/Broadridge%20Financial%20Solutions%2C%20Inc_%20smartphone-by%20rafapress%20via%20Shutterstock.jpg)

Broadridge Financial Solutions, Inc. (BR) is a New York-based financial technology and services company with a market cap of $25.7 billion. It provides mission-critical infrastructure and technology solutions to the financial services industry, including banks, broker-dealers, mutual funds, and corporate issuers. Its core offerings include investor communications and proxy services, as well as securities processing, trade lifecycle technology, and data-driven platforms that support order capture, trade settlement, portfolio accounting, and wealth management operations.

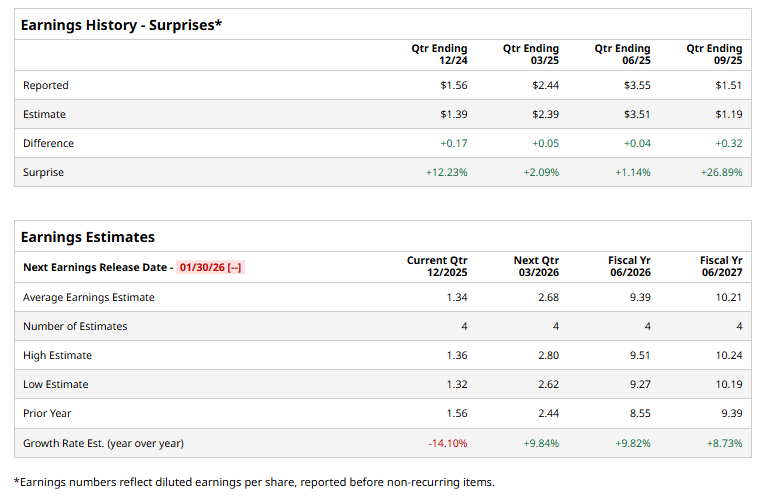

The fintech titan is gearing up to announce its second-quarter results shortly. Ahead of the event, analysts expect BR to report a non-GAAP profit of $1.34 per share, down 14.1% from $1.56 per share reported in the year-ago quarter. Furthermore, the company has surpassed analysts’ earnings expectations in each of the past four quarters.

For fiscal 2026, Broadridge is expected to deliver an adjusted EPS of $9.39, up 9.8% from $8.55 in fiscal 2025. Moreover, in fiscal 2027, its earnings are expected to increase 8.7% year over year to $10.21 per share.

Broadridge’s stock prices dipped 2.8% over the past 52 weeks, notably lagging behind the S&P 500 Index’s ($SPX) 16.9% gains and the Technology Select Sector SPDR Fund’s (XLK) 24.4% surge during the same time frame.

Broadridge has underperformed the broader market over the past year primarily due to its defensive, lower-growth profile in a market that has strongly favored high-growth and AI-exposed stocks. While the company delivers stable, recurring revenue and predictable cash flows, its modest earnings growth, exposure to muted capital markets activity, and limited near-term catalysts have constrained upside.

However, analysts remain cautious about the stock’s prospects. BR maintains a consensus “Hold” rating overall. Of the nine analysts covering the stock, opinions include three “Moderate Buys” and six “Holds.” Its mean price target of $266.43 suggests a 20.8% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)