With the start of a new year, focus is shifting to companies that have overcome short-term setbacks and are quietly regaining momentum through improved fundamentals and strong long-term tailwinds. Here are two comeback stocks that investors are closely watching in 2026.

Comeback Stock #1: Oracle (ORCL)

In 2025, Oracle (ORCL) had a mixed performance with modest revenue growth and solid cloud-services expansion driven by increasing long-term contracts. The stock experienced significant volatility and a steep pullback from its mid-year highs as investors worried about heavy capital spending on artificial intelligence (AI) data center build-outs and debt levels, as its debt-to-equity ratio sits at 3.28.

ORCL stock closed 2025 with a 17% gain compared to the broader market gain of 16%. Its recent fiscal second quarter results showed clear signs of operational momentum returning, supported by accelerating cloud growth, a surging backlog, and improving visibility into future revenue. Analysts and investors see it as a possible comeback play in 2026.

One of the most visible signs of Oracle's recovery this year is its remaining performance obligations (RPO). The company ended the second quarter of fiscal 2026 with $523.3 billion in RPO, a 433% increase year-on-year (YoY), owing to big contracts inked with customers such as Meta (META) and Nvidia (NVDA). Notably, the RPO estimated to be realized over the next 12 months increased by 40% YoY, showing that this backlog is not only huge but also near-term and monetizable. Management now expects an additional $4 billion in revenue in fiscal 2027 as a result of the newly added backlog.

Oracle’s cloud business is accelerating rapidly. Total cloud revenue climbed 33% YoY to $8 billion, compared to its prior year’s 24% growth rate, and now represents roughly half of total company revenue. Cloud infrastructure revenue increased by 66%, driven by strong demand for AI workloads, while GPU revenue increased by 177%. At the same time, cloud database services increased by 30%, while multi-cloud database consumption increased by an impressive 817%, indicating Oracle's expanding relevance in rival cloud ecosystems.

While Oracle continues to make strong investments in capacity development, profitability is also improving. Total revenue stood at $16.1 billion, up 13% YoY, marking the third straight quarter of double-digit growth. Adjusted earnings per share increased 51% to $2.26. Although free cash flow was negative due to increased capital expenditures, management underlined that the majority of spending is directly related to revenue-generating data center equipment that is intended to convert swiftly into cloud revenue.

Looking ahead to Q3, Oracle anticipates cloud revenue growth to accelerate further, with management predicting total revenue growth of up to 21% and ongoing profitability growth of 16% to 18%. With cloud infrastructure demand surging, AI-driven database and application offerings gaining traction, and a massive backlog poised to convert into revenue, Oracle is transitioning from recovery to renewed growth.

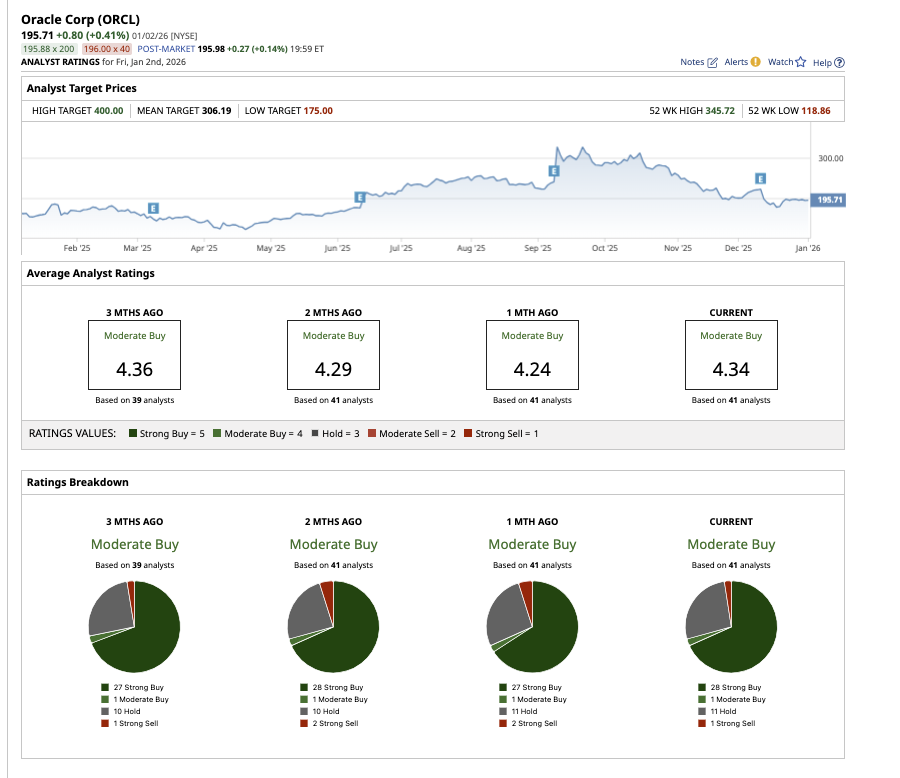

Analysts predict Oracle’s earnings to increase by 34.7% in fiscal 2026. Overall, Wall Street rates Oracle stock a consensus “Moderate Buy.” Out of the 41 analysts covering the stock, 28 rate it a “Strong Buy,” one says it is a “Moderate Buy,” 11 rate it a “Hold,” and one says it is a “Strong Sell.” The average target price for Oracle stock is $306.91, representing potential upside of 56.2% from its current levels. The high price estimate of $400 suggests the stock can rally as much as 103.6% this year.

Comeback Stock #2: Trade Desk

Valued at $18.2 billion, Trade Desk (TTD) is a global technology company that helps advertisers buy digital ads in a smart, data-driven way. Trade Desk stock dipped 67% last year, underperforming the broader market. After navigating a volatile advertising environment, Trade Desk is emerging as a comeback stock investors are watching closely in 2026.

Trade Desk's demand-side platform (DSP) enables companies and ad agencies to buy advertising space across the open internet, including connected TV (CTV), streaming video, mobile apps, websites, audio (such as podcasts and music streaming), and digital out-of-home screens. In the third quarter, Trade Desk reported an 18% YoY increase in revenue to $739 million with a 9% increase in adjusted earnings to $0.45 per share. CTV remains the company's largest and fastest-growing channel, with video accounting for approximately half of total revenue, showing where advertiser dollars are rapidly moving.

The use of artificial intelligence and analytics to boost ad performance is a key feature that could help the company's recovery story this year. The company rolled out some of the most significant platform upgrades in its history during 2025, most notably its AI-driven Kokai platform. Almost all clients have now tested Kokai, with approximately 85% setting it as their default. Campaigns launched on Kokai generated much improved performance indicators, such as lower acquisition costs, higher reach efficiency, and greater engagement, bolstering the platform's value proposition to advertisers.

The Trade Desk has made significant investments in AI to improve price discovery and supply chain efficiency. It ended the quarter with over $1.4 billion in cash and no debt, providing it the freedom to expand, innovate, and return capital to shareholders via share repurchases. Management anticipates continued revenue and profitability growth through 2026, fueled by secular tailwinds in CTV, retail media, and programmatic advertising globally. Analysts predict Trade Desk’s earnings to increase by 26.9% in 2025, followed by another 26.3% in 2026.

As advertising dollars continue shifting toward measurable, data-driven channels on the open Internet, investors see the company as a comeback story with stronger fundamentals and a clearer path to 2026.

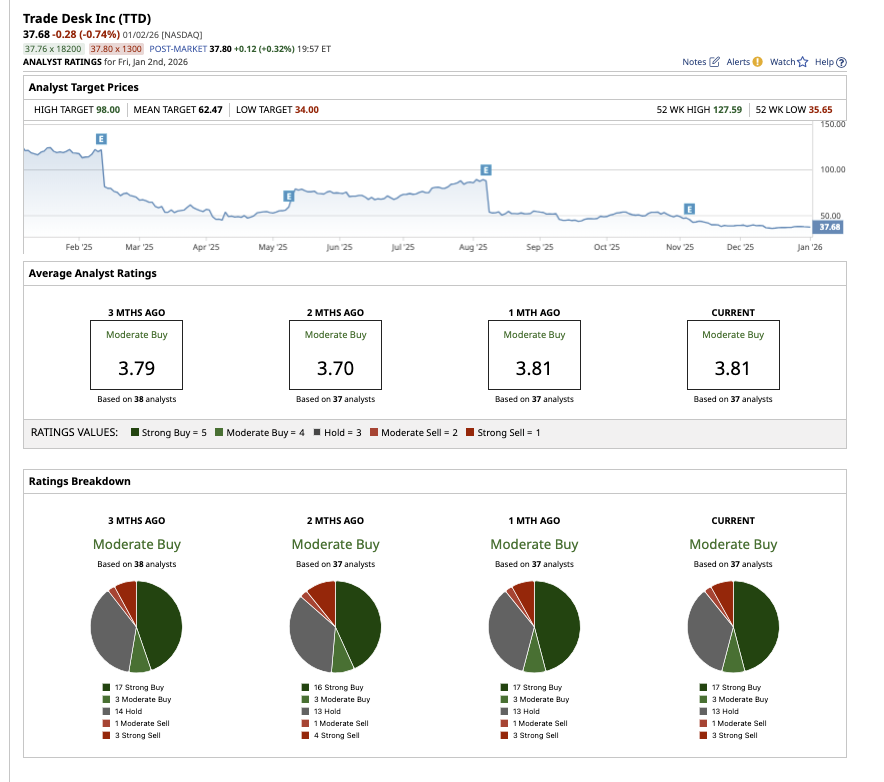

Overall, Wall Street rates TTD stock a “Moderate Buy.” Out of the 37 analysts covering the stock, 17 rate it a “Strong Buy,” three say it is a “Moderate Buy,” 13 rate it a “Hold,” one says it is a “Moderate Sell,” and three say it is a “Strong Sell.” The average target price for Trade Desk is $62.47, representing potential upside of 66% from its current levels. The high price estimate of $98 suggests the stock can rally as much as 160% this year.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)