/Super%20Micro%20Computer%20Inc%20HQ%20photo-by%20Tada%20Images%20via%20Shutterstock.jpg)

Supermicro (SMCI) shares are slipping further on Jan. 13 after senior Goldman Sachs analyst Katherine Murphy issued a bearish note.

Murphy assumed coverage of the artificial intelligence (AI) server specialist this morning with a “Sell” rating and a $26 price target that signals potential downside of another 9% from here.

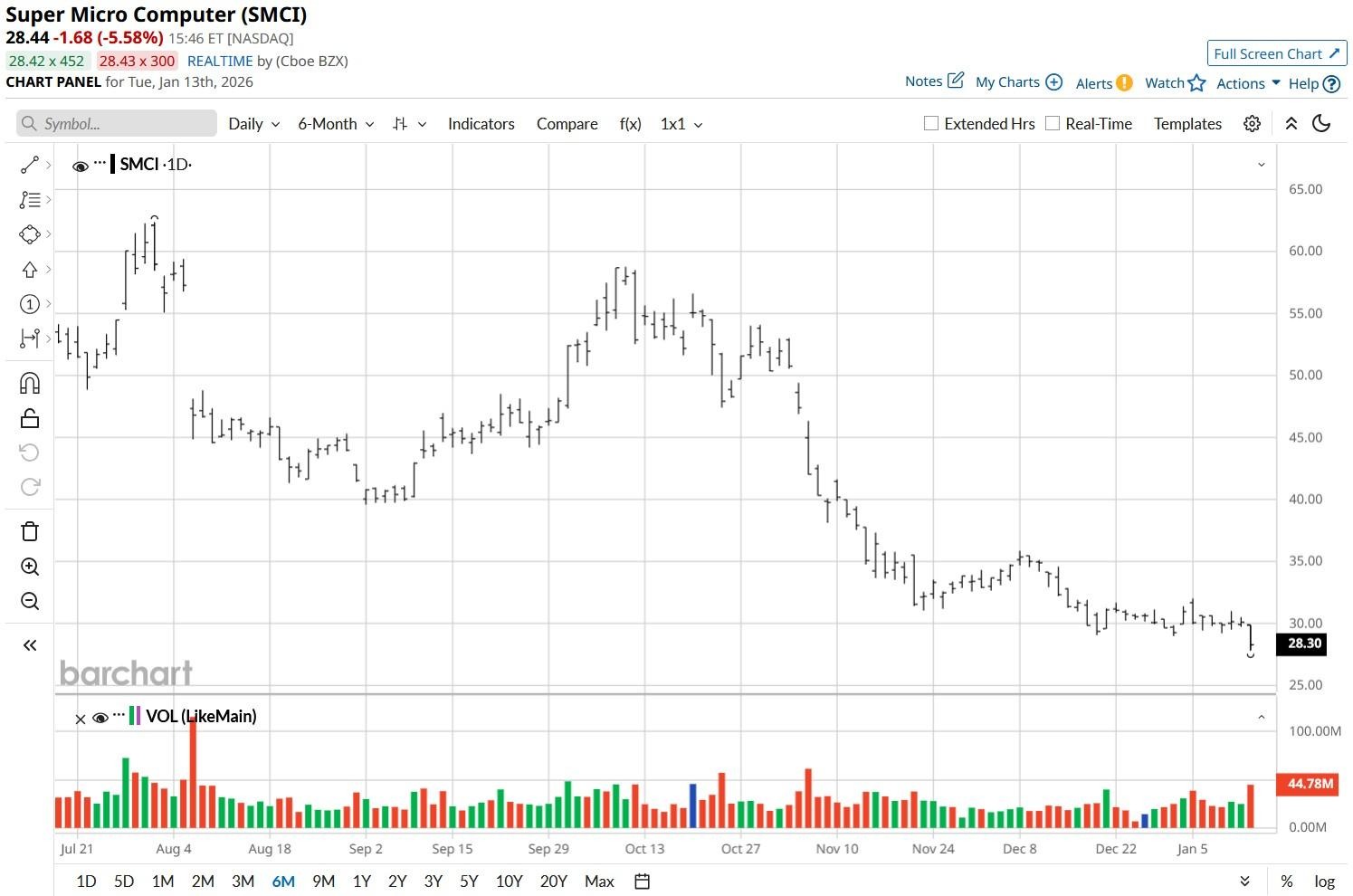

Her bearish view is particularly significant given SMCI stock has already lost nearly 50% over the past three months.

Shrinking Margins to Hurt SMCI Shares in 2026

In her research note, the Goldman Sachs analyst agreed that Super Micro Computer is “a leader in the AI server market.”

But “limited visibility into profitability” may still make it challenging for this artificial intelligence stock to notch up significant gains in 2026, she added.

SMCI’s large, margin-dilutive deals have already “halved its margin in the last three years to 9.5%,” and Murphy expects that to remain the case, at least in the near term.

Simply put, she recommends cutting exposure to Supermicro stock because the firm’s margin may shrink further over the next few quarters.

Why Else Is Supermicro Stock a ‘Sell’?

Super Micro Computer depends heavily on a “handful” of core customers. In fact, one of them reportedly drives nearly one-third of its revenue currently.

For the Nasdaq-listed firm, this means minimal pricing power, which makes it even less attractive to own in 2026, Murphy told clients in a research note today.

Additionally, the company’s software workforce comprising just over 700 employees in total is far from sufficient to compete against rivals like Dell (DELL) that employs more than 50,000, she added.

Note that the selloff today even pushed SMCI shares below their 20-day moving average (MA), indicating the downward momentum could sustain in the weeks ahead.

Goldman Sachs Has a Contrarian View on SMCI

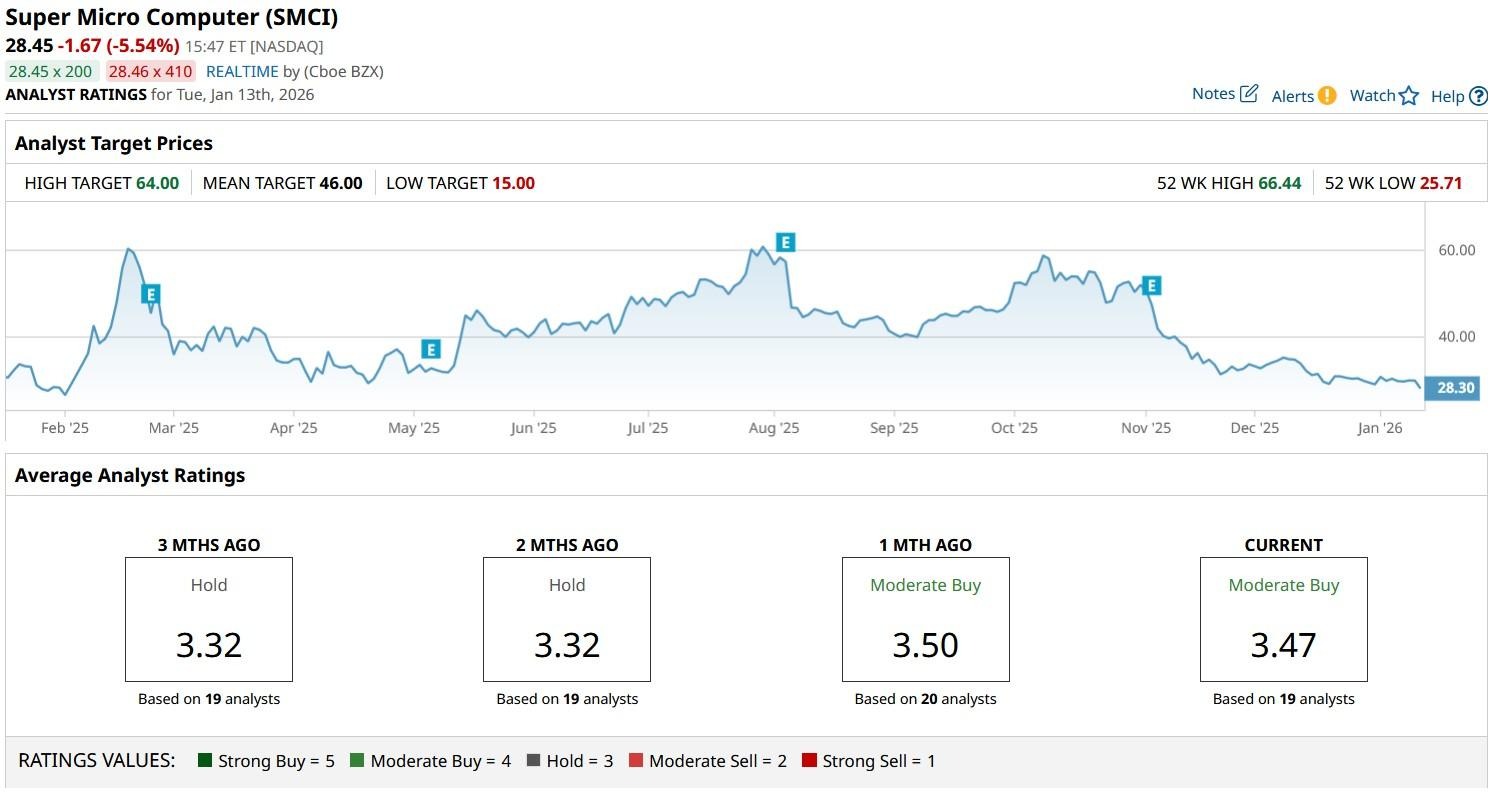

Despite the aforementioned concerns, however, other Wall Street analysts don’t currently see eye-to-eye with Katherine Murphy on Supermicro shares.

According to Barchart, the consensus rating on SMCI stock remains at “Moderate Buy” with the mean target of $46 indicating potential upside of a whopping 61% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)