Disney (DIS) is betting $1 billion that generative AI represents the future of fan engagement rather than an existential threat to its intellectual property empire. The entertainment giant announced a landmark deal with OpenAI that transforms the relationship between Hollywood studios and artificial intelligence platforms.

Disney inked a three-year agreement and became the first major content partner for Sora, which is OpenAI’s video generation platform. The partnership will begin in 2026, allowing users to create short videos with more than 200 Disney, Marvel, Pixar, and Star Wars characters through simple text prompts.

Mickey Mouse, Iron Man, Darth Vader, and dozens of other beloved characters will become available for fan-generated content, though the deal explicitly excludes any talent likenesses or voices.

Disney receives warrants to purchase additional OpenAI equity beyond its billion-dollar investment and becomes a major customer of the startup's technology. Moreover, it will deploy ChatGPT across its workforce and integrate OpenAI's systems into Disney+ to power new subscriber experiences. Curated selections of Sora-generated videos will appear on the streaming platform alongside traditional content.

The deal marks a pivot for Disney, which just hours earlier sent a cease-and-desist letter to Alphabet (GOOGL) (GOOG) alleging massive copyright infringement. Disney has also sued AI image creator Midjourney and warned Character.AI to stop using its characters without permission. Those aggressive legal moves established Disney's willingness to protect its intellectual property through litigation.

Now Disney appears ready to monetize rather than merely defend its character library. The partnership suggests CEO Bob Iger believes controlled licensing generates more value than endless courtroom battles, as AI video generation gains popularity among consumers.

Is Disney a Good Stock to Buy Right Now?

Valued at a market cap of almost $200 billion, Disney has trailed the broader markets significantly over the past five years. Since December 2020, Disney's stock has been down nearly 30% due to slowing sales and narrowing profit margins.

Last month, Disney delivered a compelling case for sustained earnings growth as CFO Hugh Johnston outlined the company's strategy to become what he calls a cash machine through disciplined execution across parks, streaming, and content.

The entertainment giant posted 19% earnings-per-share growth for fiscal 2025 and has maintained that same compounded annual growth rate over the past three years. Management guided to double-digit EPS growth for both fiscal 2026 and 2027, excluding the impact of a 53rd week. The company backed this outlook with aggressive capital returns, including a 50% dividend increase and $7 billion in share buybacks, double the prior year.

Parks remain the profit engine for Disney despite a challenging macro environment. In fiscal 2025, the experiences segment surpassed $10 billion in operating income for the first time, growing 8% year-over-year (YoY).

Per capita spending rose 5% as Disney successfully implemented yield management strategies similar to those used by airlines. Bookings for the current quarter are running 3% ahead of last year, which suggests continued momentum.

The direct-to-consumer business is transitioning from subscriber acquisition to margin expansion. Disney reached 195 million global subscribers and expects to hit 10% operating margins in fiscal 2026.

Johnston emphasized that future margin growth will come in percentage points rather than basis points, driven by higher engagement, improved retention, and reduced marketing spend.

The company is investing heavily in product technology to unify Disney+, Hulu, and ESPN into a single consumer portal. ESPN's streaming app launch exceeded expectations, with 80% of retail subscribers choosing bundle packages that combine ESPN with Disney+ and Hulu.

Content spending settled at $24 billion annually, split evenly between sports and entertainment, down from over $30 billion during the streaming gold rush. Johnston acknowledged the industry was overproducing at peak levels and said Disney now has quality dialed in correctly. The company is allocating incremental investment toward local international content to drive global streaming growth.

Is DIS Stock Undervalued?

Disney expects to spend $9 billion in capital expenditures across cruise ships, park attractions, and technology infrastructure. However, it also expects free cash flow to reach $10 billion.

Analysts tracking DIS stock estimate revenue to increase from $94.4 billion in fiscal 2025 to $113 billion in fiscal 2029. In this period, adjusted earnings per share are projected to grow from $5.93 to $8.77.

Currently, Disney stock trades at 17x forward earnings, which is below its three-year average of 20x. If Disney stock maintains its current multiple, it should trade around $150 in December 2028, implying a 35% upside from current levels. If we adjust for dividends, cumulative returns could be closer to 40%.

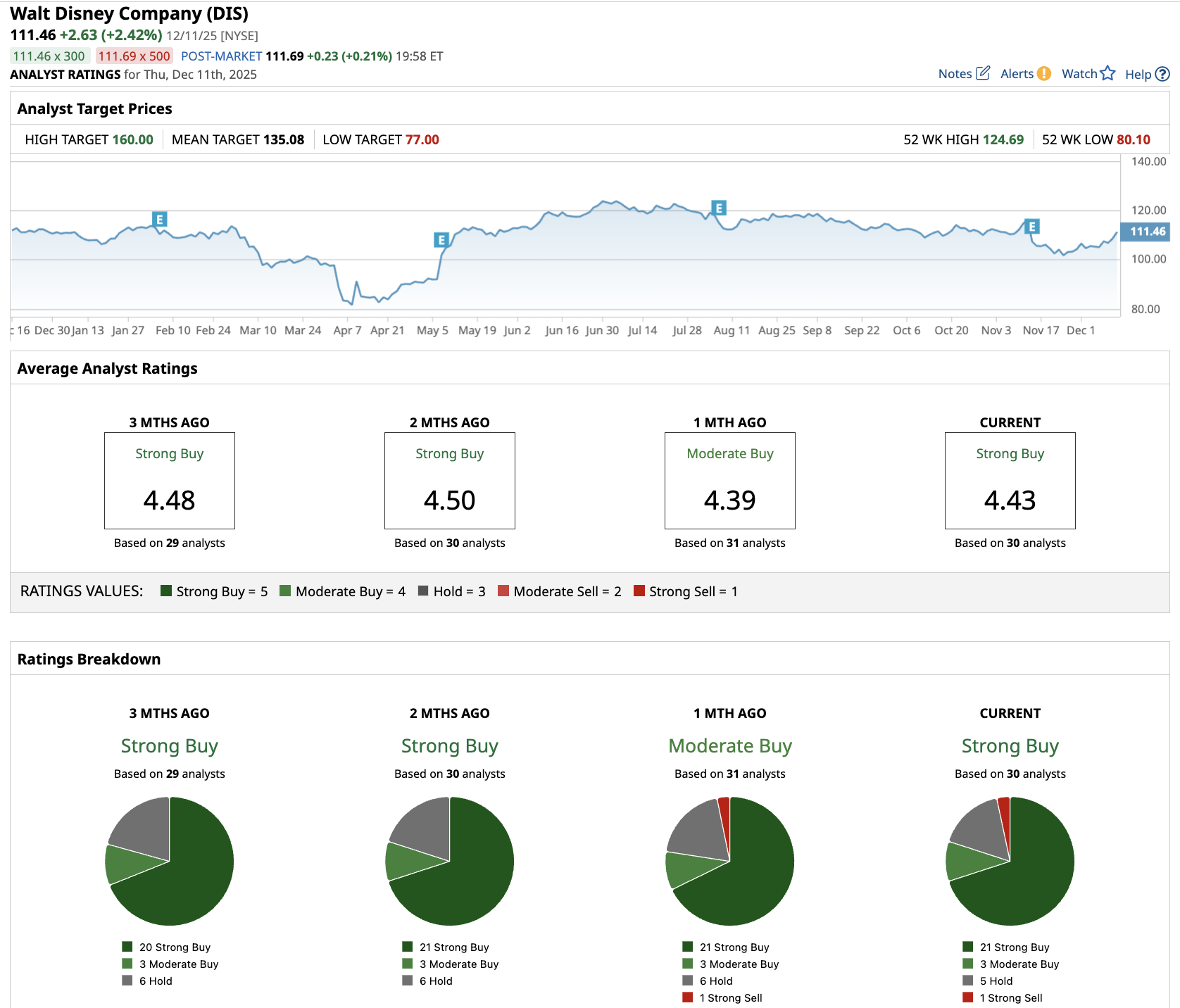

Out of the 30 analysts tracking DIS stock, 21 recommend “Strong Buy,” three recommend “Moderate Buy,” five recommend “Hold,” and one recommends “Strong Sell.” The average Disney stock price target is $135.08, above the current price of about $111.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)