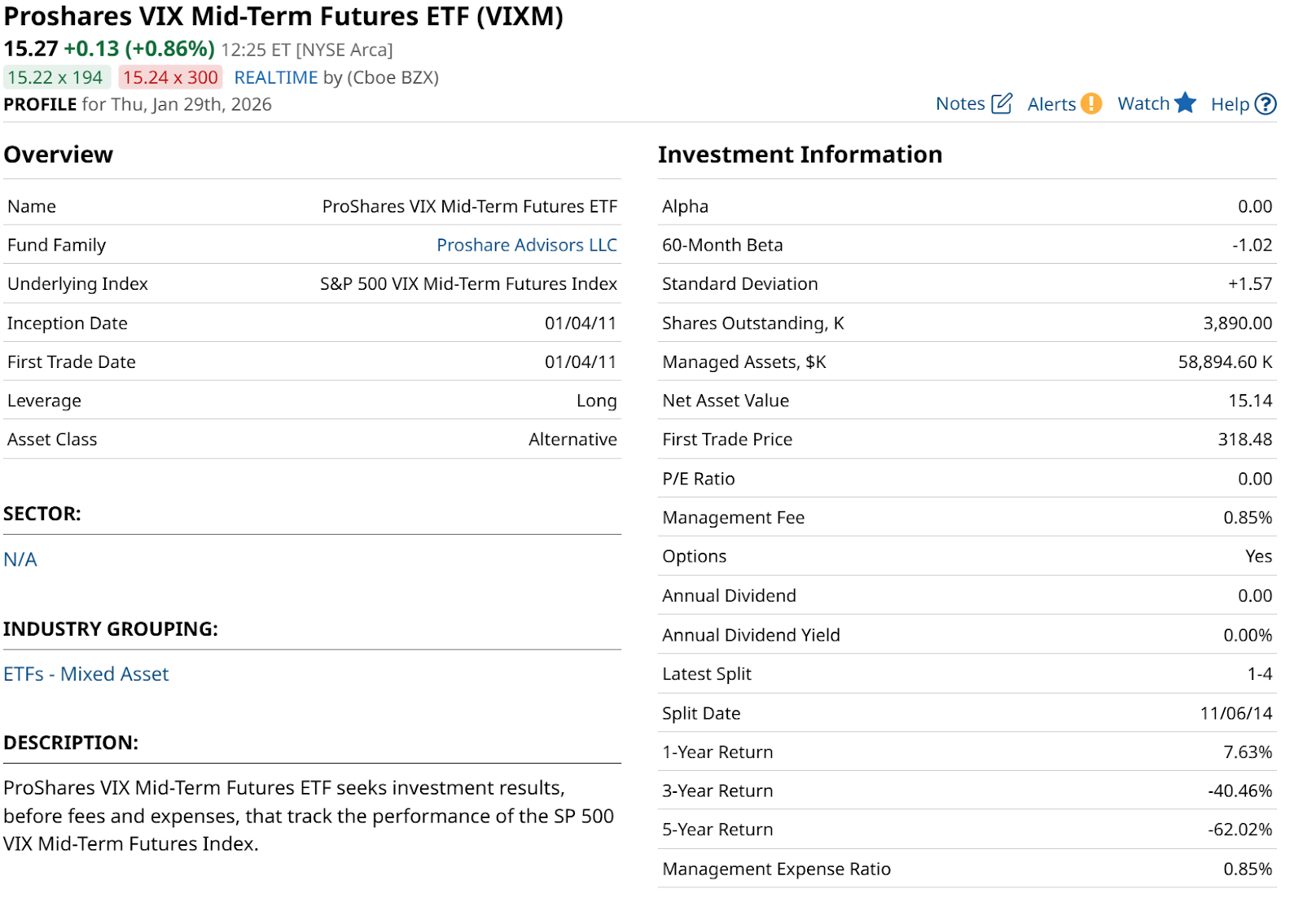

At $58 million in assets, despite 15 years since its creation, VIXM does not get the street cred that the more exciting volatility ETFs do. And yes, it doesn’t move as rapidly. But it serves a purpose for some investors.

This mid-term approach provides a unique advantage in 2026: it hedges against both sudden market shocks and the more dangerous risk of sustained high volatility. Short-term VIX funds are a big part of my arsenal. However, I track my portfolio every day, most of the day. And those short-term VIX ETFs suffer immensely from time decay because the first-month futures contracts are usually much more expensive than the spot VIX. This creates a constant downward pressure on the fund's price.

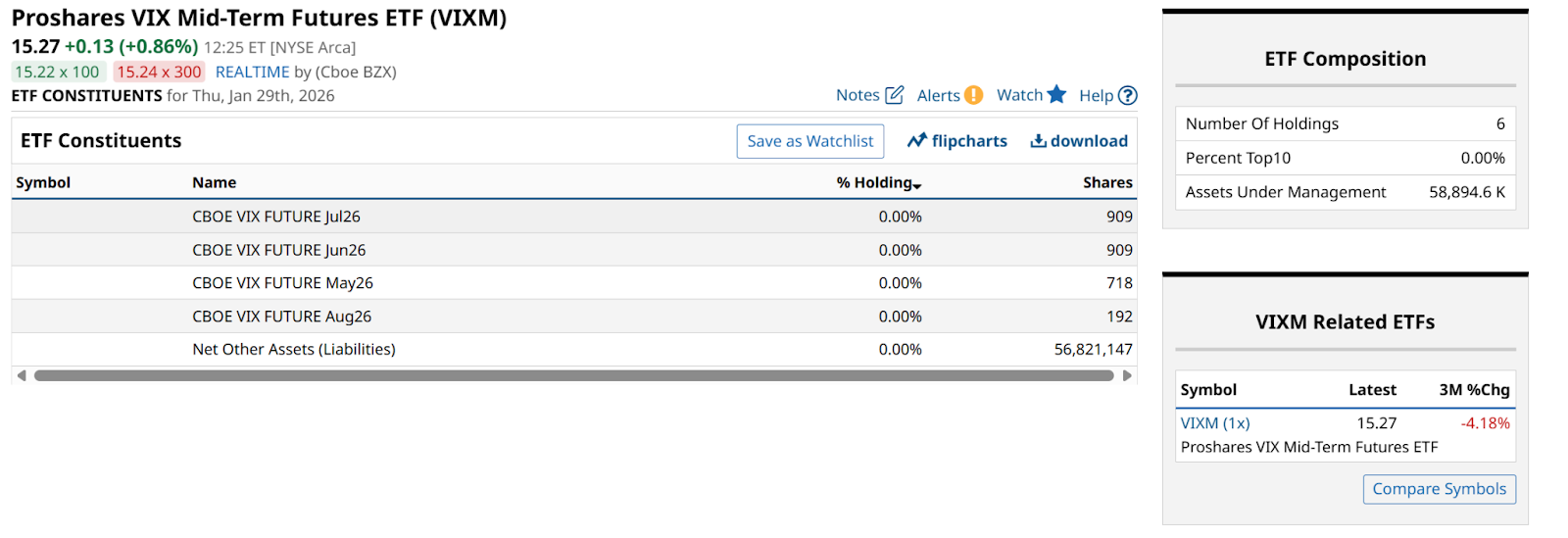

VIXM, by contrast, holds futures contracts further out on the curve (currently including May, June, and July 2026 contracts), where the price curve is much flatter. This significantly reduces the cost of holding the hedge, allowing it to sit in a portfolio for months rather than days.

As the S&P 500 Index ($SPX) tests record valuations amid a backdrop of stagnant earnings growth and rising geopolitical tension, VIXM has begun to show its value. While the broader market was flat in the first half of January, VIXM gained roughly 5%, acting as a perfect counter-balance to the wobbles in tech-heavy portfolios.

It doesn't move with the same hair-on-fire intensity as short-term funds, but it doesn’t disappear when the initial panic subsides either. It is designed for investors who recognize that the 2026 market is prone to rolling crises, events that don’t just flash and fade, but linger and keep investors on edge for weeks.

That price chart, as I’ve marked it, is an indication that despite the S&P 500 being near new highs, risk is still high. And rising further.

For the DIY investor, VIXM should be viewed as a ballast. It is the insurance policy that protects you if the market doesn’t just crash, but enters a long, grinding period of uncertainty. Because it has a negative correlation to the S&P 500, it can offset losses in your core stock holdings during a correction.

If the VIX continues to make higher lows throughout Q1 2026, VIXM will likely be the primary tool used by institutional managers to protect their year-to-date gains. For an individual, it offers a way to stay invested in the market’s upside while knowing that a significant portion of their downside is cushioned by a more stable volatility tracker.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)