/Revvity%20Inc_%20stock%20chart%20and%20logo-by%20T_Schneider%20via%20Shutterstock.jpg)

Revvity, Inc. (RVTY) is a Massachusetts-based life sciences and diagnostics company formed in 2023. It provides instruments, reagents, software, informatics, and testing platforms used by pharmaceutical and biotech firms, research institutions, clinical labs, public health organizations and governments to support genetic screening, infectious disease testing, biomarker discovery, multi-omics science, and broader life sciences workflows. It is currently valued at $11.1 billion by market cap.

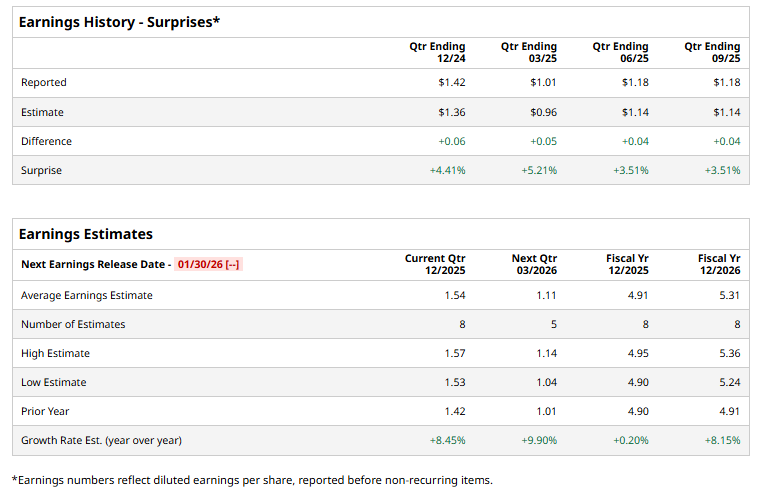

The healthcare major is set to announce its fourth-quarter results shortly. Ahead of the event, analysts expect RVTY to report an adjusted earnings of $1.54 per share, up 8.5% from $1.42 per share reported in the year-ago quarter. The company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For fiscal 2025, Revvity is expected to deliver an adjusted EPS of $4.91, marginally up from $4.90 reported in 2024. In fiscal 2026, its earnings are expected to surge 8.2% annually to $5.31 per share.

RVTY stock prices have plummeted 12.4% over the past 52 weeks, trailing the Healthcare Select Sector SPDR Fund’s (XLV) 13% rise and the S&P 500 Index’s ($SPX) 16.9% gains during the same time frame.

Revvity has lagged the broader market over the past year due to weak underlying growth and deteriorating profitability. Its constant-currency revenue growth has averaged just 2% over the last two years, signaling soft demand and underperformance compared to peers. At the same time, profitability has come under pressure, with adjusted operating margin declining by more than 9 percentage points over the past five years, reflecting higher costs and limited operating leverage. These challenges have translated into declining financial performance, as both revenue and EPS have fallen annually over the past five years. With earnings momentum weakening and the stock still trading at a relatively full valuation, investors have remained cautious, leading RVTY to trail the broader market.

Analysts remain cautiously optimistic about the stock’s prospects. RVTY has a consensus “Moderate Buy” rating overall. Of the 18 analysts covering the stock, opinions include eight “Strong Buys,” one “Moderate Buy,” and nine “Holds.” Its mean price target of $113.87 suggests a 16% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)