/AI%20(artificial%20intelligence)/Image%20of%20Cloud%20Computer%20Engineer%20Coding%20In%20Server%20Room%20In%20Data%20Center%20by%20Andrey%20Popov%20via%20Shutterstock.jpg)

With AI and data centers being among the hot investment themes, Western Digital (WDC) stock has rallied by almost 180% for the year. The rally from undervalued levels has been supported by industry tailwinds, robust top-line growth, and a strong outlook for the coming years.

While the outlook is optimistic, the big rally in WDC stock does make investors cautious. However, Morgan Stanley recently highlighted WDC as one of the top picks for 2026 with an “Overweight” rating.

Similarly, Cantor's top picks in AI compute include WDC stock. Cantor believes that total semiconductor revenue in 2026 will top $1 trillion, driven by the impact of AI on memory, storage, and networking. The uptrend in WDC stock is therefore likely to sustain.

About Western Digital Stock

Western Digital, headquartered in San Jose, is a manufacturer of storage devices. With AI and machine learning generating significant volumes of data, the company’s HDDs have been in demand.

To put things into perspective, the amount of data generated globally is expected to triple to 527.5 zetabytes between 2024 and 2029. With a global presence, Western Digital has a big addressable market.

Besides the prospects of robust revenue growth, Western Digital is likely to report healthy margins as demand for HDDs remains high. For Q2 2026, the company expects gross margin in the range of 44% to 45%.

With positive financial developments coupled with industry tailwinds, WDC stock has surged by over 200% in the past six months.

Strong Growth and Robust Cash Flows

For Q1 2026, Western Digital reported revenue growth of 27% on a year-on-year (YoY) basis to $2.82 billion. Healthy numbers were driven by the growth of data storage in the cloud.

Besides the headline numbers, it’s worth noting that Western Digital reported operating and free cash flow of $672 million and $599 million, respectively. This would imply an annualized FCF potential of $2.4 billion. With swelling cash flows, higher dividends and share repurchases are likely to create incremental value. For Q1 2026, the company repurchased shares worth $553 million.

Western Digital has also indicated that Q2 will be strong, driven by data center demand. At the same time, profitability is likely to improve, driven by the adoption of higher-capacity drives. This reaffirms the point that cash flows will be robust.

Strong fundamentals also ensure that WDL can invest in innovation and storage systems that keep pace with accelerated compute infrastructure. For Q1 2026, the company’s research and development expense was 10.4% of total revenue.

With 4,500 global active patents and seven R&D centers, WDC is likely to remain ahead of the curve. It’s worth noting that the company is already working towards high-volume production of HAMR devices (36 to 44 TB drives). By 2030, Western Digital is likely to unveil an HDMR device (80 to 100 TB drives). The product roadmap provides clear growth and value creation visibility.

What Analysts Say About WDC Stock

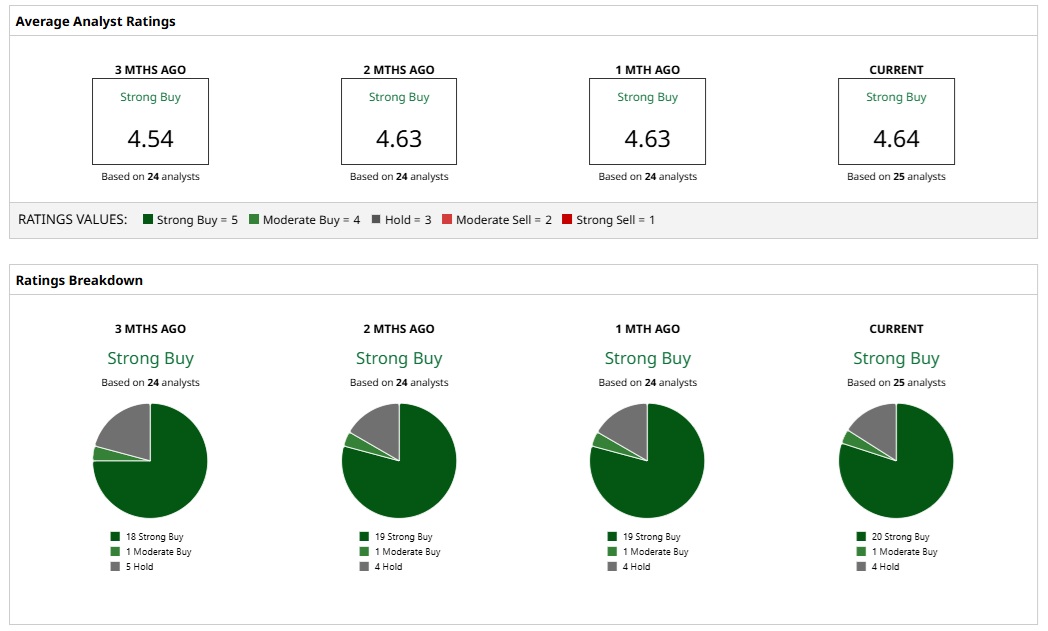

Based on the rating of 25 analysts, WDC stock is a consensus “Strong Buy.”

While 20 analysts have assigned a “Strong Buy” rating, one and four analysts have a “Moderate Buy” and “Hold” rating, respectively.

Based on these ratings, the analysts have a mean price target of $186.18. This would imply an upside potential of 5%. Furthermore, considering the most bullish price target of $250, the upside potential is 41%.

It’s worth noting that WDC stock trades at a forward price-earnings ratio of 24.1. Valuations are attractive considering the point that earnings growth for FY 2026 and FY 2027 is expected at 57.4% and 41.65%, respectively.

WDC stock also offers an annualized dividend of 50 cents. With healthy growth on the cards, it’s likely that dividend growth will be robust. Considering these factors, it’s not surprising that Citi raised its price target for WDC stock from $180 to $200.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)

/Tesla%20dealership%20with%20cars%20in%20lot%20by%20Jetcityimage%20via%20iStock.jpg)