Tesla's (TSLA) troubles with the Cybertruck just got worse. South Korean battery materials supplier L&F Co. revealed in a regulatory filing on Monday that its supply contract with the electric vehicle maker has been slashed by 99%, from 3.83 trillion won ($2.67 billion) to just 9.73 million won ($6,738).

The scaling back of its cathode supply deal, which was supposed to fuel Cybertruck production through 2025, suggests that demand for Tesla’s stainless-steel behemoth is cratering. L&F essentially admitted that “supply quantity” adjustments were necessary, a polite way of saying the orders just aren't coming in.

L&F was contracted to supply high-nickel cathode material for Cybertruck batteries from January 2024 through December 2025, but only minimal amounts were ultimately delivered.

The Cybertruck's struggles extend beyond supplier relationships. After launching in November 2023 at prices far higher than originally promised, the angular truck has faced weak consumer demand.

Tesla sold only 85,133 units of all its premium models combined in 2024, including the Model S, Model X, and Cybertruck, putting Cybertruck sales well below 30,000 units by most estimates.

That's a far cry from CEO Elon Musk's prediction of 500,000 annual Cybertruck sales, raising serious questions about Tesla's manufacturing strategy heading into 2026.

The Cybertruck Woes Continue to Pile

Tesla's Cybertruck problems have evolved from manufacturing hiccups into a full-blown crisis that threatens the company's reputation and financial stability. CEO Elon Musk once touted the Cybertruck as Tesla’s “best product ever.” Alternatively, the numbers tell a brutal story.

Tesla sold just 4,306 Cybertrucks in the second quarter of 2025, down 50.8% year-over-year (YoY). In the first six months of 2025, total Cybertruck sales stood at 10,712 units, compared with close to 40,000 units in 2024.

Quality issues have plagued the truck from day one. Tesla has issued ten recalls so far, addressing problems ranging from stuck accelerator pedals to body panels flying off at highway speeds. Some of these defects were known internally before launch, according to former employees, but pressure to get the product to market overrode proper testing.

The truck's massive windshield frequently cracks, and its 50-inch wiper fails under stress. Owners report vehicles breaking down after car washes or arriving at dealerships already damaged.

Moreover, key executives are jumping ship. Siddhant Awasthi, who led Cybertruck production scaling, and Emmanuel Lamacchia, who oversaw Model 3 and Model Y manufacturing, both departed in late 2025.

These exits follow a pattern of leadership turnover that suggests deeper cultural concerns at Tesla, where burnout and Musk's demanding management style create constant churn.

What Is the TSLA Stock Price Target?

Valued at a market cap of $1.52 trillion, TSLA stock has returned over 13% in 2025. However, since November 2021, it has risen by less than 15%, underperforming the broader markets by a wide margin. While the Cybertruck is not a key revenue driver, investors are worried about slowing EV sales and narrowing profit margins amid rising competition.

Tesla’s revenue rose by less than 1% in 2024 and is projected to decline by 3.1% this year. In 2022, Tesla reported revenue of $81.46 billion and a free cash flow of $7.57 per share. While its sales are forecast at $94.7 billion, its free cash flow is unlikely to surpass $5 billion this year.

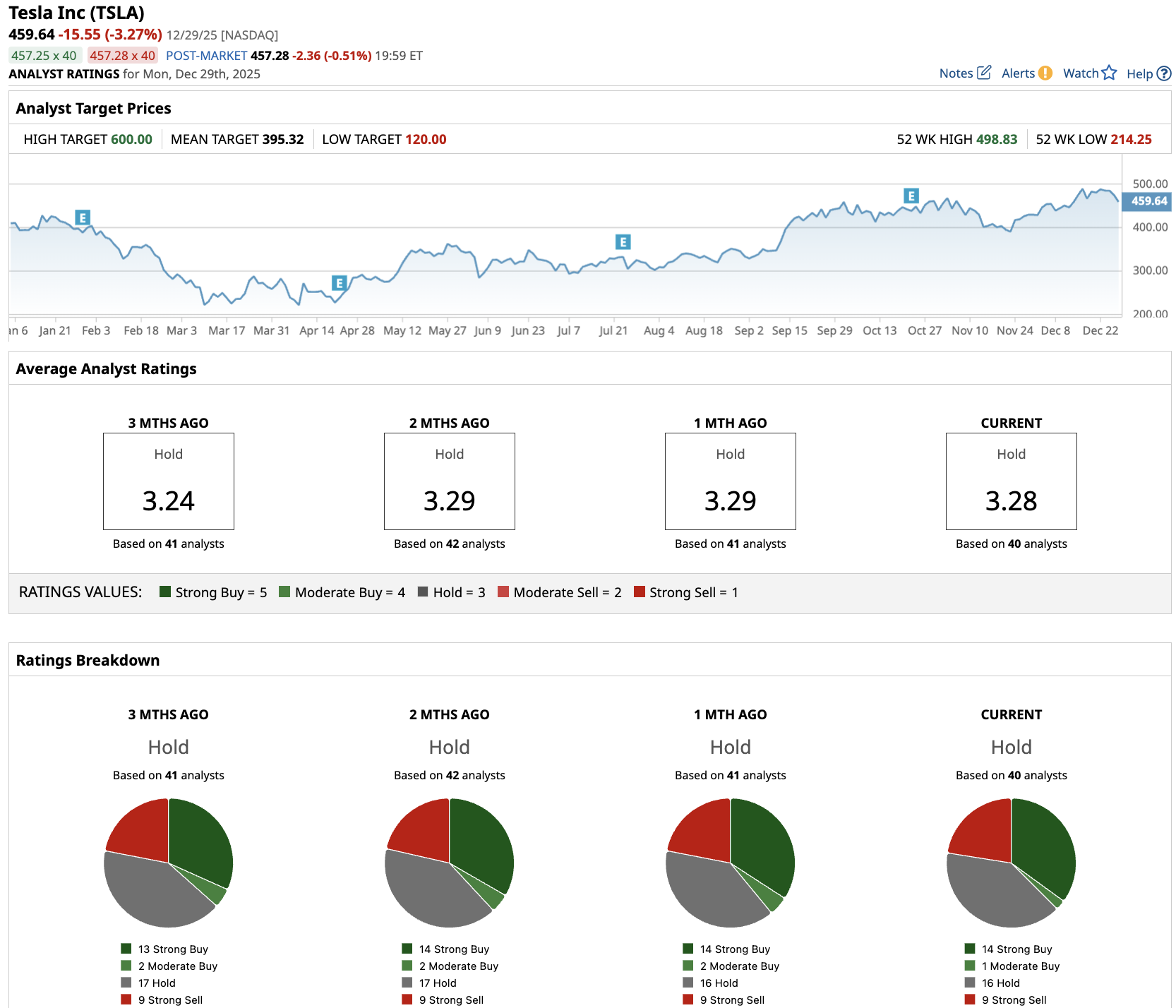

Out of the 40 analysts covering TSLA stock, 14 recommend “Strong Buy,” one recommends “Moderate Buy,” 16 recommend “Hold,” and nine recommend “Strong Sell.” The average TSLA stock price target is $395.32, below the current price of $460.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20logo%20outside%20building-by%20BING-JHEN_HONG%20via%20iStock.jpg)