/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

New York-based Pfizer Inc. (PFE) is a leading global biopharmaceutical company. With a market cap of $139.3 billion, it is focused on discovering, developing, and commercializing medicines and vaccines. Founded in 1849, Pfizer operates across multiple therapeutic areas, including oncology, vaccines, cardiology, immunology, rare diseases, and internal medicine. It is best known in recent years for its COVID-19 vaccine and antiviral treatment, developed in partnership with BioNTech.

Shares of this pharmaceutical giant have underperformed the broader market over the past year. PFE has declined marginally over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 13.9%. Over the past six months, PFE stock is up 4.4%, compared to SPX’s 8.8% rise.

Narrowing the focus, PFE’s underperformance is also apparent compared to the Invesco Pharmaceuticals ETF (PJP). The exchange-traded fund has gained about 24.8% over the past year and 25.1% over the past six months.

On Dec. 16, Pfizer shares fell more than 3% after the company issued a 2026 revenue forecast that disappointed investors. Pfizer projected revenue in the range of $59.5 billion to $62.5 billion, with the midpoint coming in below Wall Street’s consensus estimate of $61.63 billion. The weaker-than-expected outlook raised concerns about slowing growth, particularly as demand for COVID-related products continues to decline and the company works to offset these pressures through new drug launches and acquisitions

For FY2025, which ended in December, analysts expect PFE’s EPS to improve marginally to $3.12 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

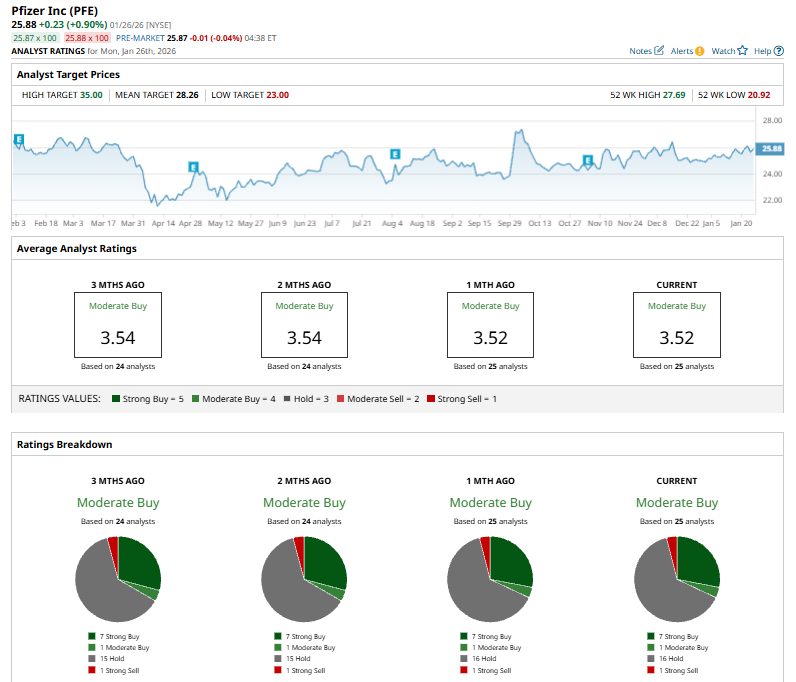

Among the 25 analysts covering PFE stock, the consensus is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, one “Moderate Buy,” 16 “Holds,” and one “Strong Sell.”

The configuration has been consistent over the past three months.

On Jan. 7, UBS analyst Michael Yee initiated coverage of Pfizer with a “Neutral” rating and set a price target of $25, reflecting a cautious outlook on the stock.

The mean price target of $28.26 represents a 9.2% premium to PFE’s current price levels. The Street-high price target of $35 suggests an ambitious upside potential of 35.2%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)