Berkshire Hathaway (BRK.B) faces the most notable leadership transition in corporate history next year as Warren Buffett steps down as chief executive at the end of 2025.

Greg Abel is set to take the helm after Buffett’s extraordinary 60-year tenure.

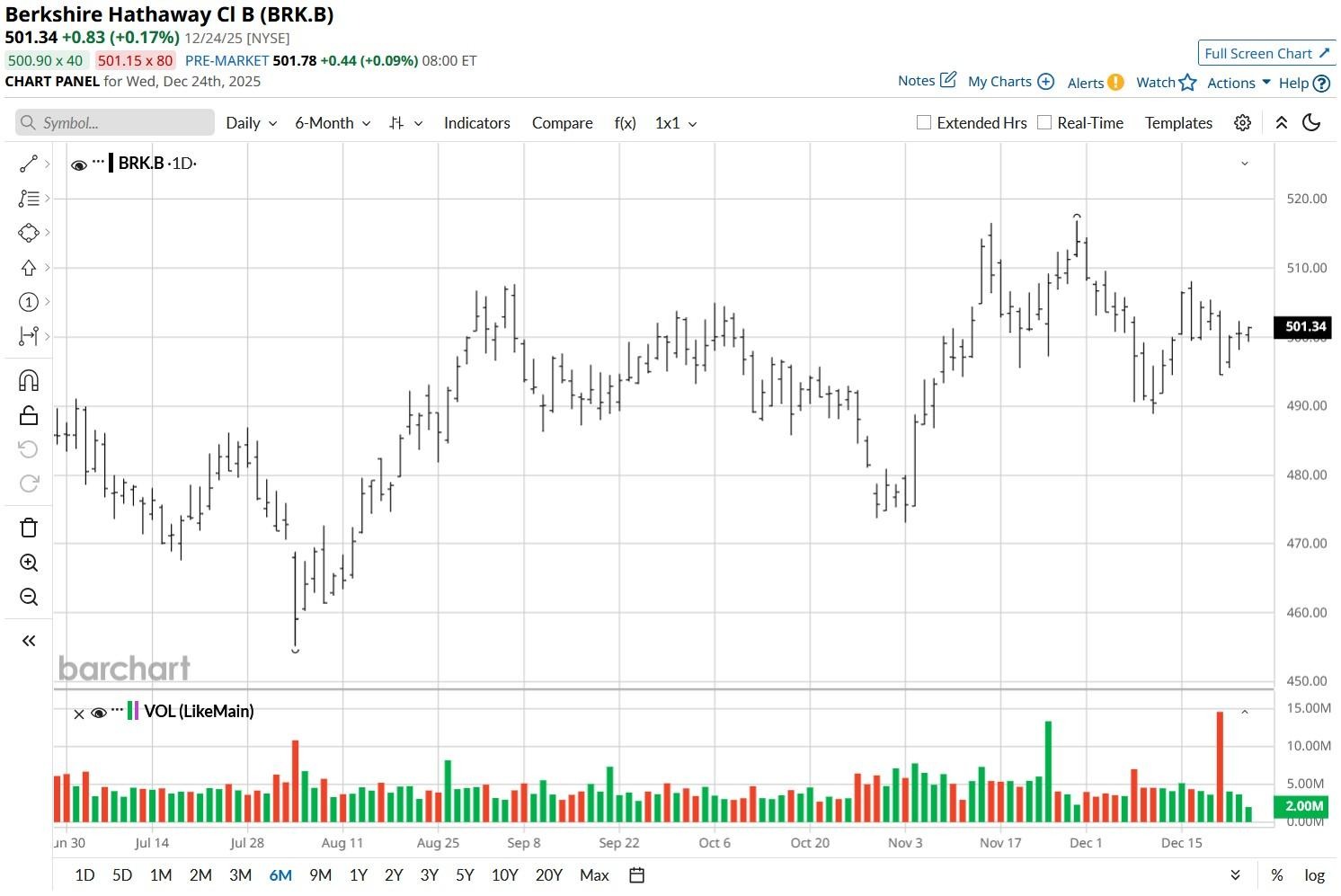

That said, Berkshire shares have actually underperformed the broader market this year. At writing, they’re up some 10% year-to-date – significantly less than about 16% for the S&P 500 Index ($SPX).

BRK.B Stock’s Valuation Multiple Warrants Buying

Valuation wise, Berkshire Hathaway stock appears rather attractive to own heading into 2026.

At about 16 times earnings, it’s trading at a modest premium to diversified financials but a material discount to the peer group average of nearly 27x.

More importantly, discounted cash flow analysis suggests BRK.B is currently trading at about 35% below its intrinsic value.

What’s also worth mentioning is that Greg Abel is inheriting an unprecedented financial war chest of as much as $380 billion.

This record cash position, generating about $8.7 billion annually at current interest rates, positions him to capitalize on market dislocation and deploy capital aggressively on attractive opportunities.

What Berkshire Hathaway Has in Store for 2026

Berkshire Hathaway shares are worth owning also because the conglomerate’s insurance operation continue to generate substantial underwriting float ($176 billion in the third quarter of 2025).

For the coming year, investors should view BRK.B as offering an asymmetric risk-reward profile combining defensive characteristics with meaningful offensive capabilities.

Berkshire’s diversified business model provides stability through economic cycles, with core units (insurance, railroad, energy) generating consistent cash flows independent of market volatility.

From a technical perspective as well, BRK.B stock is trading above its key moving averages (50-day, 100-day, 200-day) – signaling continued bullish momentum ahead.

How Wall Street Recommends Playing BRK.B Shares

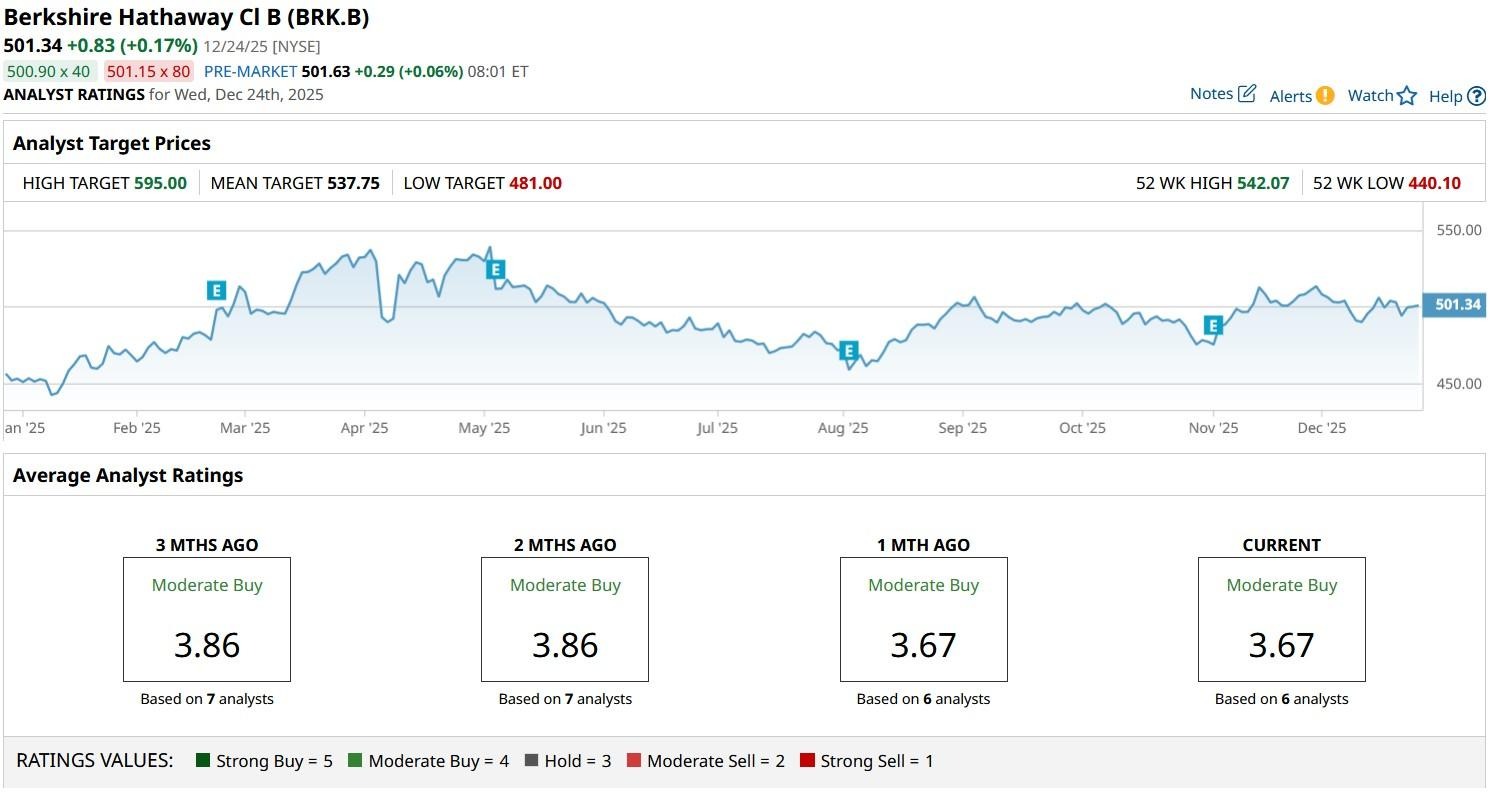

Wall Street analysts also remain convinced that Berkshire Hathaway stock will push higher under Greg Abel next year.

According to Barchart, the consensus rating on BRK.B currently sits at “Moderate Buy” with price targets going as high as $595 indicating potential upside of another 19% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)