As the stock market digests the dramatic events in Venezuela over the weekend, in which the U.S. military captured President Nicolas Maduro, and U.S. President Donald Trump’s announcement that the U.S. would take control of the country’s vast oil reserves – oil stocks surged higher on expectations of renewed investment opportunities.

Oil prices (CBH26) (CLG26) initially tumbled as low as $56 per barrel, but quickly began moving higher again, reflecting already-ample global supplies seeing potential inventory increases from Venezuela’s Orinoco Belt. While Chevron (CVX) emerged as one of the biggest gainers, thanks to its ongoing large-scale operations in the country as the only major U.S. firm still active there, and Marathon Petroleum (MPC) is expected to benefit from refining Venezuela’s heavy crude at its Gulf Coast facilities, ConocoPhillips (COP) holds a unique claim to significant profits from the region’s reopening, leveraging its past arbitration awards and expertise in heavy oil extraction.

About ConocoPhillips Stock

ConocoPhillips is an independent exploration and production company that explores for, develops, produces, transports, and markets crude oil, bitumen, natural gas (NGG26), natural gas liquids, and liquefied natural gas worldwide. Headquartered in Houston, Texas, it operates in 15 countries with a focus on low-cost, low-carbon intensity assets.

Key operations include the Lower 48 segment, featuring unconventional plays in the Permian Basin (Delaware and Midland), Eagle Ford, and Bakken; Alaska’s super-giant fields like Kuparuk and Prudhoe Bay; Canada’s oil sands through steam-assisted gravity drainage (SAGD) at Surmont, producing heavy bitumen; Norway’s Ekofisk and Eldfisk fields in the North Sea; and Asia Pacific projects like Australia Pacific LNG and Malaysia’s offshore fields.

In 2025, COP stock declined 5.6%, underperforming the S&P 500 Index’s ($SPX) 16.4% gain, amid fluctuating oil prices and broader energy sector pressures. Its forward price-to-sales ratio stands at approximately 2x, below the oil and gas exploration and production industry average of 2.15x and in line with its historical five-year average of around 2x, indicating COP is fairly valued relative to peers. It reflects its efficient operations and growth potential without excessive premiums, and suggests balanced investor expectations for future sales amid stable demand. ConocoPhillips is positioned as a solid hold in a volatile sector.

Why ConocoPhillips Can Profit From Venezuela Tumult

ConocoPhillips stands out as a top oil stock for investors eyeing profits from Venezuela’s evolving leadership situation, thanks to its $8.7 billion ICSID arbitration award – now exceeding $11 billion with interest – for the 2007 expropriation of its Petrozuata, Hamaca, and Corocoro assets under Hugo Chavez. This positions COP to potentially reenter the market and recover substantial value, especially as Trump has signaled U.S. companies will invest billions to revive Venezuela’s infrastructure, explicitly noting Conoco’s interest due to its owed billions.

Unlike peers who fully exited, COP’s unresolved claims provide leverage in negotiations for asset restitution or new joint ventures in the Orinoco Belt, home to the world’s largest heavy crude reserves.

COP’s expertise in heavy crude extraction further magnifies its advantage. Venezuela’s extra-heavy oil, similar to Canadian bitumen, requires specialized techniques like SAGD, upgrading, and dilution for transport – areas where COP excels through its Canadian operations. At Surmont, COP operates a 100%-owned SAGD project producing over 150,000 barrels per day of bitumen, using steam to mobilize viscous resources efficiently.

This mirrors Orinoco’s challenges, where COP previously held stakes in upgraders converting heavy oil to synthetic crude. Reentry could allow COP to apply proprietary technologies, boosting production from Venezuela's estimated 300 billion recoverable barrels while integrating with its global portfolio.

Moreover, COP’s low-cost structure – evident in its efficient Permian and Bakken operations – aligns with Venezuela’s need for capital-intensive revival. Analysts project Venezuelan output could rise by hundreds of thousands of barrels daily by late 2026 with U.S. involvement (though others say it could take several years), and COP’s scale – 1.8 million barrels of oil equivalent per day (boe/d) production – enables rapid scaling.

As sanctions will likely ease, COP could secure favorable terms, offsetting risks like further political instability. This combination of legal claims, technical prowess, and a strategic fit makes COP uniquely poised to capitalize, potentially adding billions in value and diversifying beyond North America.

What Do Analysts Expect for ConocoPhillips Stock

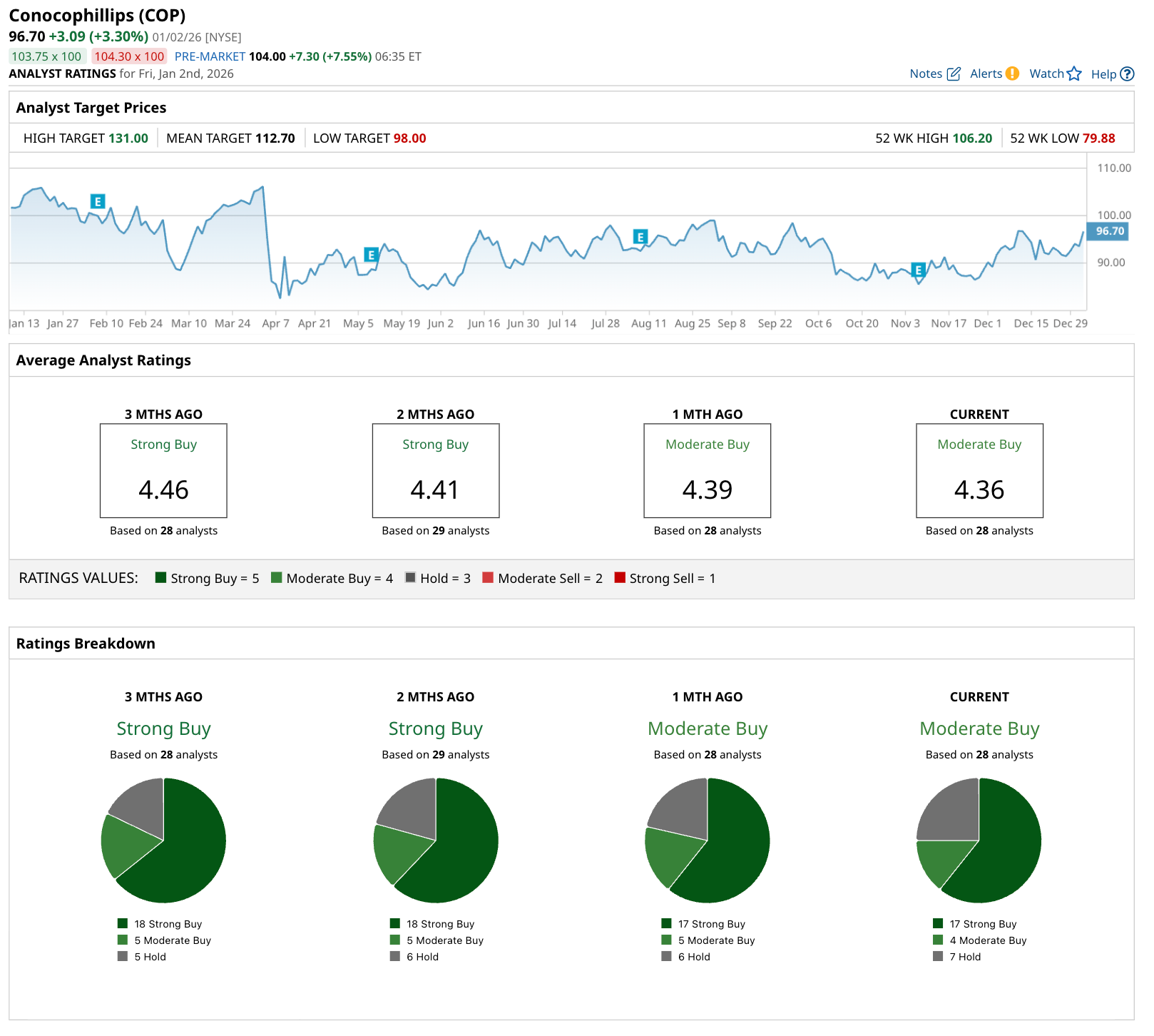

Consensus analyst ratings for ConocoPhillips remain bullish, with a “Moderate Buy” overall, based on coverage from 28 analysts. The breakdown shows approximately 17 “Strong Buy” ratings, 4 “Moderate Buy,” and 7 “Hold.” There are no “Sell” ratings. These reflect Wall Street’s optimism about its diversified portfolio and acquisition synergies from the 2024 Marathon Oil deal. Recent months have seen minimal changes in consensus, with a slight downtick in “Strong Buy” recommendations following its Q3 2025 earnings beat and dividend increase, signaling confidence in its durable cash flows despite oil price volatility.

The mean price target is $112.70, derived from analyst forecasts emphasizing low-cost assets and growth in unconventionals. It represents potential upside of 16.5% from its closing price of $96.70 on Friday before the Venezuelan events unfolded, positioning COP for outperformance in a recovering global oil market.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)