Valued at a market cap of $39.7 billion, TKO Group Holdings, Inc. (TKO) is a global sports and entertainment company formed through the combination of World Wrestling Entertainment (WWE) and the Ultimate Fighting Championship (UFC). Headquartered in New York, TKO operates two of the most recognizable and monetizable brands in live sports entertainment, with a strong global fan base and year-round content distribution.

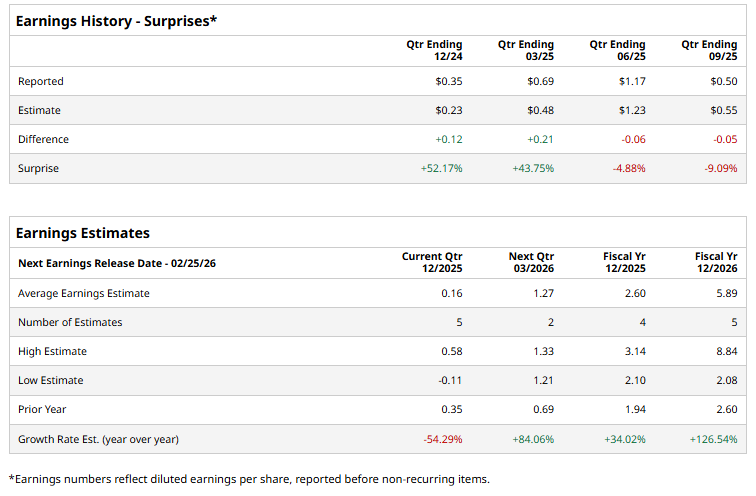

The sports giant is expected to announce its fiscal Q4 earnings soon. Before this event, analysts expect this sports and entertainment leader to report a profit of $0.16 per share, down 54.3% from $0,35 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in two of the last four quarters, while missing on two other occasions.

For fiscal 2025, analysts expect TKO to report a profit of $2.60 per share, representing a 34% increase from $1.94 per share in fiscal 2024. Furthermore, its EPS is expected to grow by an even more impressive 126.5% year over year to $5.89 in fiscal 2026.

TKO has soared 43.1% over the past 52 weeks, considerably outpacing both the S&P 500 Index's ($SPX) 13.3% uptick and the Communication Services Select Sector SPDR Fund’s (XLC) 16.5% return over the same time period.

TKO shares climbed 3.1% on Dec. 4 after the company announced a quarterly cash dividend of $0.78 per share, representing an aggregate distribution of approximately $150 million, paid on December 30, 2025.

Wall Street analysts are highly optimistic about TKO’s stock, with an overall "Strong Buy" rating. Among 23 analysts covering the stock, 17 recommend "Strong Buy" and six suggest "Hold.” The mean price target for TKO is $224.50, indicating a 10.4% potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)