/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)

Super Micro Computer, or Supermicro (SMCI), was once one of the market’s favorite ways to gain exposure to the artificial intelligence (AI) infrastructure boom. However, that enthusiasm has faded. Over the past three months, SMCI stock has fallen roughly 46%, and it now sits nearly 57% below its 52-week high.

Supermicro remains a leading supplier of high-performance servers and storage systems that support AI workloads. The problem is not the demand for AI infrastructure, but execution. The company’s growth rate has slowed steadily, quarter by quarter, while margins and earnings have stayed under pressure. As the growth narrative weakened, investor confidence weakened, dragging the share price lower. That pressure intensified recently after Goldman Sachs downgraded the stock to “Sell,” citing concerns around profitability and margins.

The latest earnings report highlighted these challenges. In the first quarter of fiscal 2026, Supermicro reported net sales of $5 billion, a sharp decline of 15.5% from the prior year. Management attributed much of the drop to timing issues, as several large customer orders arrived late in September, preventing associated GPU and SuperRack products from shipping before the quarter ended. The decline was also influenced by changes in product mix and lower average selling prices as the company maintained competitive pricing.

Notably, Supermicro’s growth slowed with each successive quarter, even as the broader AI spending environment remained strong. For instance, its top line increased 7.4% year-over-year (YoY) in the fourth quarter of fiscal 2025. That followed growth of 19.5% in the third quarter, 54.9% in the second quarter, and a solid 180.1% in the first quarter.

Profitability has weakened alongside revenue momentum. During the last reported quarter, adjusted gross margin fell by 360 basis points to 9.5%, while adjusted EBITDA margin declined by 320 basis points. Looking at the full year, adjusted gross margin dropped from 13.9% in fiscal 2024 to 11.2% in fiscal 2025.

Will Supermicro’s Growth Reaccelerate?

Supermicro is poised for renewed growth in Q2 fiscal 2026. Management struck a confident tone during the company’s first-quarter earnings call, signaling optimism about business momentum through the remainder of the fiscal year. Supporting the company’s growth is sustained demand for AI-focused GPU platforms, which account for a significant portion of Supermicro’s revenue.

For the second quarter, Supermicro is forecasting net sales of $10 billion to $11 billion, representing a substantial increase both sequentially and year-over-year. The anticipated acceleration reflects strong demand for advanced AI computing systems and data center infrastructure. With offerings such as its Data Center Building Block Solutions (DCBBS), Supermicro is well-positioned to meet customer demand.

That said, management expects gross margins to decline by approximately 300 basis points compared with the first quarter of fiscal 2026. Several factors are contributing to this pressure. A large strategic design win secured in the first quarter involves higher upfront costs and lower margins as Supermicro ramps production of a new GB300-optimized rack platform. In addition, the company is increasing investments in AI engineering support and customer services to ensure successful deployments for new clients. While these initiatives weigh on near-term profitability, management believes they are helping to secure additional large global design wins that could support longer-term growth.

Competitive dynamics are also at play. Intense competition in AI infrastructure is driving lower average selling prices, further constraining margins. Although Supermicro expects to benefit from economies of scale as revenue rises, along with efficiencies from its cost-effective global manufacturing footprint and ongoing customer diversification, margin pressure remains a key risk.

Overall, Supermicro’s revenue growth story remains compelling, driven by secular demand for AI infrastructure. However, investors should be mindful that near-term margin compression could temper bottom-line growth, even as the company lays the groundwork for future expansion.

Is Supermicro a Buy, Sell, or Hold?

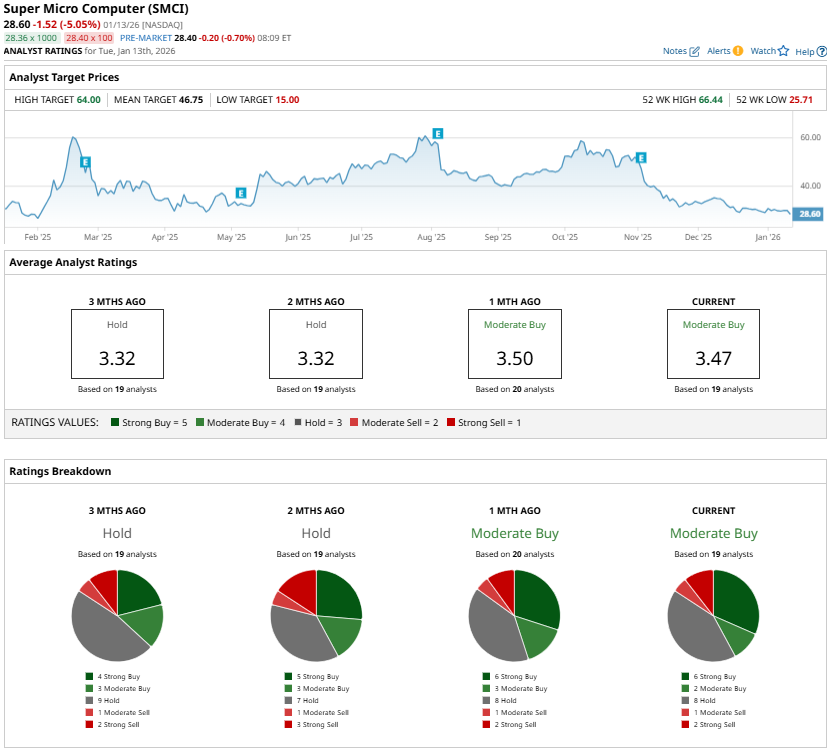

Analysts are cautiously bullish about its prospects and maintain a “Moderate Buy” consensus rating. For long-term investors who believe in the durability of AI infrastructure spending and are comfortable with near-term margin volatility, the stock’s steep pullback could represent a high-risk, high-reward opportunity.

However, conservative investors should wait for clearer signs of margin stabilization and consistent execution before stepping in. Until profitability improves, SMCI is likely best viewed as a “Hold.”

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20by%20IgorGolovinov%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)