Four weeks in, 2026 is starting to shape up and show its cards. It's going to be a mess. That is not a statement about stock market direction or the path of interest rates. It is about the news flow, the macro risks all around us, and the absolute urgency with which I believe all investors and traders need to focus on managing risk.

When I see social media posts focused on “how to get rich” themes, I want to simultaneously laugh and cry. When getting rich seems easy, that’s the exact time to focus on managing risk. Because the time to think about how to protect yourself is not when everyone is panicking. The whole idea is to have rehearsed and prepared for whatever may happen. Because, clearly, 2026 is a year in which anything can.

A Storm Is Brewing

In meteorology, you have hurricanes, which are slow-moving and visible for days before they reach land. You also have tornadoes, which are sudden and localized. In 2026, we have both on the financial radar. Ignoring them isn't bravery — it's a failure of fiduciary duty to your own capital.

The Financial Hurricane: The Slow-Moving Macro Threat

A hurricane is a high-probability event with a long lead time. You see it forming in the Atlantic (or, in our case, the Treasury market) days before landfall.

- The Storm: This is the narrowness of the market. As of January 2026, the S&P 500's concentration in just 10 stocks is at dot-com-bubble levels. We also see "Stagflation Lite" building, with inflation stuck near 3% and gross domestic product (GDP) growth projected at a modest 2.2%.

- The Preparation: When you know a hurricane is coming, you don't wait for the wind to rip off your shutters. You board up early. In your portfolio, this means diversifying away from the Magnificent 7. This year, the smart money is shifting from a 50/50 U.S./international split toward a 40/60 split to capture cheaper valuations in Europe and emerging markets.

The Financial Tornado: The Sudden Tail Risk

A tornado gives you just minutes of warning. It’s a Black Swan event — a sudden geopolitical flare-up at Davos or a massive artificial intelligence (AI) earnings miss that triggers a flash crash.

- The Storm: This is tail risk. It’s the $100 parabolic move in silver (SLV) or a sudden break of the 200-day moving average in tech.

- The Preparation: You build a storm cellar. This isn't about "timing the market." It's about having what I would call a “convex hedge.” That’s where a small loss won’t create much defense in my portfolio, because I don’t need it. But if the proverbial storm pops up, the hedge starts as a defender, and becomes a profit-making weapon in a crisis.

One of my favorites, which I write about frequently, is tail-risk hedging — buying out-of-the-money (OTM) puts. While they cost a premium (your "insurance policy"), they prevent a 50% drawdown, which would require a 100% gain just to break even.

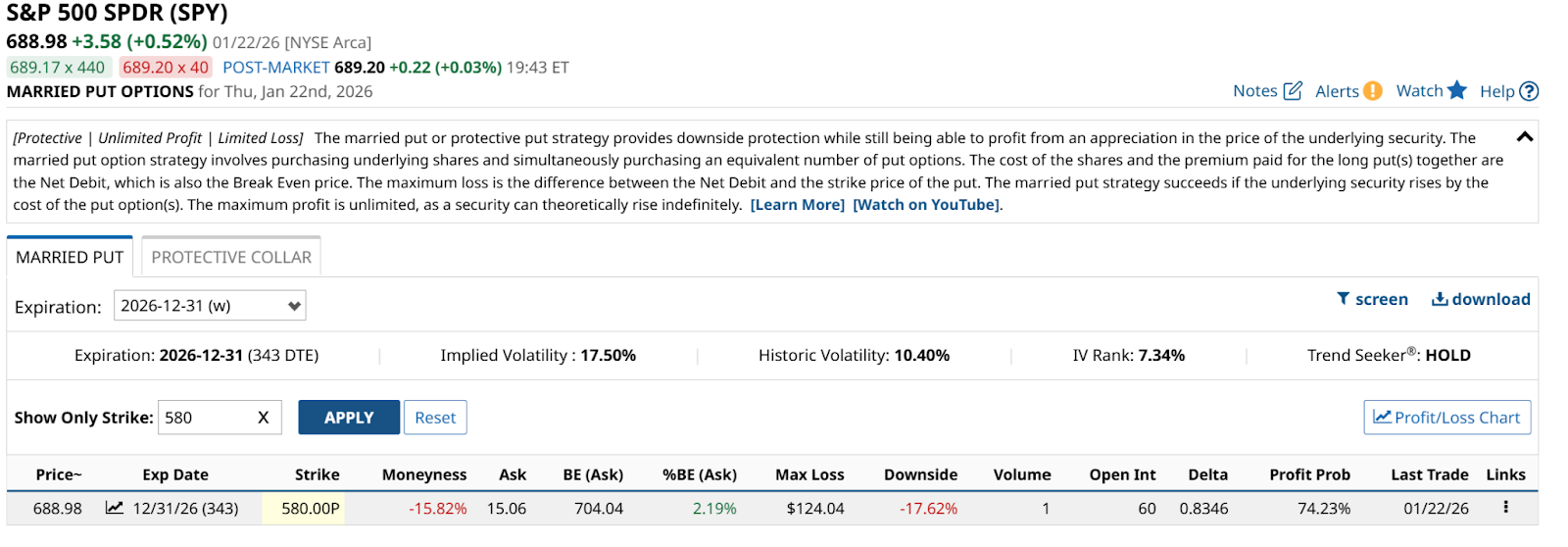

How far out of money depends on the underlying asset, but think 10% to 15%. Let’s look at one on the S&P 500 ETF (SPY), 15% OTM, and go out to year-end.

Above, we see the Dec. 31 expiration date, so about 11 months of protection. And its way out of the money, with the put struck at $580 versus the $689 Thursday close for SPY. The put options cost around $15 a share, or $1,500 for one contract covering 100 shares. That’s about $69,000 in notional value of S&P 500 exposure, protected below $580. Or net of the cost, $565.

This is not a tight hedge. It is one that, if we recall last year’s tariffs, might stop the bleeding if SPY were to revisit the $480 area where it bottomed last April.

Planning for the storm doesn't mean you want it to happen. It means you intend to be the one most solvent when the sun comes back out.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. His new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)