/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

Autonomy excitement can move EV stocks fast; one update can push shares up or down. Investors are betting on a future where robotaxis and ride-hailing reshape automakers’ profits, but execution and regulation still matter.

Tesla (TSLA) just added a new twist. Elon Musk said the company will remove safety drivers from its Austin Robotaxis in about three weeks. He also teased a much larger Full Self-Driving (FSD) model, “an order of magnitude bigger,” which could launch in January or February 2026.

If Tesla successfully scales unsupervised driving and Robotaxi revenue, it could lift the stock. But regulatory hurdles, rare driving scenarios, or hardware limits could slow progress. For investors eyeing TSLA now, the opportunity looks promising, but it carries notable risks.

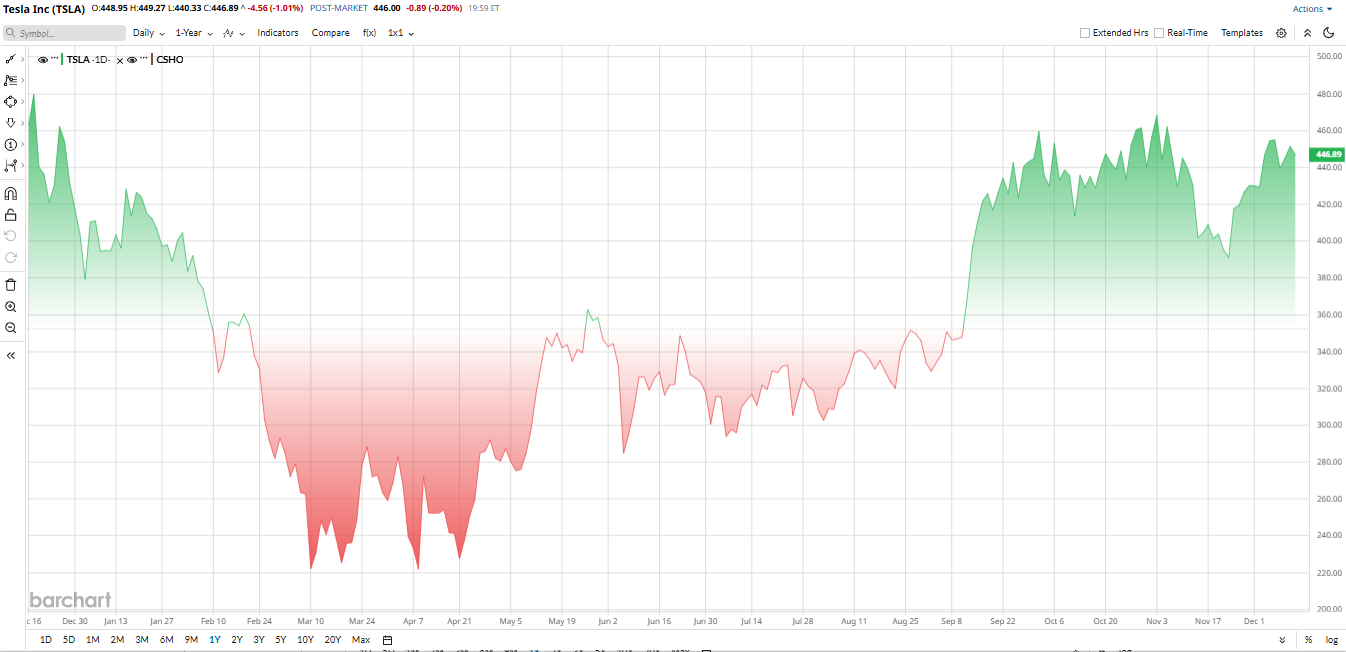

Tesla Stock Performance

Founded in 2003, Tesla is a leading electric vehicle and clean energy company. It pioneered advanced driver-assist software (FSD) and is developing robotaxis and humanoid robots named “Optimus.” The company is currently valued at around $1.4 trillion, with significant investments in factories and autonomous technology.

Tesla's stock ride is quite volatile this year. TSLA stock is up roughly 11% year-to-date (YTD), clawing back April slumps sparked by soft deliveries and nerves over Musk’s political distractions. Momentum returned in mid-2025 as rate-cut optimism lifted growth stocks, and Musk’s $1 billion insider buy reignited confidence.

On the valuation end, TSLA presents a challenging landscape. The stock is trading with a price-to-earnings (P/E) ratio of 240, significantly above the sector median of 16, indicating an expensive stock. Its price-to-sales (P/S) ratio of 15 also reflects a premium compared to the sector median of 1. The high valuation reflects investor optimism about FSD and robotaxis, but it also means less upside if those don’t materialize quickly.

Robotaxi & FSD News

Tesla’s announcement of unsupervised robotaxis and a new FSD model drew guarded optimism. The market sees it as a milestone. Removing safety drivers would help Tesla catch up to competitors, like Waymo, which already has over 100 million miles without safety drivers under its belt. However, analysts note this is still a small-scale test and not yet revenue-generating.

Some investors cheered the bold progress. Others remain cautious, pointing out execution risks (safety, regulation) and the fact that full profits from robotaxis are years away.

Overall, the news buoyed confidence in Tesla’s tech leadership but had a limited immediate impact on the stock price.

Tesla Reports Record Revenue Yet Squeezes Profits

The third quarter report of Tesla was a tale of two stories. One of them is record revenue and record free cash flow, and it has significantly tightened the profit margin. Revenue reached a record high of $28.1 billion, driven by vehicle sales and robust energy deployments, but net income dropped 37% to $1.37 billion as AI compute and research and development, as well as SG&A margin, were strained. Automotive gross margin relaxed to approximately 15.4%.

Nevertheless, it was cash that mattered most. Cash flow operations were also strong at $6.24 billion, capital expenditure was significantly lower at $2.25 billion, and the FCF was higher at about $4.0 billion, which was a quarterly record. Cash on hand increased to approximately 41.6 billion, which provides Tesla with a lot of balance-sheet flexibility.

Tesla is balancing between victories and crosswinds on product and demand. Volume should be supported by new models, such as a long-wheelbase Model Y in China and cheaper 3/Y models priced below 40,000. There was also momentum in energy with Megapack and Megablock of larger sizes. However, the main markets have weakened in demand. U.S. deliveries declined drastically at the end of the year, registrations in Europe are flat, and Chinese brands are becoming tougher competitors. Such tendencies, together with new policy changes concerning the incentives of EVs, are actual drags in the near term.

The major growth story that is still in the headlines at Tesla is autonomy. The management boasts great FSD innovations and robotaxi trials spreading throughout cities, and Elon Musk describes autonomy as a turning point. While the opportunity to enable true unsupervised driving at scale can result in enormous revenue and margin upside, regulatory scrutiny and edge-case safety are still significant factors to consider.

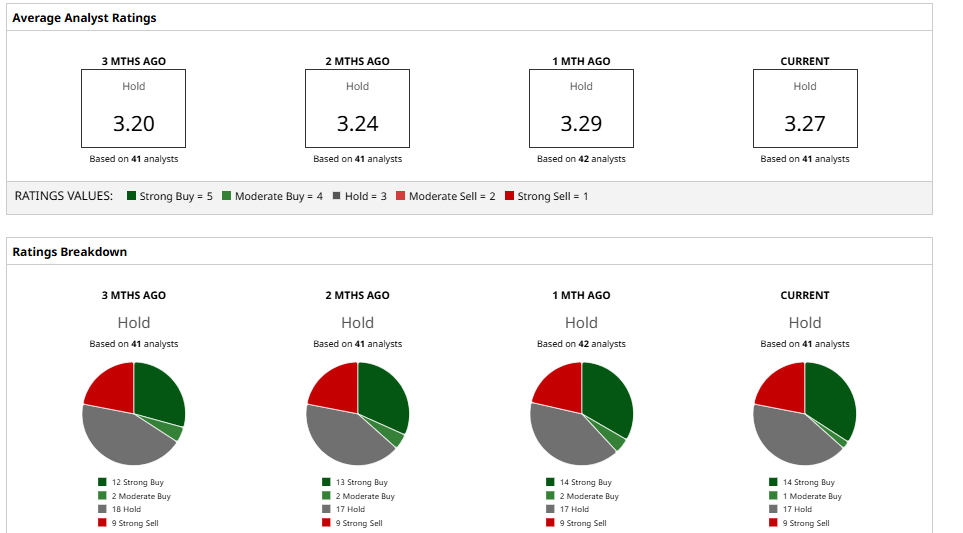

What Do Analysts Say About TSLA Stock?

Wall Street is pretty split on Tesla right now. Morgan Stanley in early December moved TSLA from a “Buy” to a “Hold” but nudged its price target up to about $425 from $410. Their analyst, Andrew Percoco, praised Tesla’s FSD and robotics progress but trimmed delivery forecasts for 2026 by roughly 10% because EV demand looks softer than expected. The $425 target only signals a modest downside from here, so MS is basically saying progress exists, but the market already prices a lot of it in.

Goldman Sachs, in late October, landed in a similar neutral camp with a $400 target. GS called the Q3 print “mixed to slightly negative”: revenue beats offset by weaker margins and EPS. It flagged upcoming catalysts, the shareholder meeting, robotaxi testing, and the Optimus rollout, but still views the shares as fairly valued at today’s multiples.

On the other end, Piper Sandler remains bullish. In November, they kept an “Overweight/Buy” rating and a $500 target after on-site factory checks that highlighted improved production efficiency. Piper’s thesis leans on FSD and robotaxi upside to justify a premium valuation, essentially a higher conviction that autonomy will ultimately pay off.

Wedbush’s Dan Ives, as usual, remains the most bullish among all, predicting a “magical 2026” from autonomy and AI; he highlights robotaxi upside and maintains a $600 price target for Tesla amid rising optimism in markets.

Overall, Tesla's consensus rating is “Hold” by 41 analysts tracked by Barchart. The average 12-month price target sits at $386.29, which is well below Tesla's current price. However, the Street high target of $600 suggests 35% upside potential.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)