Valued at a market cap of $16.1 billion, Invitation Homes Inc. (INVH) is a residential real estate investment trust (REIT) that owns, renovates, leases, and manages single-family rental homes across major metropolitan areas. The Dallas, Texas-based company focuses on high-growth Sun Belt and Western U.S. markets, where housing demand is supported by population growth, job creation, and limited housing supply.

This residential REIT has underperformed the broader market over the past 52 weeks. Shares of INVH have declined 14.1% over this time frame, while the broader S&P 500 Index ($SPX) has surged 15%. Moreover, on a YTD basis, the stock is down 5.2%, compared to SPX’s 1.9% return.

Narrowing the focus, INVH has also lagged behind the iShares Residential and Multisector Real Estate ETF (REZ), which gained marginally over the past 52 weeks and dropped slightly on a YTD basis.

On Jan. 7, shares of INVH dropped 6% after the Trump administration announced immediate measures to bar large institutional investors from purchasing additional single-family homes in the U.S. The announcement, which directly targets private equity firms and residential REITs, signaled a notable change in federal housing policy and sparked shockwaves across the sector.

For the current fiscal year, ending in December, analysts expect INVH’s FFO to decline marginally year over year to $1.87. The company’s FFO surprise history is promising. It topped the consensus estimates in each of the last four quarters.

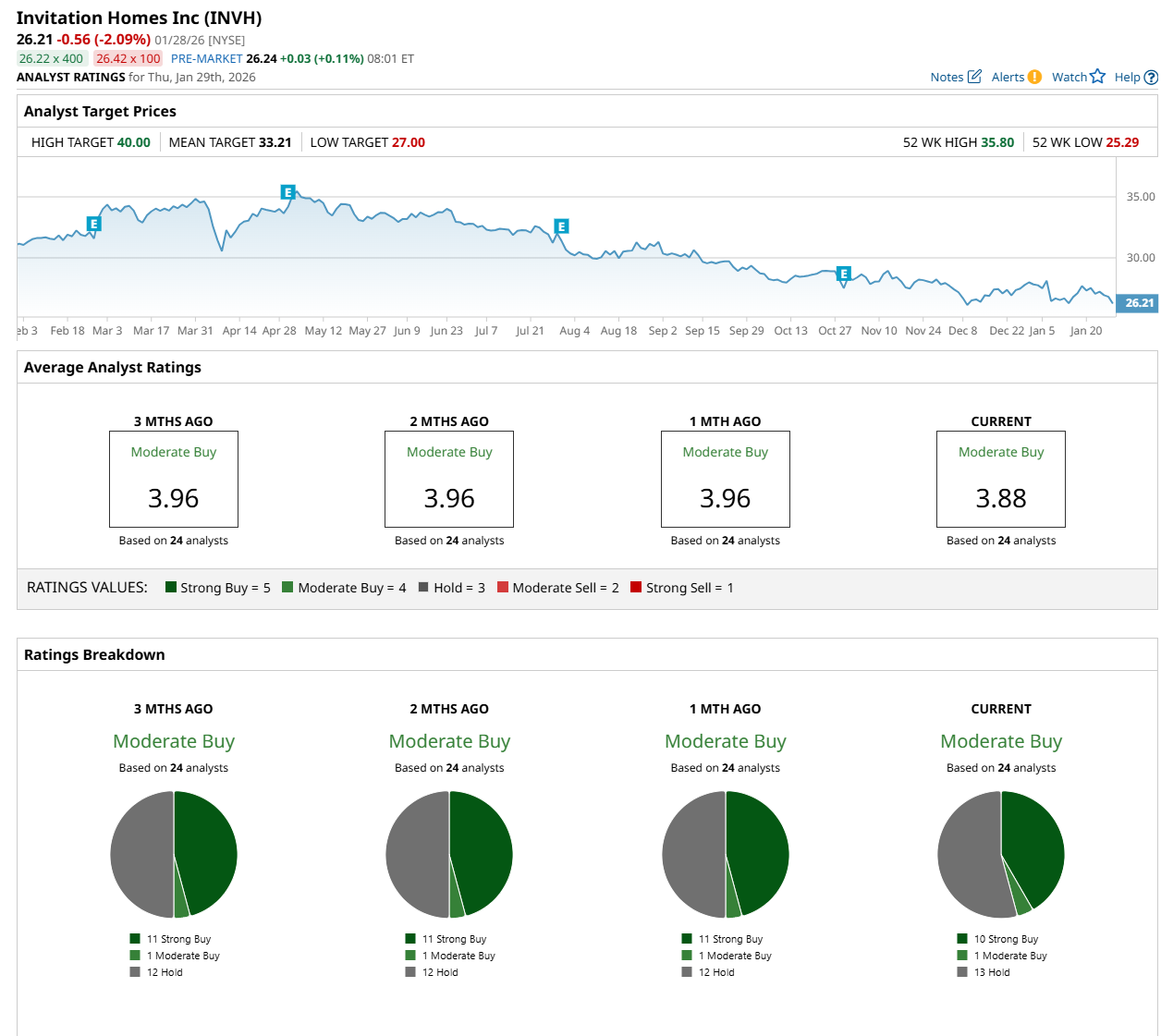

Among the 24 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 10 “Strong Buy,” one “Moderate Buy,” and 13 “Hold” ratings.

The configuration is slightly less bullish than a month ago, with 11 analysts suggesting a “Strong Buy” rating.

On Jan. 27, James Feldman from Wells Fargo & Company (WFC) maintained a "Hold" rating on INVH, with a price target of $31, indicating an 18.3% potential upside from the current levels.

The mean price target of $33.21 represents a 26.7% premium from INVH’s current price levels, while the Street-high price target of $40 suggests a 52.6% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)