The artificial intelligence (AI) revolution has powered a strong rally in several stocks over the past few years, as companies rush to position themselves for this transformative trend. However, not every AI-related stock has managed to sustain momentum. And one notable example is chip designer Arm Holdings (ARM). Arm kicked off 2025 on a high note. The company was among several high-profile names linked to the Stargate Project, a massive $500 billion AI infrastructure initiative that brings together industry giants such as Nvidia (NVDA), Oracle (ORCL), OpenAI, and SoftBank Group (SFTBY).

That association initially boosted optimism around Arm’s long-term growth prospects in the AI ecosystem. But as the year unfolded, sentiment began to cool. Arm finished 2025 deep in the red, pressured by rising fears of an AI bubble and concerns over the stock’s stretched valuation. In addition, investors appear uneasy about SoftBank’s margin loan backed by its ARM shares. In the event of a broader AI sell-off, the risk of forced selling has added another layer of anxiety, one that could quickly amplify downside pressure.

Despite the company’s solid fundamentals and rapid pace of innovation, Arm’s stock is now down double digits from its October 2025 peak. Still, the pullback hasn’t scared everyone away. In a research note released on Jan. 20, Mizuho said investors should consider taking advantage of the recent weakness in the chip stock. So why does Mizuho believe this downturn could be more of a buying opportunity than a red flag? Let’s take a closer look.

About Arm Stock

Founded in 1990 and headquartered in England, ARM is unlike traditional chipmakers because it doesn’t manufacture chips itself. Instead, Arm designs energy-efficient processor architectures and licenses its technology to hundreds of companies worldwide. Arm makes money in two main ways. First, it earns licensing fees when customers, such as smartphone makers, cloud providers, and chip designers, use its designs.

Second, it collects royalties every time a chip built on Arm’s architecture is shipped. While smartphones have historically been Arm’s largest source of revenue, the company’s footprint now extends well beyond mobile. Its designs are increasingly being adopted in data centers, automotive systems, consumer electronics, and AI-focused chips, placing Arm at the center of several powerful long-term growth trends.

Currently commanding a market capitalization of about $120.4 billion, this British chip designer has been struggling to find its footing on Wall Street. After peaking at $183.16 last October, the stock tanked almost 53.7% from that level. In 2025, ARM stock plunged nearly 33.8%, while the broader S&P 500 Index ($SPX) has soared 13.6% over the same stretch, highlighting the unpopularity of ARM stock despite its long-term growth narrative.

Even after the recent sell-off, Arm’s valuation still looks far from cheap. The stock is currently trading at a lofty 121.32 times earnings and 24.9 times sales, levels that remain well above industry norms. By comparison, the sector’s median valuation stands at just 31.32 times earnings and 3.62 times sales.

Arm’s Q2 Earnings Snapshot

While concerns around Arm’s rich valuation are understandable, the company’s underlying fundamentals continue to stand out, and its fiscal 2026 second-quarter earnings report released in November made that clear. Arm Holdings delivered a strong set of results, highlighting robust growth and improving profitability. During Q2, Arm posted year-over-year (YOY) revenue growth of 34%, with total revenue climbing to $1.14 billion, marking a record second quarter for the company.

Notably, revenue topped $1 billion for the third straight quarter and also beat Wall Street expectations of $1.06 billion, reinforcing confidence in the company’s momentum. A closer look at the breakdown shows encouraging trends. Royalty revenue climbed 21% YOY to $620 million, driven by broader adoption of higher-value Arm technologies such as Armv9 architecture and Arm CSS, along with growing use of Arm-based chips in data centers.

Meanwhile, license and other revenue surged 56% YOY to $515 million, driven by the timing and size of several high-value license deals and solid contributions from backlog. Another key metric also impressed. Annualized contract value (ACV), which reflects normalized license and other revenue, jumped 28% YOY to $1.60 billion, pointing to strong demand visibility going forward.

Profitability remained exceptional as well, with non-GAAP gross margin reaching 98.2%, up from 97.2% a year earlier. On the bottom line, adjusted EPS jumped an impressive 30% YOY to $0.39, easily topping the consensus forecast of $0.33. The company also maintained a strong financial position, ending the quarter with $3.26 billion in cash, cash equivalents, and short-term investments.

Looking ahead, attention now turns to Arm’s Q3 earnings report, scheduled for release after market close on Feb. 4. Management guided third-quarter revenue to about $1.225 billion, with a plus-or-minus $50 million range, pointing to continued top-line strength. On the earnings front, the company expects non-GAAP EPS to land between $0.37 and $0.45.

How Are Analysts Viewing Arm Stock?

Mizuho seems to believe the market has turned too negative on ARM stock and that investors may be missing a buying opportunity. In a recent investment note, the firm said the stock’s sell-off reflects excessive pessimism around smartphone demand. According to Mizuho analyst Vijay Rakesh, the concerns behind Arm’s decline are “overdone,” making the pullback an attractive entry point. Crucially, Mizuho argues that Arm’s growth story goes far beyond smartphones.

While mobile accounts for around 50% of ARM’s royalty revenue, that revenue has historically grown faster than overall handset demand. Looking ahead, Mizuho expects Arm’s royalty revenue to expand at an annual rate of 7% to 31% between 2021 and 2027, supported by multiple long-term drivers.

Moreover, one of the biggest tailwinds is the industry’s shift to Arm’s v9 architecture, which delivers roughly twice the average selling price per core compared with v8. On top of that, rising demand for custom, in-house chips could unlock meaningful upside. Mizuho estimates that potential ASIC and CPU ramps in 2027 and 2028 could add more than $1 billion in incremental revenue.

Beyond phones and AI, Arm is gaining ground in data centers. Big cloud players are increasingly using Arm-based chips, including Amazon (AMZN) Web Services’ Graviton, Microsoft’s (MSFT) Cobalt, Meta Platforms’ (META) upcoming CPU, and Nvidia’s Grace and Vera platforms. This growing adoption is helping Arm expand its customer base and earn higher royalties.

Thus, keeping all these factors in mind, Mizuho reiterated its “Outperform” rating and $190 price target, noting that Arm is well-positioned as one of the most important semiconductor platforms globally, even after the recent pullback.

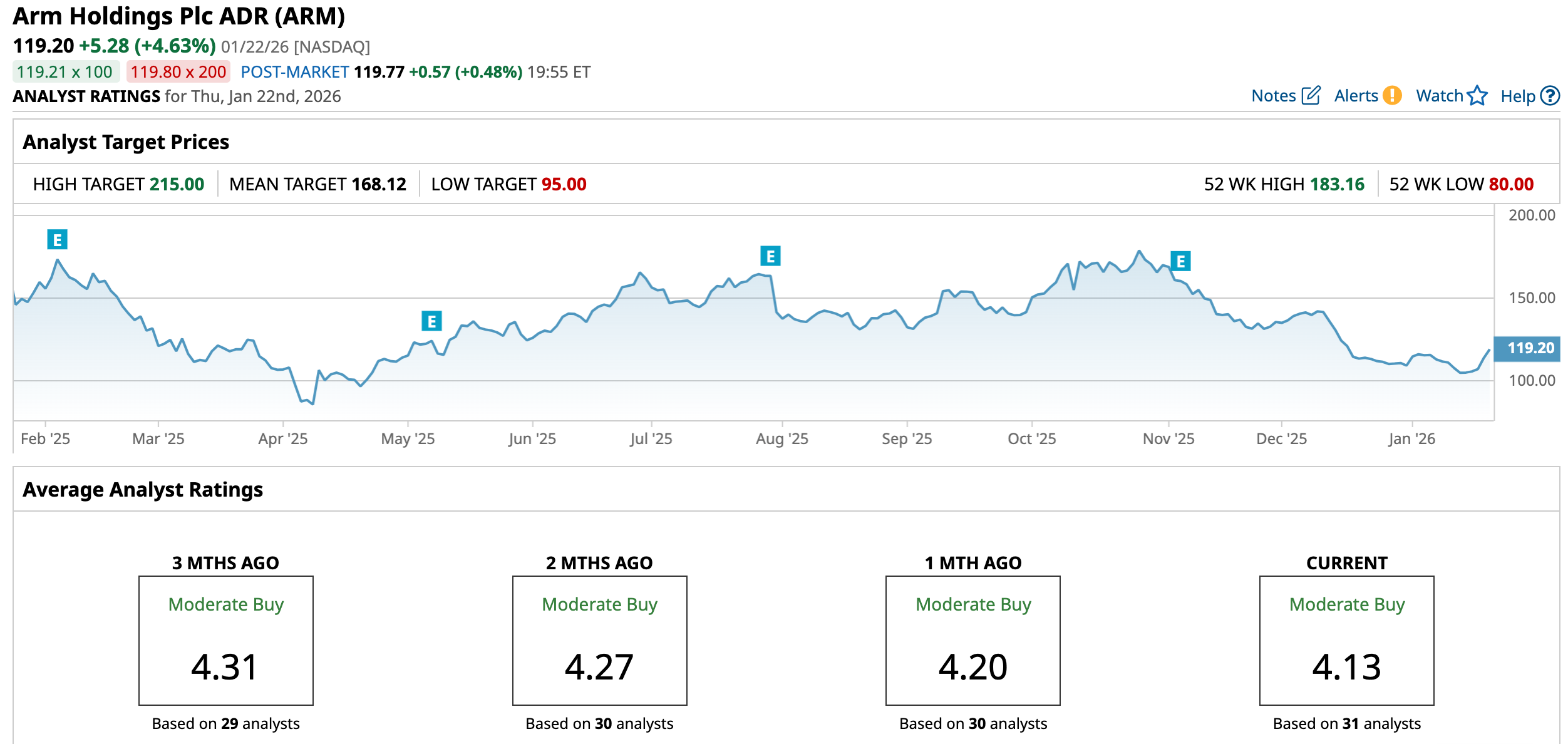

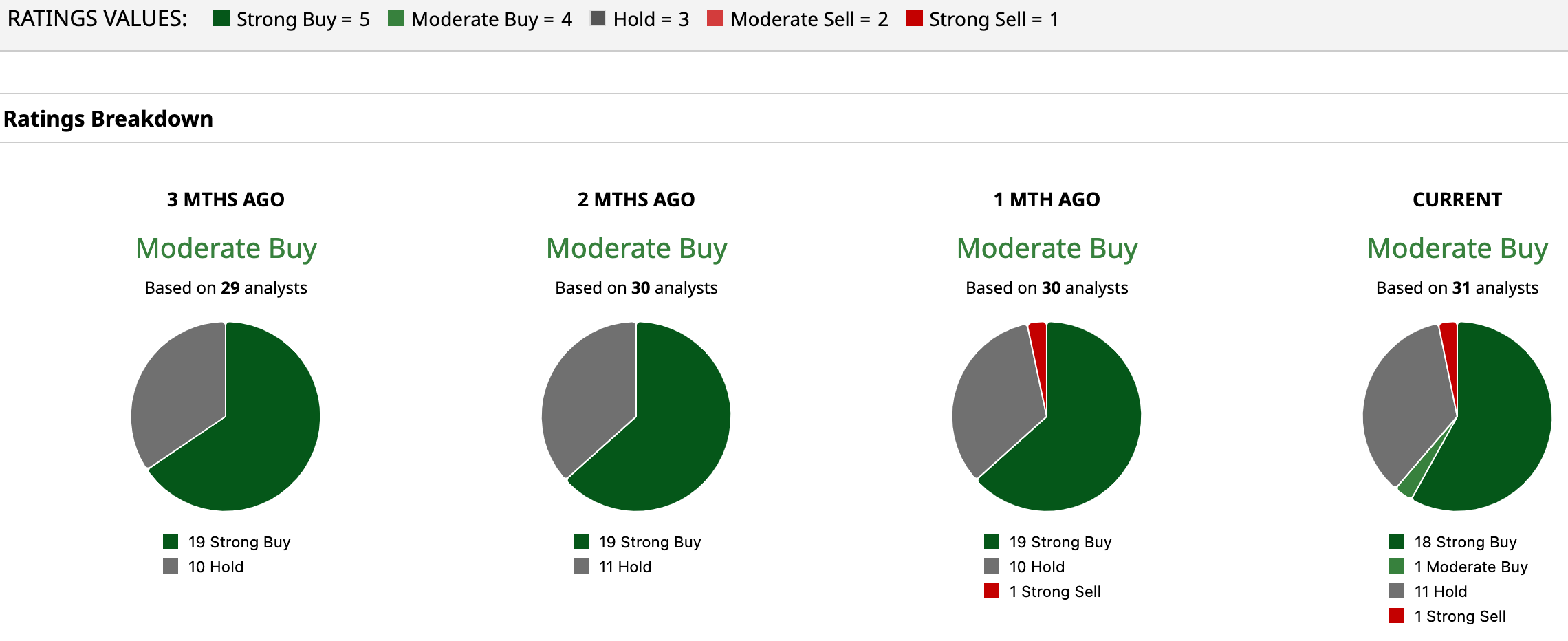

Overall, Wall Street is still firmly in ARM’s corner. The stock carries a consensus “Moderate Buy” rating, reflecting broad optimism despite recent volatility. Of the 31 analysts covering the name, 18 rate it a “Strong Buy,” one calls it a “Moderate Buy,” 11 sit on the sidelines with “Hold” ratings, and just one analyst has turned outright bearish with a “Strong Sell.”

The upside case is equally compelling. ARM’s average price target of $168.12 points to a potential 41% rally from current levels, while the Street-high target of $215 suggests the stock could soar as much as 80.37% from here if the bullish thesis plays out.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)