/A%20corporate%20sign%20for%20AppLovin%20by%20Poetra_RH%20via%20Shutterstock.jpg)

AppLovin (APP) stock was on a losing streak in the final week of 2025 and the first trading session of the new year wasn’t any kinder to the mobile technology company either.

On Friday, the Nasdaq-listed firm lost another 8%, sinking below its 50-day moving average (MA) that’s widely seen as an indicator of accelerated bearish momentum ahead.

Including today’s losses, AppLovin shares are down more than 15% versus their December high.

Should You Buy AppLovin Stock on the Pullback?

Despite the aforementioned technical breakdown, APP’s underlying business fundamentals remain robust, creating a disconnect between market performance and operational results.

In its latest reported quarter, the California-based company saw a better-than-expected 17% year-over-year increase in its revenue to $1.41 billion.

Together with exceptional EBITDA results, AppLovin’s earnings release demonstrated continued strength of its AI-powered ads platform, serving over 200 free-to-play games in its portfolio.

More importantly, even after a significant decline in recent sessions, APP shares remain decisively above their longer-term moving average (100-day), indicating the broader uptrend is intact.

Where Options Data Suggests APP Shares Are Headed

AppLovin’s strategic positioning within the mobile advertising ecosystem remains valuable, as it provides AI-driven advertising and analytic tools that help developers market, monetize, and grow their apps.

AI integration and advanced targeting capabilities has become a critical differentiator in the industry, where APP maintains competitive advantage through its “proprietary” data analytics and consumer intelligence platforms.

According to Barchart, derivatives data also currently points to notable further upside potential in AppLovin shares. Options traders are pricing in a near-25% move through April 17, indicating the Palo Alto-headquartered firm could be trading at about $771 within the next four months if bulls win.

AppLovin Remains a ‘Buy’ Among Wall Street Firms

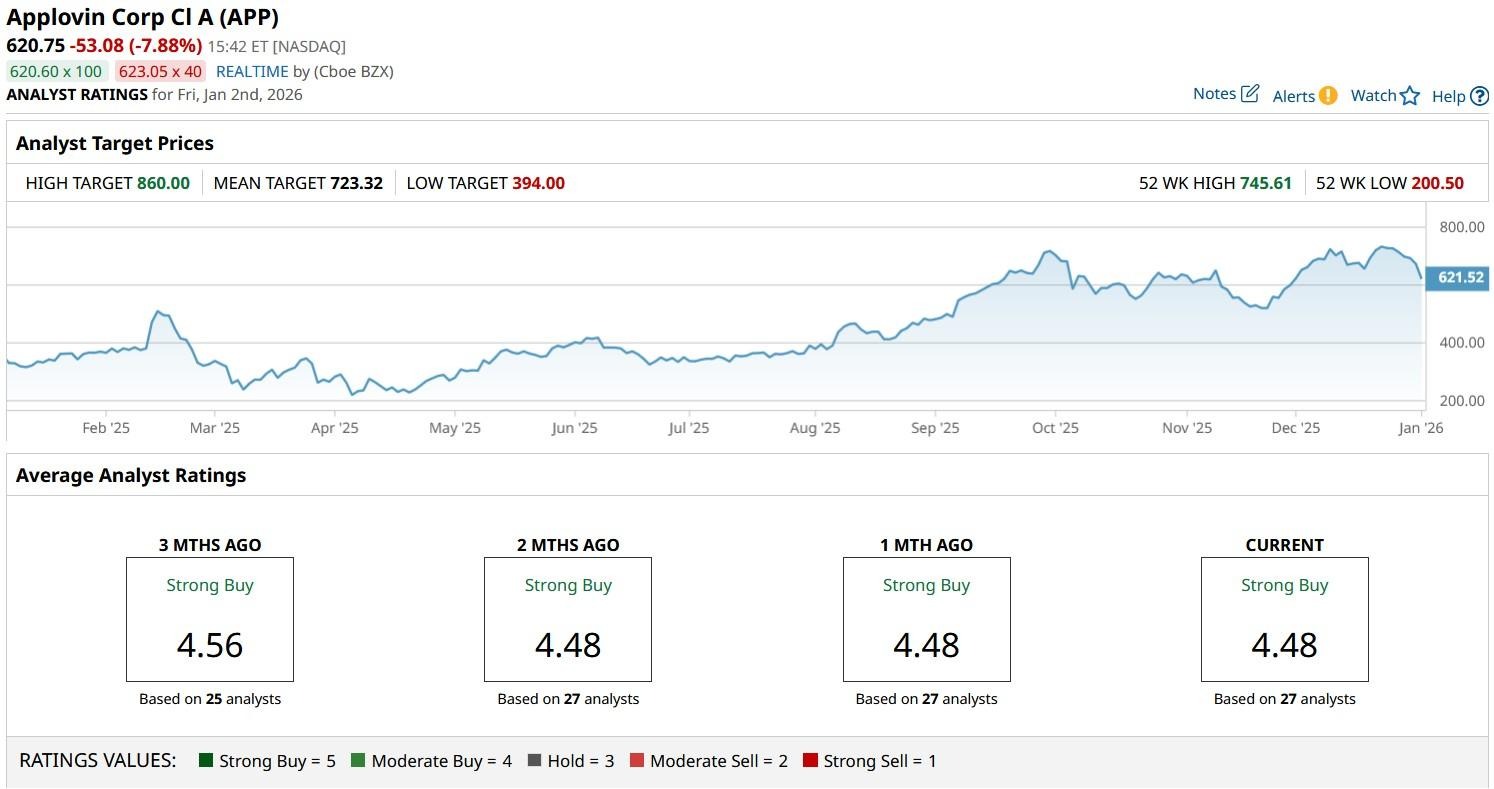

What’s also worth mentioning is that Wall Street analysts remain constructive on AppLovin stock for the next 12 months.

According to Barchart, the consensus rating on APP shares currently sits at “Strong Buy” with the mean target of about $723 indicating potential upside of more than 15% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)