/A%20concept%20image%20of%20a%20self-driving%20car%20image%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

Lemonade (LMND) is in the news after announcing the development of a new insurance policy for self-driving cars, beginning with the Full Self-Driving (FSD) system offered in Tesla (TSLA) vehicles. The news was met with an immediate reaction in the stock market. LMND stock saw an uptick in shares — up 9% on Jan. 21 and 13% on Jan. 22 — as did Tesla stock.

The most prominent part of the announcement was impossible to overlook: Lemonade is promising to decrease its per-mile rates by about 50% with FSD enabled, based on data that demonstrates accident rates decrease substantially with FSD mode engaged. Additionally, Lemonade anticipates that its insurance premiums will continue to decrease as Tesla improves its FSD software packages in future releases. Simply stated, Lemonade is betting that improved autonomy translates into decreased risk that it will be able to accurately assess for their policyholders.

This also comes at an important time as investors reassess the insurance, data, and AI nexus. Usage-based pricing models have always been a sought-after goal in the car insurance space, although access to Tesla car data could potentially represent a paradigm shift.

About Lemonade Stock

Lemonade, a tech-enabled insurance company serving renters, homeowners, pets, life, and most recently auto insurance policies, has established itself as a tech-driven alternative to traditional insurers using AI, automation, and behavioral economics. Lemonade has a total valuation of around $7. billion in terms of market capitalization and is based in New York.

LMND stock has experienced an impressive run. In fact, the stock has risen by 181% in the last year alone, trading for around $93 per share, just short of its $99.90 high. In the last year, the S&P 500 Index ($SPX) has risen by only a fraction of the gains experienced by LMND. Hence, speculative future gains can be gauged from the performance of the stock.

LMND stock is still highly valued. Lemonade is not yet profitable and currently trades at 10.35 times sales and more than 13 times book value. These valuations far exceed those of traditional insurance companies. Still, the case for Lemonade is a different business model — one powered by AI underwriting and a rising loss ratio.

Lemonade Advances Toward Profitability

The company’s recent quarterly results support the notion of investors being willing to pay up for LMND stock. In the third quarter, In Force Premium came to $1.16 billion, representing a 30% increase year-over-year (YOY), the company’s eighth consecutive quarter of growth. Gross profit more than doubled to $80 million in Q3, with gross margins increasing to 41%, or 14 points above last year’s figure.

Perhaps as significant, the company’s gross loss ratio declined to 62%, the lowest in its history. Looking at the 12 months trailing the current quarter, the loss ratio is at 67%, implying that Lemonade's AI-based models are starting to gain traction. Adjusted EBITDA losses were also cut in half as the company produced an adjusted free cash flow (FCF) of $18 million during the quarter.

Management emphasized that these improvements were achieved despite the fact that the firm’s spend on marketing was over three times greater. Due to better segmentation and pricing enabled by the power of artificial intelligence, the firm was able to maintain its lifetime value to customer acquisition cost ratio of 3:1 while also keeping its operating costs (excluding growth investments) flat. The Tesla FSD initiative is a prime example of these above factors coming together.

What Do Analysts Expect for LMND Stock?

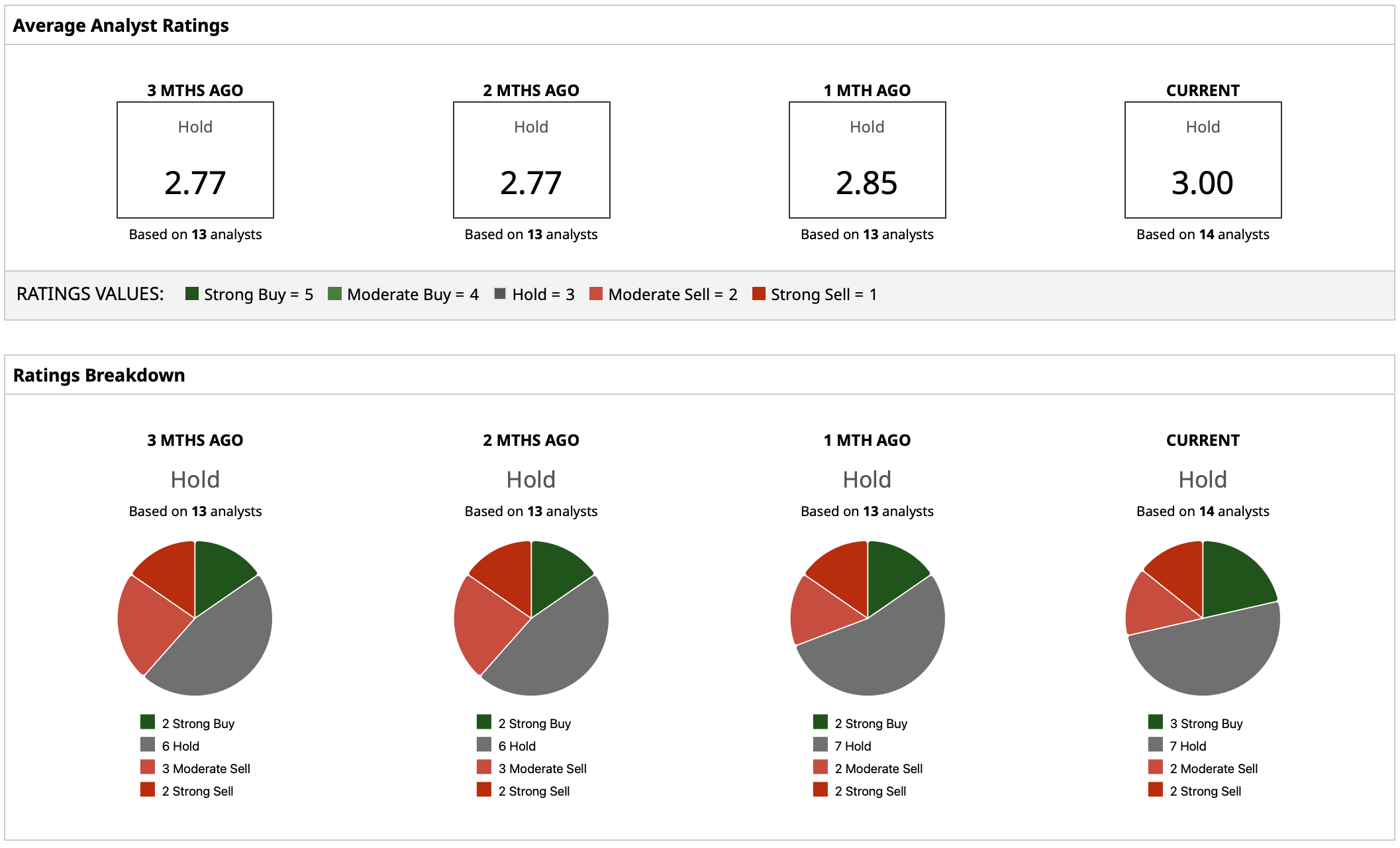

Wall Street, however, still remains cautious about LMND stock with a “Hold” consensus rating and a mean target price of $63.40, significantly below the current trading price. This indicates that the stock still has considerable downside potential if the company fails to deliver on expectations.

While the highest price target for Lemonade is $98, the lowest target is $30 per share. From a certain viewpoint, the partnership between Lemonade and Tesla only serves to support the bullish narrative that the former is transforming into a data-centric insurance platform aligned with the future of autonomous mobility. From another viewpoint, though, a large portion of that optimism is simply priced into the stock, while profitability is still a work in progress.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)