With a market cap of $43.9 billion, Xcel Energy Inc. (XEL) is a U.S.-based utility company engaged in the generation, purchasing, transmission, distribution, and sale of electricity and natural gas through its regulated electric and natural gas utility segments. It serves residential, commercial, and industrial customers across eight states and generates power from a diverse mix of renewable and traditional energy sources.

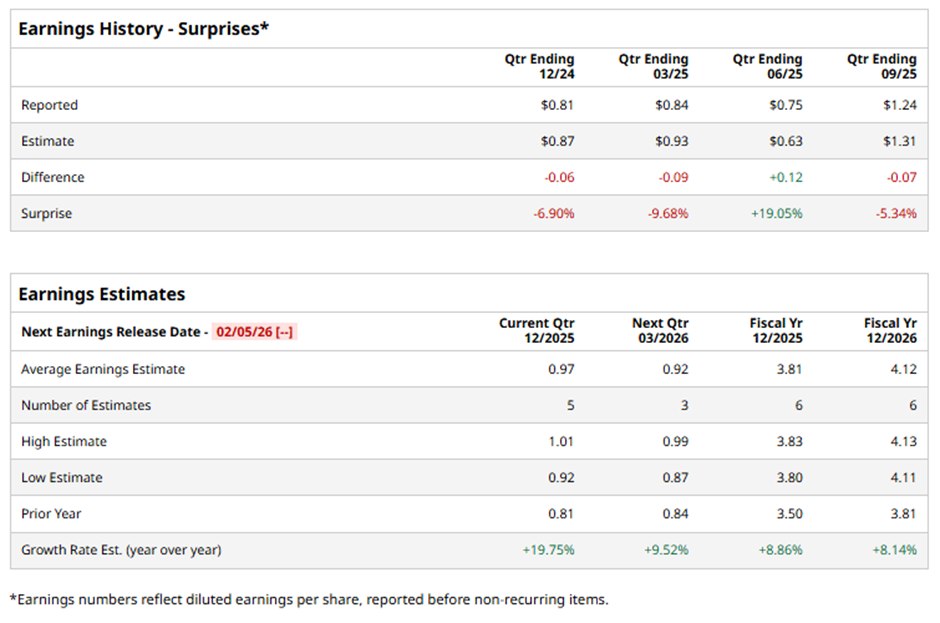

The Minneapolis, Minnesota-based company is expected to unveil its fiscal Q4 2025 results soon. Before the event, analysts anticipate XEL to report an adjusted EPS of $0.97, up 19.8% from $0.81 in the year-ago quarter. It has exceeded Wall Street's bottom-line estimates in one of the past four quarters while missing on three other occasions.

For fiscal 2025, analysts predict Xcel Energy to report adjusted EPS of $3.81, a rise of 8.9% from $3.50 in fiscal 2024.

XEL stock has increased 11.9% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 17.7% gain. However, the stock has matched the State Street Utilities Select Sector SPDR ETF's (XLU) 11.9% return over the same period.

Despite reporting weaker-than-expected Q3 2025 adjusted EPS of $1.24 and revenue of $3.92 billion, Xcel Energy shares rose 2.4% on Oct. 30. The company ramped up its five-year capital investment plan to $60 billion to meet rising power demand from data centers and strengthen transmission and distribution systems, while reaffirming a 6% to 8% EPS growth target. Investors were also encouraged by solid segment performance, with electric segment revenue rising 7.2% to $3.64 billion and natural gas revenue increasing to $264 million.

Analysts' consensus rating on XEL stock is strongly optimistic, with a "Strong Buy" rating overall. Out of 18 analysts covering the stock, opinions include 14 "Strong Buys," one "Moderate Buy," and three "Holds." The average analyst price target for Xcel Energy is $88.29, indicating a potential upside of 18.9% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)