With a market cap of $25.4 billion, AvalonBay Communities, Inc. (AVB) is a real estate investment trust (REIT) that develops, redevelops, acquires, owns, and operates apartment communities across major U.S. markets. As of September 30, 2025, it owned or held interests in 314 apartment communities with 97,219 homes and additional projects under development.

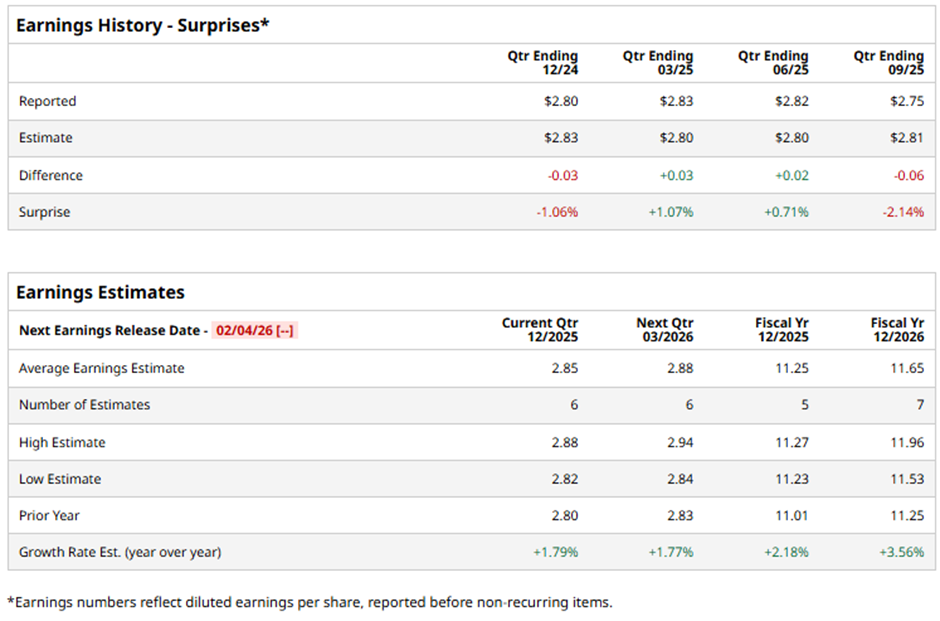

The Arlington, Virginia-based company is set to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts predict AVB to report a core FFO of $2.85 per share, a 1.8% rise from the $2.80 per share in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in two of the past four quarters while missing on two other occasions.

For fiscal 2025, analysts expect AVB to post core FFO per share of $11.25, up 2.2% from $11.01 in fiscal 2024. Looking ahead to fiscal 2026, core FFO is projected to rise a further 3.6% to $11.65 per share.

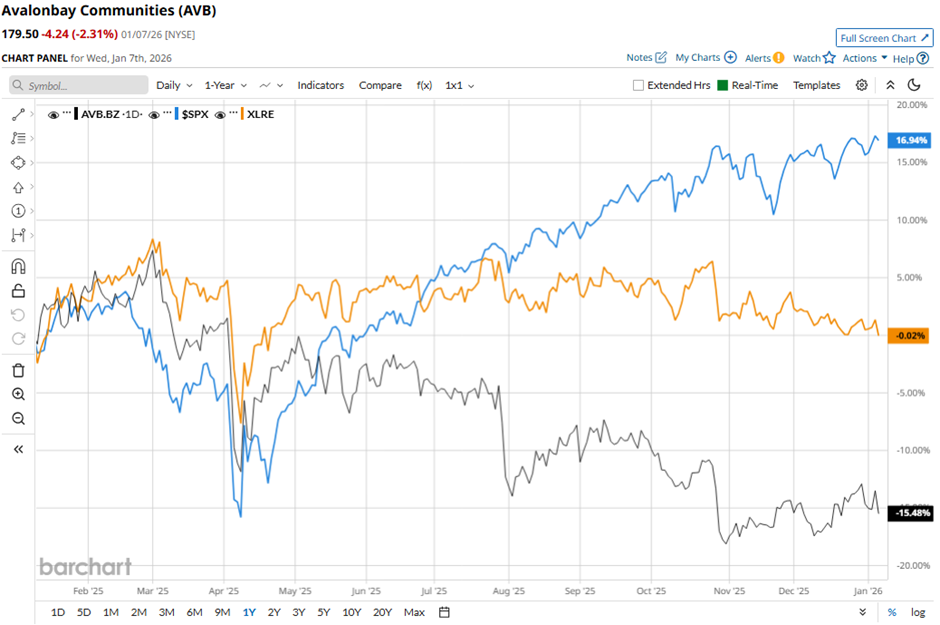

AVB stock has decreased 15% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 17.1% gain and the State Street Real Estate Select Sector SPDR ETF's (XLRE) marginal rise over the same period.

Shares of AvalonBay Communities fell nearly 1% following its Q3 2025 results on Oct. 29 as the company reported core FFO of $2.75 per share, missing analysts’ expectations. Investor sentiment was further hurt by its forecast of Q4 core FFO in the range of $2.80 per share to $2.90 per share, with the midpoint below the estimate. In addition, rental demand softened in key markets such as Seattle, Northern California, San Francisco, and San Jose due to weaker consumer activity and an oversupply of units.

Analysts' consensus view on AVB stock is cautiously optimistic, with a "Moderate Buy" rating. Out of 24 analysts covering the stock, seven give a "Strong Buy," one has a "Moderate Buy" rating, and 16 give a "Hold" rating. The average analyst price target for AvalonBay Communities is $202.98, suggesting a potential upside of 13.1% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/The%20sign%20for%20Marvell%20Technology%20out%20front%20of%20a%20corporate%20office%20by%20Valeriya%20Zankovych%20via%20Shutterstock.jpg)

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Palo%20Alto%20Networks%20Inc%20HQ%20sign-by%20Sundry%20Photography%20via%20Shutterstock.jpg)