/Visa%20Inc%20logo-by%20Cineberg%20via%20Shutterstock.jpg)

President Donald Trump's endorsement of the “Credit Card Competition Act” has brought fresh regulatory pressure back onto payment networks. On Jan. 12, Trump urged lawmakers to back the bipartisan bill, writing on social media that it would “stop the out of control Swipe Fee ripoff.” Markets reacted quickly. Visa (V) shares dropped 4.7% in morning trading that day, while Mastercard (MA) fell 5.2% in the same session, marking the worst daily performance for both stocks in more than six months.

The policy risk also goes beyond the interest rate debate. The national average credit card rate is 19.7%, and Trump’s earlier Jan. 9 proposal to cap rates at 10% for one year pushed large bank stocks down 1% to 3% as investors reworked the math on consumer lending profits.

For transaction-focused networks like Visa, which make money from processing volumes rather than lending spreads, swipe fees are a more direct pressure point. Visa shares fell 1.9% on Jan. 12 after the interest rate cap proposal. But the bigger issue may come down to whether the Credit Card Competition Act starts moving in Congress. The bill would force large banks to give merchants additional, lower-cost routing choices beyond Visa and Mastercard’s current setup, which would challenge the basic economics of the card network model.

Can Visa sustain its transaction-driven growth model if regulators fracture the payment processing landscape? Let’s find out.

Visa’s Numbers Under the Microscope

Visa runs a simple payments model. It takes a small cut each time a transaction runs across its global card network, instead of making money by lending from its own balance sheet.

Over the past 52 weeks, the stock is up about 3.6%, but it is down roughly 6.3% year-to-date (YTD) as investors weigh the political noise around swipe fees and regulation.

Visa trades at about 26.8x forward earnings, more than double the sector’s roughly 11.5x forward multiple, a gap that reflects Visa’s market position, steady cash generation, and long-term growth outlook.

Income investors also have a steadily improving story. Visa yields about 0.74% on an annualized basis, with an annual dividend yield of 2.44% on financial averages, backed by a forward payout ratio near 19% and an 18-year streak of dividend increases. That includes a recent hike to a quarterly dividend of $0.67 per share.

The latest results help support that confidence: fiscal 2025 GAAP net income was $20.1 billion ($10.20 per share), and non-GAAP net income was $22.5 billion ($11.47 per share), on $40 billion in net revenue that rose about 11% to 12% on a constant-currency basis. In fiscal Q4 alone, Visa posted $5.1 billion in GAAP profit ($2.62 per share) and $5.8 billion in non-GAAP profit ($2.98 per share) on $10.7 billion of revenue, up roughly 11% to 12%, with payments volume, cross-border activity, and processed transactions all staying strong. That cash generation funded $6.1 billion of buybacks and dividends in the quarter and $22.8 billion for the full year, which helps explain why the stock has long commanded a premium valuation.

What’s Powering Visa’s Fundamentals

Fiserv’s (FISV) collaboration with Visa is about connecting Visa Intelligent Commerce and the Trusted Agent Protocol to Fiserv’s agentic ecosystem so merchants can take part as AI-driven agents begin handling product discovery, comparisons, and checkout for consumers.

This matters because it carries Visa’s “trust layer” into where commerce is heading, meaning authentication, permissions, and secure payment execution, and it also taps into Fiserv’s large merchant network, so adoption can scale faster than Visa could drive on its own.

Visa says this is already moving beyond concepts. The company has completed hundreds of secure, agent-initiated transactions with partners across the ecosystem, setting up 2026 as the point when agent-driven payments start moving from testing into broader real-world use. At the same time, this ties back to the swipe fee and routing debate. If rules tighten around traditional card routing, Visa is pushing to stay central to how identity checks and payment authorization work when the “buyer” is increasingly an automated agent.

The Lumanu partnership goes after a different, fast-growing area: creator and contractor payouts at a global scale. By integrating Visa Direct, Lumanu is extending real-time payments to creators and contractors in more than 195 countries and territories while still providing the visibility, compliance, and spend controls brands and agencies rely on, which supports Visa’s continued push beyond cards into real-time disbursements.

What Wall Street Thinks Comes Next

For Visa’s upcoming earnings on Jan. 29, analysts expect earnings of 3.14 per share versus 2.75 a year ago, which implies about 14.18% year-over-year (YoY) growth. For the full fiscal year 2026, consensus sits at 12.81 per share versus 11.47 previously, an 11.68% increase, as Visa keeps growing payment volumes even as the political backdrop gets tougher.

Those earnings expectations help explain why major firms are staying positive despite Trump’s rhetoric. Bank of America recently upgraded V stock from “Neutral” to “Buy” and set a $382 price target, pointing to strong fundamentals, steady revenue growth, expanding cross-border transactions, and solid shareholder returns.

HSBC moved the same way, upgrading the stock from “Hold” to “Buy” and raising its target from $335 to $389, suggesting it sees long-term growth and cash generation as stronger forces than the risk of fee pressure in the headlines.

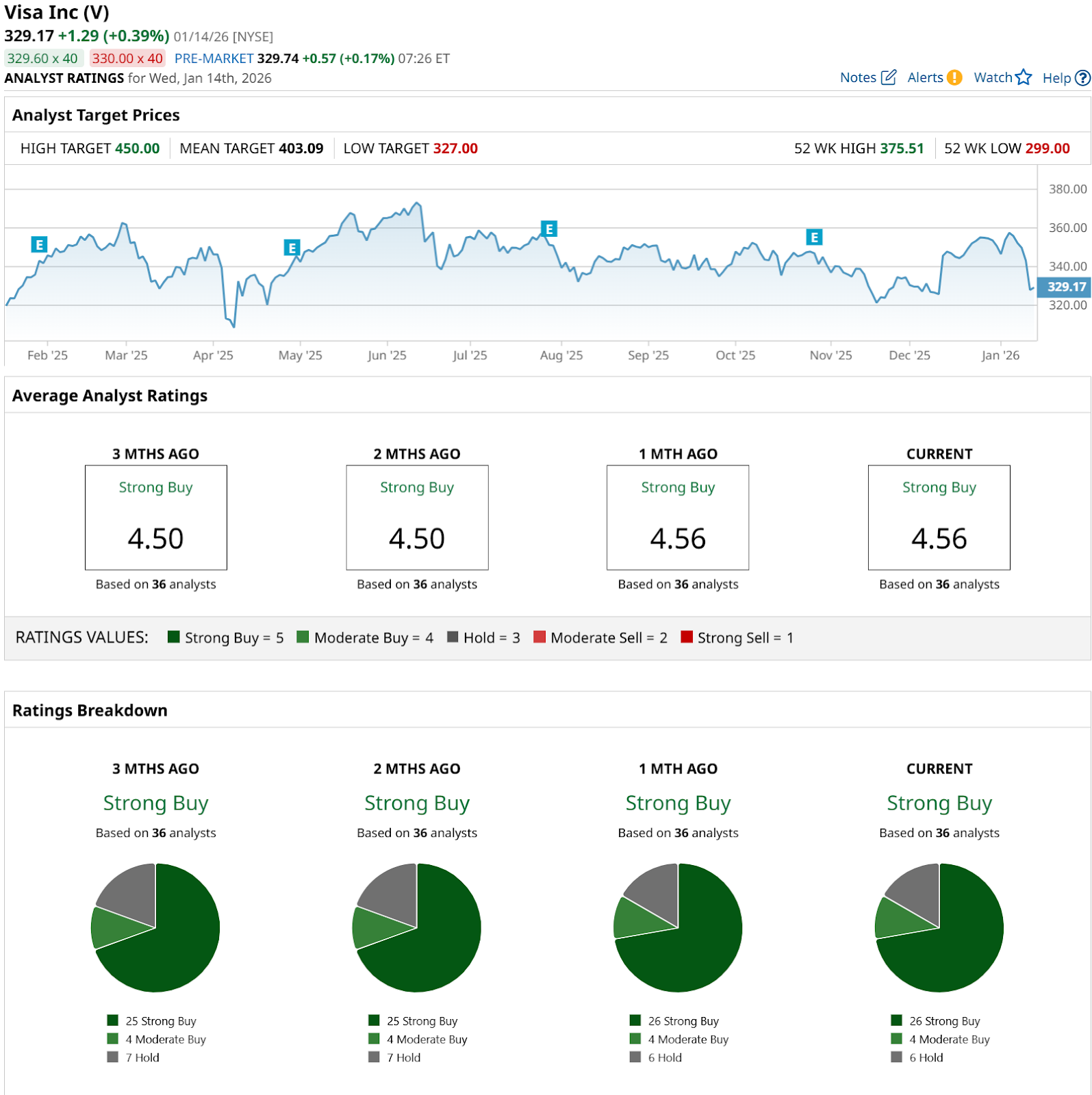

Looking across the full analyst group, all 36 analysts surveyed rate Visa a consensus “Strong Buy.” The mean price target is $403.09, which implies about 22.5% upside from the current level.

Conclusion

For now, Trump’s swipe-fee broadside looks more like a sentiment shock than a thesis-breaker for Visa. The Credit Card Competition Act is a real overhang, but it is not law yet, and markets know it.

With earnings still growing double digits, a rich but supported valuation, and every covering analyst sitting in the Strong Buy camp with roughly 22.5% implied upside from here, the setup leans toward volatile, headline-driven trading rather than a structural derating. If Washington meaningfully advances the bill, then the stock will probably stay volatile. However, if momentum cools, Visa’s fundamentals and Wall Street’s targets suggest shares are more likely to grind higher than reset lower.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)