Sunnyvale, California-based Fortinet, Inc. (FTNT) provides cybersecurity and convergence of networking and security solutions. Valued at a market cap of $60.8 billion, the company’s offerings include network security, secure networking, zero trust access, and AI-driven security operations.

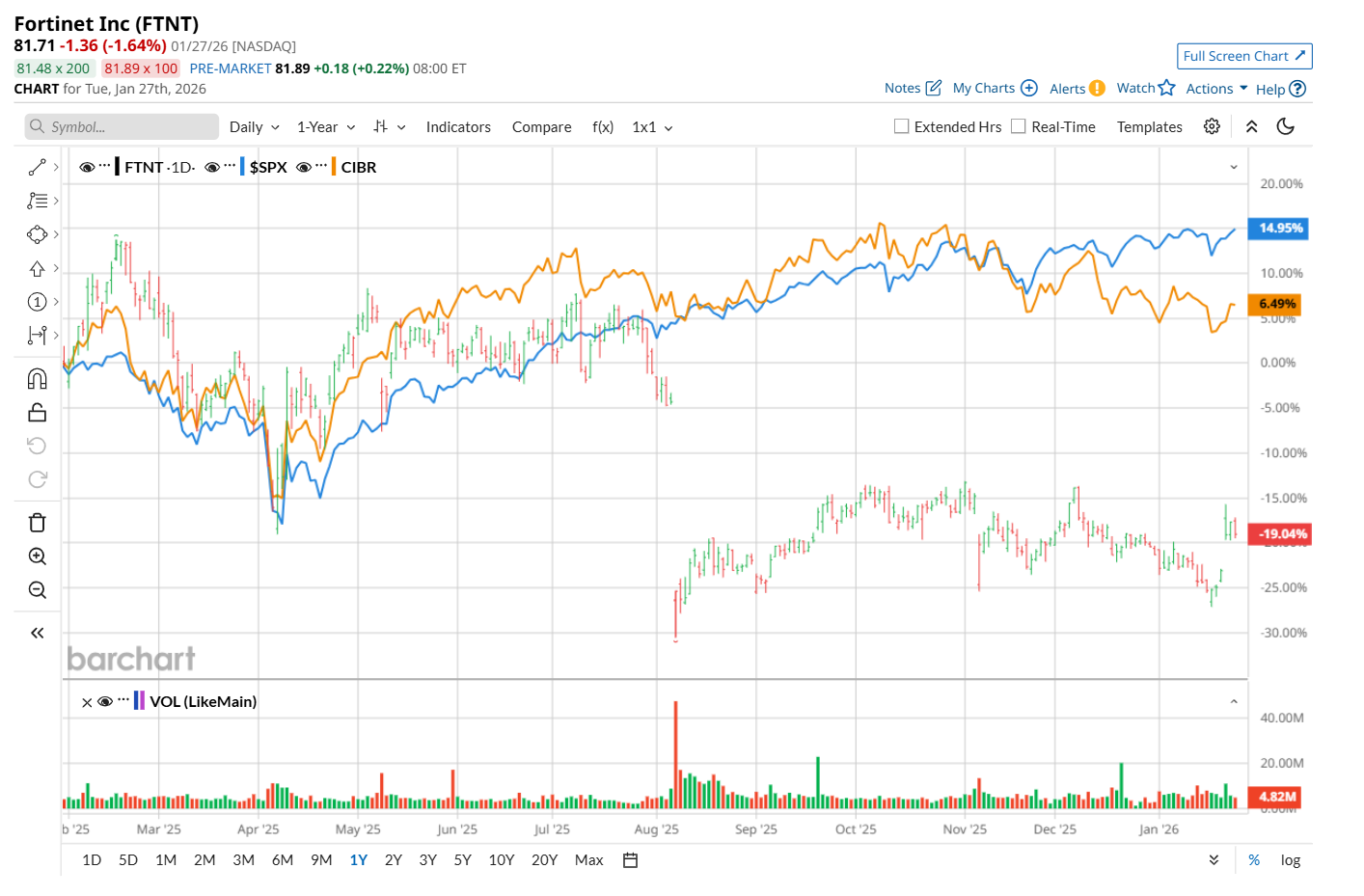

This cybersecurity company has considerably underperformed the broader market over the past 52 weeks. Shares of FTNT have declined 15.6% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16.1%. However, on a YTD basis, the stock is up 2.9%, outpacing SPX’s 1.9% return.

Narrowing the focus, FTNT has also lagged behind the First Trust NASDAQ Cybersecurity ETF (CIBR), which rose 10.2% over the past 52 weeks. Nonetheless, it has outpaced CIBR’s marginal YTD rise.

On Nov. 12, Fortinet shares fell 1.8% after Daiwa Securities downgraded the stock from “Outperform” to “Neutral,” pointing to slowing near-term growth momentum and valuation pressures across the broader cybersecurity sector.

For the current fiscal year, ending in December, analysts expect FTNT’s EPS to grow 13.9% year over year to $2.38. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

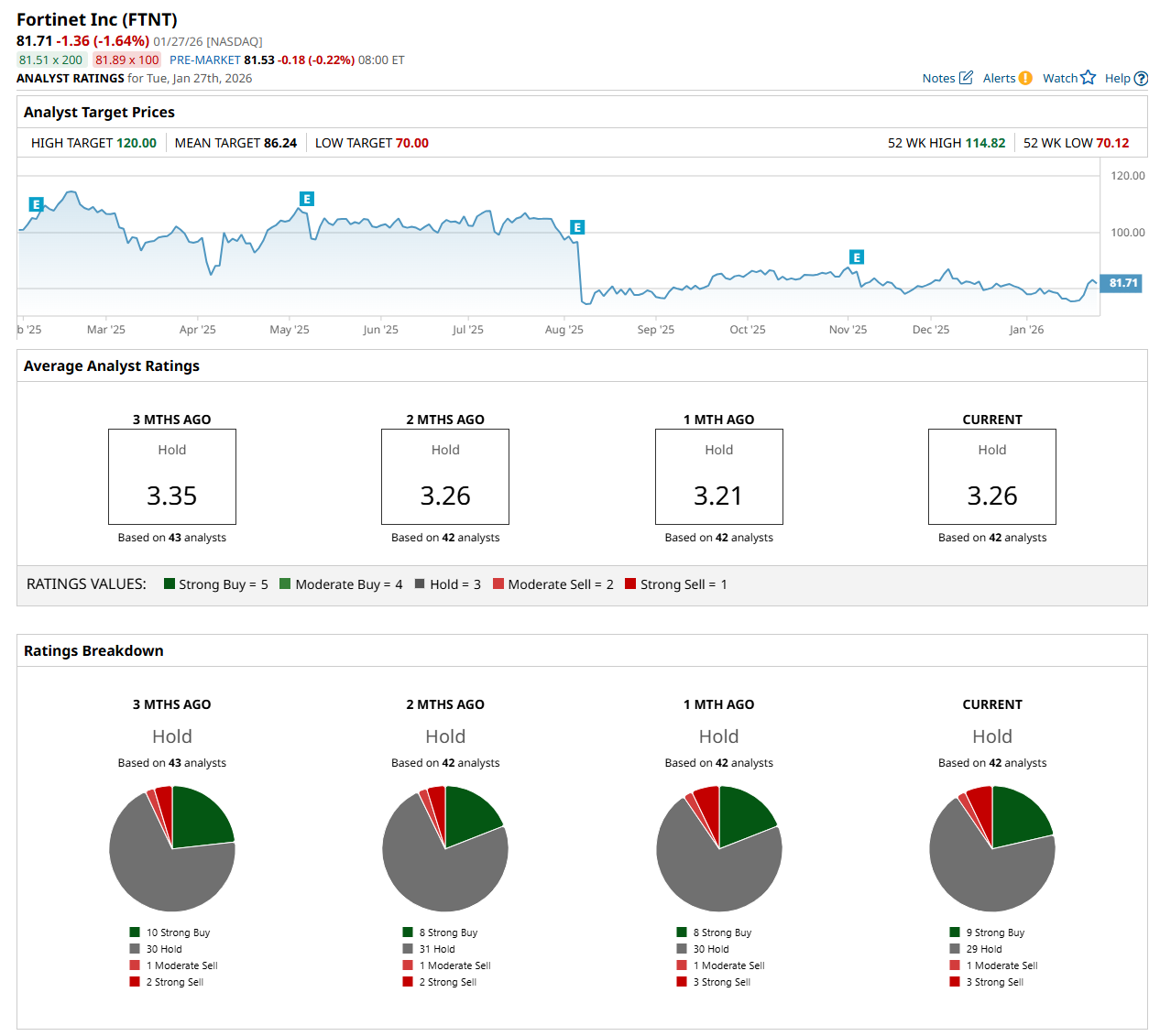

Among the 42 analysts covering the stock, the consensus rating is a "Hold,” which is based on nine “Strong Buy,” 29 “Hold,” one "Moderate Sell," and three “Strong Sell” ratings.

The configuration is more bullish than a month ago, with eight analysts suggesting a “Strong Buy” rating.

On Jan. 23, The Toronto-Dominion Bank (TD) analyst Shaul Eyal upgraded FTNT to "Buy," with a price target of $100, indicating a 22.4% potential upside from the current levels.

The mean price target of $86.24 represents a 5.5% premium from FTNT’s current price levels, while the Street-high price target of $120 suggests a 46.9% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/McDonald's%20Corp%20arches%20by-%20TonyBaggett%20via%20iStock.jpg)