/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

Microsoft (MSFT) stock has lagged several of its big-tech peers over the past three months, which comes as a surprise given the company’s consistently strong financial results over the past several quarters. The primary factor weighing on Microsoft shares is growing concern about its rapidly expanding capital expenditure (CapEx), particularly amid fears of an artificial intelligence (AI) bubble.

During the first quarter of the current fiscal year, Microsoft spent $34.9 billion on CapEx, well above its earlier guidance of $30 billion. This sharp increase reflects surging demand for the company’s cloud and AI offerings, especially across its Azure platform. The company said that about half of this spending was directed toward assets such as GPUs and CPUs, which are essential for handling rising workloads tied to cloud infrastructure, AI applications, and the replacement of aging server and networking equipment.

As demand continues to accelerate, Microsoft’s remaining performance obligations (RPO) have also grown, signaling a robust pipeline of future revenue. To support this momentum, the company has further ramped up investments in GPUs and CPUs. Management now expects CapEx to rise sequentially and has indicated that the growth rate in fiscal 2026 will exceed that of fiscal 2025, reflecting a multi-year commitment to scaling its AI and cloud capabilities.

Despite the strategic rationale behind these investments, investor skepticism remains elevated. The concern is not whether Microsoft can execute, but whether the scale and speed of spending will translate into returns quickly enough to justify the investments. As fears of an AI bubble circulate across the market, even industry leaders like Microsoft are not immune to sentiment-driven pullbacks.

Is Microsoft Stock a Buy?

Rising CapEx has become a point of concern for investors, particularly as Microsoft continues to invest heavily in AI. These investments may keep margins under pressure in the near term, even as the company continues to deliver ongoing efficiency gains. However, the broader financial picture remains compelling. Microsoft is executing well. Moreover, strong revenue growth, expanding earnings, and robust free cash flow reflect the resilience of its business model.

In the first quarter of the current fiscal year, Microsoft reported revenue of $77.7 billion, up 18% year-over-year. Profitability improved alongside that growth. Gross margin dollars rose 18%, operating income climbed 24%, and adjusted earnings per share (EPS) reached $4.13, up 23% after accounting for the impact of investments in OpenAI. Free cash flow was strong, increasing 33% to $25.7 billion, reflecting MSFT’s ability to fund growth initiatives while returning value to shareholders.

One of the key highlights of the quarter was the surge in commercial bookings, which rose 112%. This performance was driven largely by Azure commitments from OpenAI, as well as continued momentum in securing large-scale enterprise contracts. Microsoft continues to see growth in the number of deals exceeding $100 million across both Azure and Microsoft 365. Importantly, these figures do not yet reflect the impact of an additional $250 billion in Azure commitments from OpenAI, suggesting further upside in future periods.

The company’s commercial RPO maintained momentum, rising to $392 billion, up 51% year-over-year. This balance has nearly doubled over the past two years, providing strong revenue visibility and confidence in sustained long-term growth.

Microsoft Cloud revenue reached $49.1 billion, up 26% year over year. Within this, the Intelligent Cloud segment generated $30.9 billion in revenue, growing 28%. Azure and other cloud services continued to accelerate, with revenue rising 40%, reflecting strong demand from Microsoft’s largest customers and continued strength in its core infrastructure offerings. The demand for Azure AI services remains strong, suggesting continued growth ahead.

With demand for cloud and AI services remaining strong, Microsoft’s cloud business is well-positioned to deliver continued growth. The company is expanding capacity, which should help ease supply constraints and support further revenue expansion. While elevated investment levels may pressure margins in the near term, Microsoft’s financial strength, solid execution, and long-term growth outlook continue to support a constructive view on the stock.

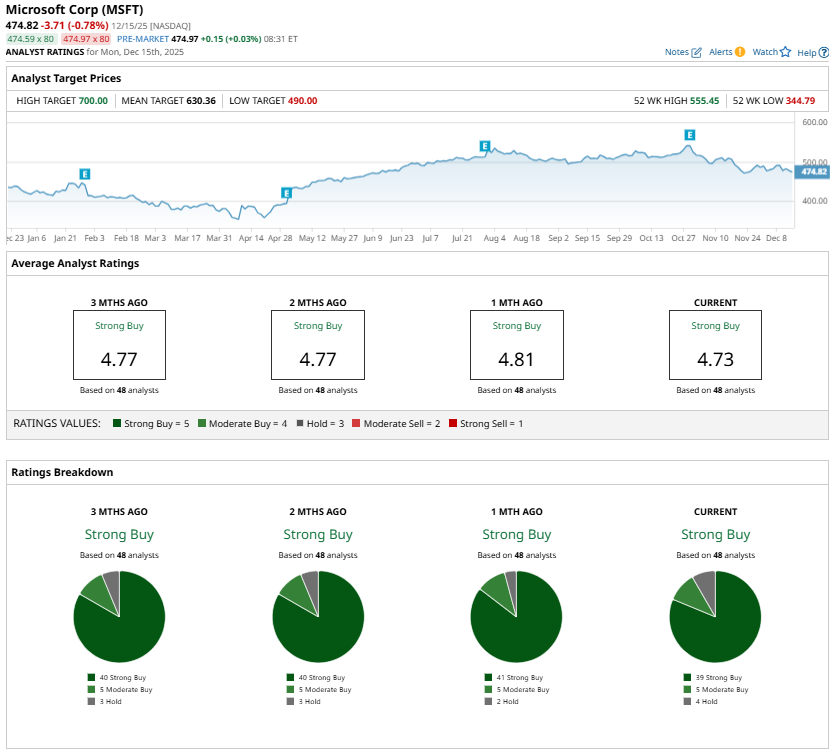

Analysts are upbeat and maintain a “Strong Buy” consensus rating on Microsoft stock.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)