/Unitedhealth%20Group%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg)

UnitedHealth (UNH) shares slipped further on Friday after President Donald Trump said his “Great Healthcare Plan” will “get rid of insurance brokers and corporate middlemen.”

For Americans, this would mean a significant decline in healthcare premiums, he added at a White House event on Jan. 16.

While such a seismic policy change would generally be seen as negative for health insurance firms like UNH, Bernstein continues to see significant further upside in its stock through the end of 2026

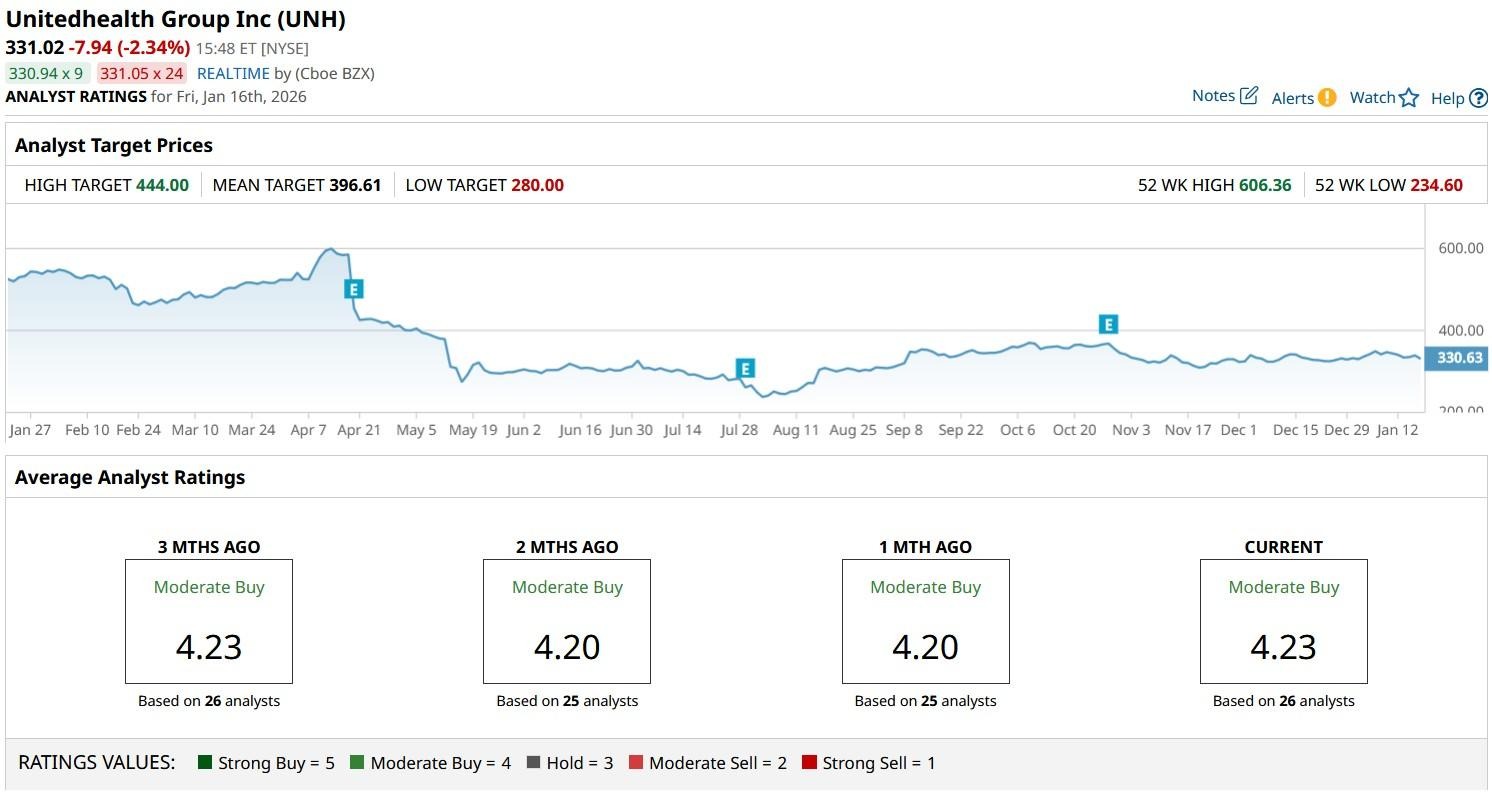

Despite ongoing declines, UnitedHealth stock remains up some 40% versus its 52-week low.

What Trump’s Remarks Mean for UnitedHealth Stock

Trump’s announcement is concerning for UNH stock primarily because the company benefits from distribution networks that include brokers and intermediaries.

Eliminating or reducing their role will trim its administrative fee and reduce pricing flexibility.

Moreover, while cost-sharing reduction (CSR) funding – as referenced in the president’s remarks – may lower premiums for consumers, it’ll cap insurer margins on exchange plans as well.

This means UnitedHealth and its insurance peers will see lower profitability in individual markets once this policy change takes effect.

Why Bernstein Still Recommends Buying UNH Shares

Despite policy headwinds, Bernstein analysts continue to see UnitedHealth shares as a “top pick” for 2026.

According to them, the health insurance giant remains strongly positioned for margin recovery as it continues to exit unprofitable business segments.

In its research note, the investment firm also said UNH is still trading at a major discount relative to its earnings growth potential.

All in all, it sees the company rallying a staggering 80% over the next three years. A healthy dividend yield of 2.67% makes up for another great reason to own UnitedHealth for the long term.

Note that bears have so far failed in driving UNH below its 50-day moving average (MA), which is another positive sign for the believers.

UnitedHealth Remains a ‘Buy’

While not nearly as bullish as Bernstein, other Wall Street firms recommend sticking with UNH shares in 2026 as well.

The consensus rating on UnitedHealth stock remains at “Moderate Buy” with the mean target of about $397 indicating potential upside of 21% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)