Warner Bros. Discovery (WBD) has been in a strong uptrend since April as strategic restructuring, a commitment to reducing debt, and buyout offers renewed investor confidence in its streaming and content assets.

In fact, the mass media and entertainment conglomerate is currently a top Nasdaq-100 ($IUXX) name despite being removed from the artificial intelligence (AI) boom that has driven much of the broader rally.

At the time of writing, WBD shares are up nearly 300% versus their year-to-date low in early April.

What Will Determine the WBD Stock Trajectory in 2026?

WBD stock currently finds itself at the center of an unprecedented bidding war that’s expected to fundamentally reshape its future in 2026.

On the one hand is the world’s largest streaming platform – Netflix (NFLX) – willing to pay $82.7 billion for its streaming and studio assets.

And on the other, is Paramount Skydance (PSKY) with hostile $108.4 billion all-cash proposal backed by Oracle (ORCL) co-founder Larry Ellison’s personal guarantee of $40.4 billion in equity financing, seeking to acquire the entire enterprise.

The strategic value underlying these competing bids center on Warner Bros. Discovery’s extensive content library, including globally recognized franchises like Harry Potter, DC Comics, and Game of Thrones.

These established intellectual properties provide defensive characteristics and predictable revenue streams that remain valuable regardless of ownership structure, offering some downside protection in an increasingly competitive streaming market.

What to Expect From WBD Shares Next Year

For 2026, investors should view WBD stock primarily as a merger arbitrage opportunity, where returns will be determined by deal completion rather than standalone operational performance.

The company’s independent prospects appear rather limited given its debt burden and exposure to declining linear television revenues, making successful completion of either acquisition critical for immediate shareholder value.

The extended timeline for regulatory approval, with tender deadlines extending to January, signals volatility will remain elevated in early 2026 as competing parties potentially adjust their proposals to secure shareholder approval.

In short, the investment thesis simply depends on which acquirer ultimately prevails.

How Wall Street Recommends Playing WBD

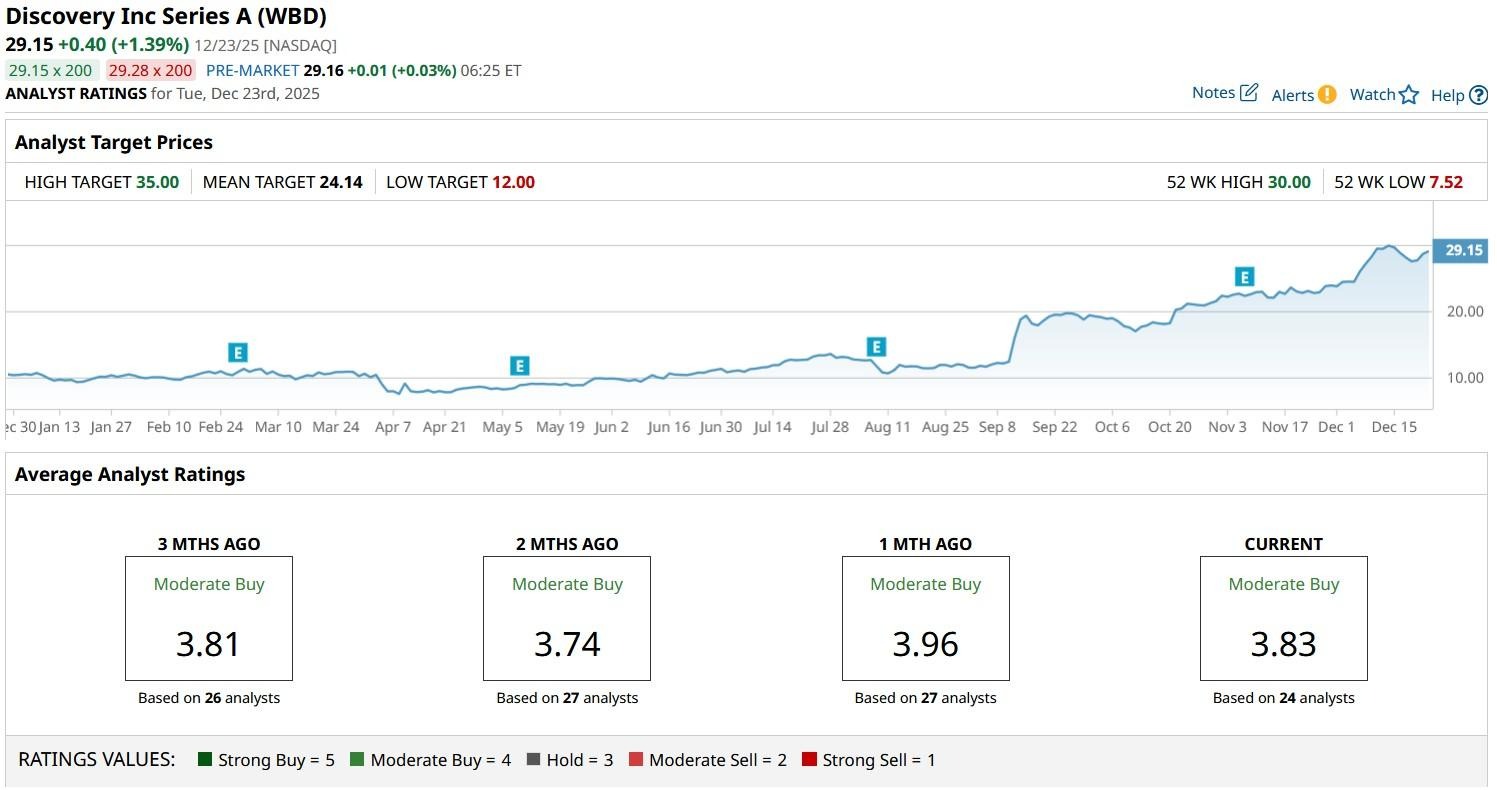

Despite the bidding war, WBD shares aren’t particularly exciting heading into 2026 because they are already trading well above the analysts’ mean target.

According to Barchart, while the consensus rating on Warner Bros. Discovery remains at “Moderate Buy,” the mean target of about $24 indicates potential downside of about 17% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)