Last month, Barron’s pointed out that the U.S. economy is “K-shaped.” In other words, wealthier Americans, powered by the stock market’s strength, are in good shape financially, while poorer consumers who don’t own equities are struggling because the labor market is weak and inflation remains elevated, partly due to tariffs.

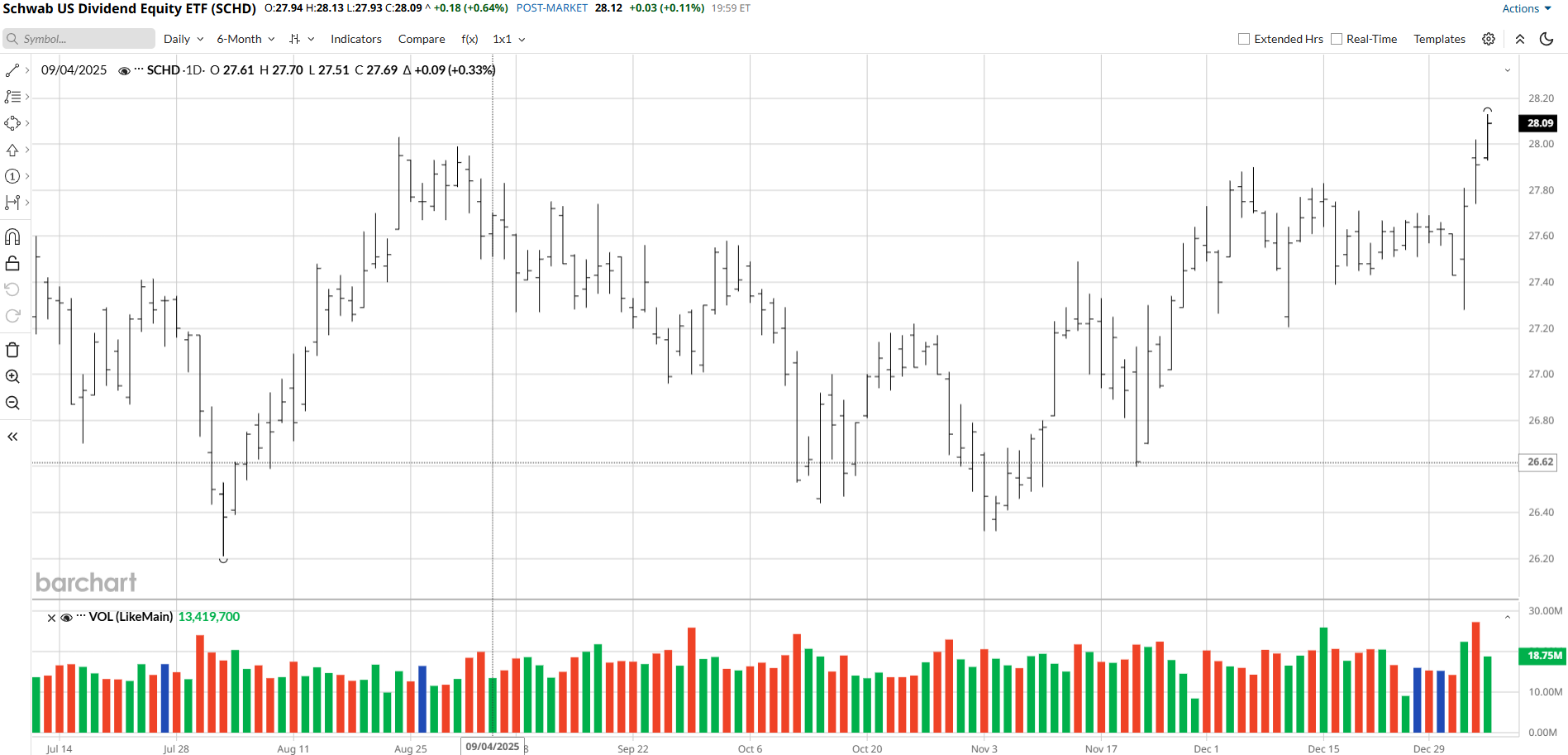

Since consumer spending accounts for about 70% of U.S. GDP, lower outlays by the working class and the middle class could cause economic growth to decelerate sharply in 2026. Additionally, AI stocks’ rally, which many view as a bubble, could end. If one or both of these scenarios, which would cause equities to correct sharply, unfold, then the Schwab US Dividend Equity ETF (SCHD) could outperform the stock market by a wide margin. Additionally, the ETF’s sizeable dividend yield would effectively “pay investors to wait” for the equity market to recover and could enable SCHD to get a big boost from lower interest rates.

And even if the negative scenarios do not play out, the fund’s large investments in energy, healthcare, and industrials could enable it to perform very well in 2026.

About the Schwab US Dividend Equity ETF

A combined total of nearly 37% of the ETF’s holdings are in either consumer defensive or healthcare stocks, both of which tend to be rather impervious to economic downturns. Of its top nine holdings, four are large pharmaceuticals—AbbVie (ABBV), Amgen (AMGN), Pfizer (PFE), and Bristol Myers (BMY)—and two of its top ten equities are classic consumer defensive plays—Coca-Cola (KO) and PepsiCo (PEP). Weighing in at number 14 is defense contractor juggernaut Lockheed Martin (LMT), which is also resilient to economic downturns (it gets the lion’s share of its revenue directly from governments) and should get a big boost from the Trump administration’s large defense-spending hikes.

Also noteworthy is that, during economic downturns, the Federal Reserve tends to lower interest rates sharply. Further, President Donald Trump is looking to nominate a Fed chair who believes in lowering rates by large amounts. If rates do drop a great deal, SCHD, with its 3.73% dividend yield, is likely to be lifted by investors looking for higher yields.

Energy, Healthcare, and Industrials Could Meaningfully Outperform in an Economic Downturn

SCHD appears to have rather high exposure to oil companies, as 19.2% of its holdings are in the energy sector, and its top three energy holdings as of June were all in the oil sector. Reportedly, Trump is looking to let U.S. oil companies prolifically drill in Venezuela and talking about Washington potentially reimbursing them for their related infrastructure expenses. Thus, the shares of large oil firms are likely to perform quite well in the medium-to-long-term, even if the broader U.S. economy slumps.

In addition to large drug companies being defensive, they tend to benefit a great deal from interest rate cuts.

Finally, industrial stocks are rallying due to the proliferation of data centers. Because the large tech firms that are building many of the data centers have huge cash reserves and tend to base their actions on long-term projections. A big slowdown of the U.S. economy and even a temporary termination of the AI rally probably won't dent spending on data centers much.

On the date of publication, Larry Ramer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)