/Facebook-you've%20been%20Zucked%20by%20Annie%20Spratt%20via%20Unsplash.jpg)

Social media giant Meta Platforms (META) kicked off 2026 on a shaky note as its aggressive push into artificial intelligence (AI) began to unsettle investors. The trouble began last October, when the company reported its Q3 results and unveiled ambitious AI-focused capital spending plans. While the company’s underlying performance remained solid, the sheer scale of planned spending stole the spotlight. Investors balked at the prospect of sharply higher capex in 2026, worrying that the company may be taking on too much risk at a time when the returns from generative AI remain uncertain.

That said, despite lingering skepticism on Wall Street, one major bull is standing firm. In a recent investment note, Jefferies argued that Meta’s sharp selloff has created an attractive entry point, naming the stock a “Top Pick.” The firm laid out five key reasons why the selloff should be bought, suggesting the market may be overemphasizing near-term spending fears while underestimating Meta’s long-term AI and monetization potential. With that in mind, here’s a closer look at what’s driving Jefferies’ bullish stance.

About Meta Stock

Meta has grown far beyond its Facebook beginnings in 2004. As the company behind Instagram, WhatsApp, Messenger, and Threads, it remains at the heart of how billions of people connect and communicate every day. Now, Meta is placing a big bet on AI, a move reflected in its rising capex plans. From improving content discovery and boosting ad efficiency to enhancing messaging and building more immersive experiences, AI is shaping Meta’s next phase of growth, alongside the development of both open and proprietary models through its Llama platform.

With a towering $1.66 trillion market capitalization, Meta still sits comfortably among Wall Street’s elite “Magnificent Seven.” But despite its heavyweight status, the ride hasn’t been smooth lately. The social media giant’s stock has taken a noticeable hit, lagging the broader market as investors wrestle with the company’s aggressive AI spending push. Over the past year, shares have been up just 3.5%, well behind the broader S&P 500 Index’s ($SPX) roughly 13% gain, highlighting a clear bout of underperformance.

The near-term picture looks even tougher. Over the past three months, Meta shares have slid 10.3%, pushing the stock firmly into negative territory and keeping it in the red so far in 2026. Ongoing concerns about the scale and timing of returns from Meta’s AI investments continue to weigh on sentiment, even as the company pours capital into what it believes will define its next era of growth.

Meta’s Q3 Earnings: Strong Numbers, Weak Stock Reaction

Meta Platforms delivered a surprisingly strong fiscal 2025 third-quarter earnings report on Oct. 29, one that on paper looked good enough to send the stock higher. Instead, shares slumped nearly 11.3% in the very next session, as investors looked past the headline growth and focused on what lies ahead. Revenue climbed to $51.2 billion, marking a robust 26.3% year-over-year (YoY) increase and Meta’s fastest revenue growth since Q1 2024. The figure also handily beat Wall Street’s $49.5 billion estimate.

The quarter was weighed down by a one-time tax item. Meta said it expects lower U.S. federal cash tax payments going forward under the One Big Beautiful Bill Act, but the change also required the company to record a valuation allowance tied to the U.S. Corporate Alternative Minimum Tax. This led to a $15.93 billion non-cash tax charge in Q3. Excluding this item, diluted EPS would have jumped to $7.25, versus the reported $1.05. Beneath the tax noise, Meta’s core metrics remained healthy.

Family daily active people (DAP) averaged 3.54 billion in September 2025, up 8% YoY, while ad impressions across its Family of Apps rose 14%. Average ad pricing also increased 10%, signaling improving monetization and advertiser demand. The company closed the quarter with a sizable $44.45 billion in cash, cash equivalents, and marketable securities, even as capital expenditures, including finance lease payments, reached $19.37 billion.

Still, the selloff wasn’t about Q3. It was about spending. Meta guided to Q4 revenue of $56 billion to $59 billion, a solid outlook that was largely overshadowed by its investment plans. Management now expects 2025 capital expenditures of $70–$72 billion, up from its previous $66–$72 billion range, while also hinting at even higher spending levels in 2026. Total full-year 2025 expenses are projected at $116–$118 billion, reflecting a 22–24% YoY increase, slightly higher than earlier guidance.

All eyes now turn to Meta’s next update. The tech giant is scheduled to report its fiscal Q4 and full-year 2025 results after the market closes on Wednesday, Jan. 28. Analysts currently expect the company's EPS to grow 1.6% YoY to $8.15 in Q4, with investors keenly focused on whether Meta can balance aggressive AI investment with clearer visibility into future returns.

Why Jefferies Believes Meta’s Dip Is Worth Buying

On Jan. 22, Meta Platforms shares climbed about 5.7% after Jefferies said the stock’s sharp pullback has created an attractive buying opportunity. Analyst Brent Thill noted that Meta now trades “an 8-turn NTM PE discount to GOOGL,” a gap driven by fears around margins, heavy AI spending, and execution risk. The analyst believes those concerns are largely priced in, leaving limited downside to earnings and room for positive revisions through 2026.

Jefferies also downplayed worries around future spending. Even if Meta guides 2026 capital expenditures above roughly $110 billion and operating expenses beyond about $150 billion, the investment firm doesn’t expect investors to be surprised, pointing to management’s conservative guidance and calling Q4 the likely “peak pressure” period for spending.

On the growth side, Jefferies sees Meta’s AI story improving, helped by recent “All-Star AI hires” that could deliver a stronger frontier model in early 2026 and move the company past earlier Llama 4 issues. At the same time, Meta continues to strengthen its AI-powered core flywheel, stacking gains across recommendation and conversion systems.

On monetization, Jefferies estimates WhatsApp is currently generating about $9 billion in annual revenue, with the potential to scale to around $36 billion by fiscal 2029. Threads, with roughly 500 million users, offers early-stage monetization upside, while Llama and Meta’s broader AI offerings could eventually introduce paid features, opening the door to entirely new revenue engines.

How Are Analysts Viewing META Stock?

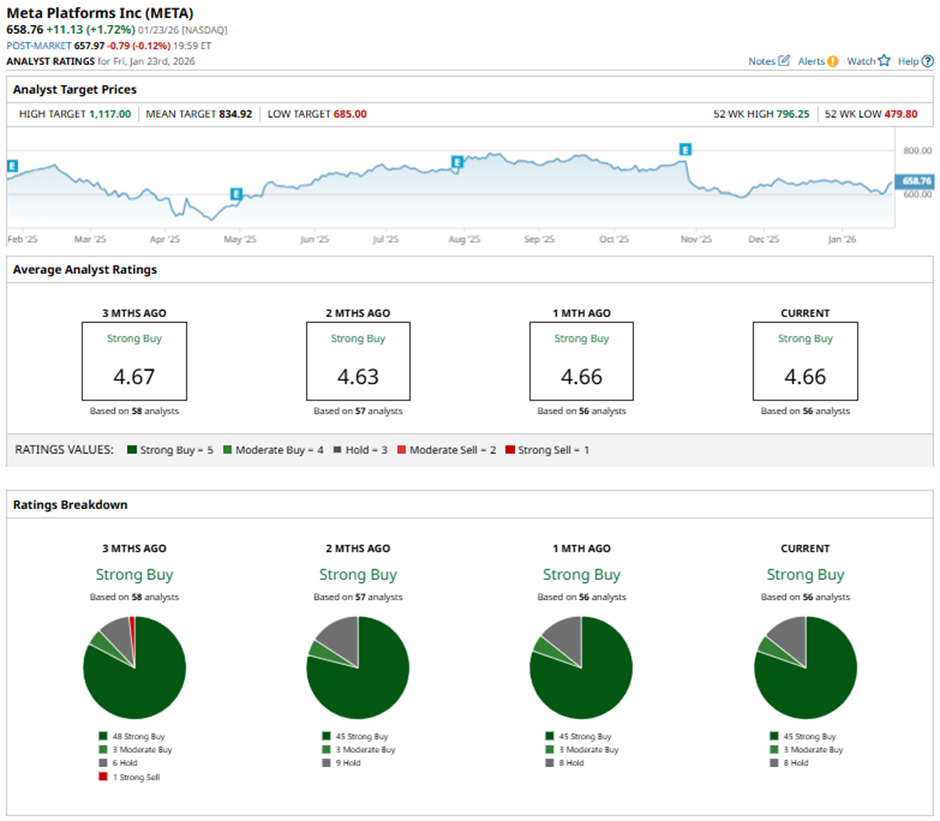

Overall, Wall Street’s enthusiasm for Meta Platforms hasn’t faded, even as some investors remain cautious about near-term AI spending. The stock currently carries a consensus “Strong Buy” rating, signaling broad confidence in Meta’s long-term story. Of the 56 analysts covering the name, a commanding 45 rate it a “Strong Buy,” another three call it a “Moderate Buy,” and just eight sit on the sidelines with a “Hold.”

Price targets reinforce that optimism. META stock's average price target of $834.92 implies nearly 27% upside from current levels, suggesting analysts see meaningful room for the stock to recover and push higher. Even more striking, the Street-high target of $1,117 points to a potential 70% upside, highlighting how bullish some on Wall Street are about Meta’s ability to turn heavy AI investments into powerful long-term growth.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)