Aircraft developer Archer Aviation (ACHR) recently signed an agreement with Saudi Arabia’s General Authority of Civil Aviation (GACA) to accelerate the deployment of air taxis in the country.

This development aims to establish a regulatory framework to enable the introduction and scale-up of air taxi deployment. This may also be a step toward commercializing the service in the U.S., as the framework is expected to align with Federal Aviation Administration (FAA) regulations.

So, should you consider buying the stock now?

About Archer Aviation Stock

Archer Aviation creates electric vertical takeoff and landing (eVTOL) aircraft for fast air taxi services in busy cities. These planes help people skip traffic by flying short trips, such as to airports or across town. The company's primary focus is its Midnight model, which seats a pilot and four passengers and flies at speeds up to 150 mph.

It also builds strategic partnerships with airlines, automakers, and government agencies to support deployment, infrastructure, and fleet operations. Headquartered in San Jose, California, Archer Aviation has a market capitalization of $5.45 billion.

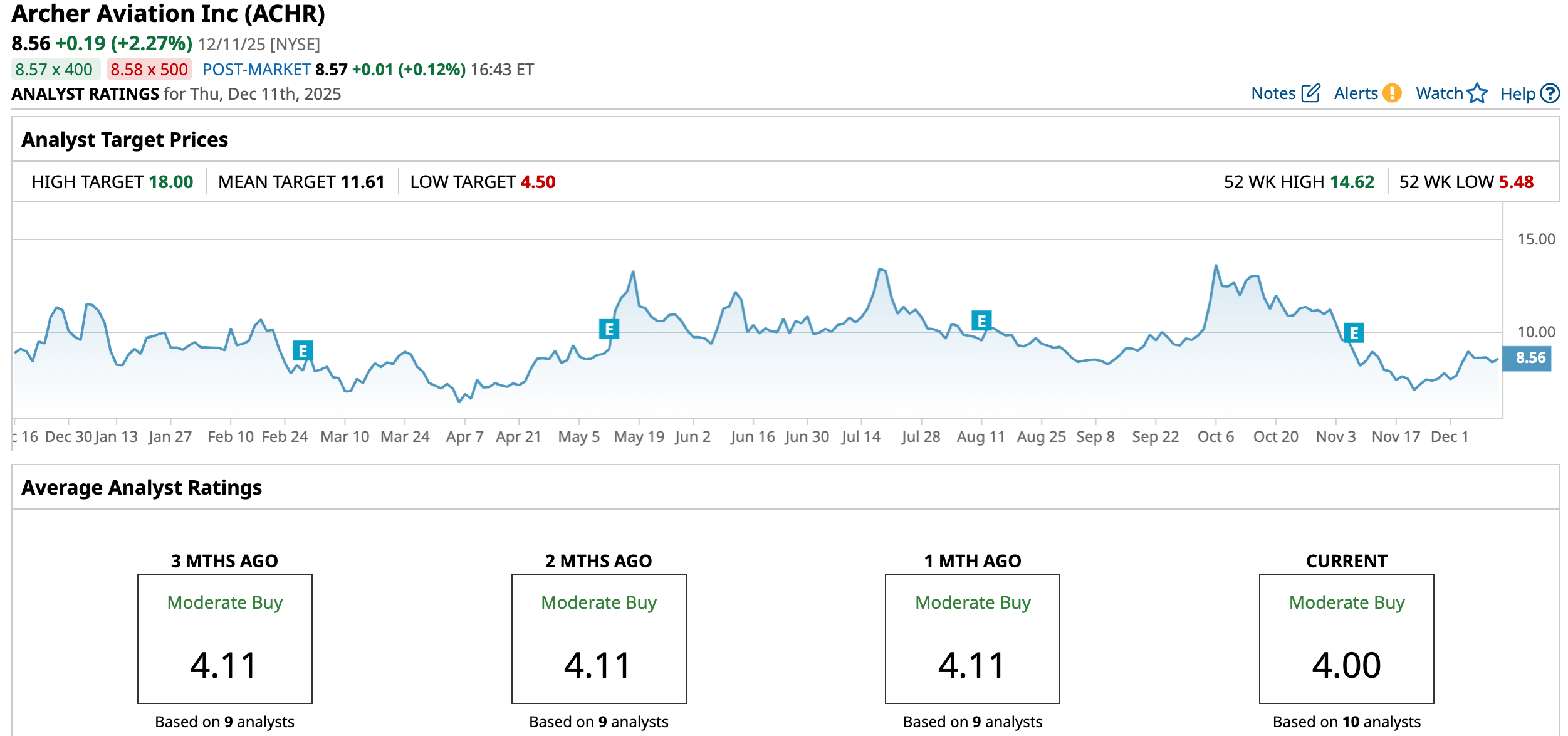

Investor concerns about execution risks, given the company’s pre-revenue status, have led to a volatile stock price trajectory. Over the past 52 weeks, the stock has gained 15.76%. However, over the past six months, it has dropped by 29.7%. Archer Aviation shares had reached a 52-week high of $14.62 in October, but are down 41.5% from that level.

Archer Aviation’s stock is trading close to a reasonable valuation. Its price-to-book ratio of 3.30x compares to the industry average of 3.18x.

Archer Aviation’s Latest Strategic Developments

During the third quarter, the company pursued several strategic initiatives to advance its goal of creating a sustainable air-taxi network. In October, Archer Aviation won a bid to acquire Lilium’s (LILMF) GmbH’s portfolio, with about 300 advanced air mobility patent assets. Lilium has spent over $1.50 billion developing enabling technologies for eVTOL, which are expected to bolster Archer Aviation’s portfolio.

Also, the company partnered with Korean Air to commercialize the Midnight eVTOL aircraft in Korea. As part of the agreement, Korean Air plans to purchase up to 100 Midnight aircraft. Additionally, Archer Aircraft became part of phase one of Tokyo’s “eVTOL Implementation Project” last month.

It appears Archer Aircraft’s strategy is to acquire assets to advance its development. In line with this, the company announced that it has signed definitive agreements to acquire the Hawthorne Airport in Los Angeles. The site is expected to serve as the operational hub for its air-taxi network. The aviation asset is near LAX and strategically located near several key locations. In December, Archer Aviation completed the first phase of this transaction.

Archer Aviation Is Still Without Revenue

As of the third quarter of 2025, Archer Aviation has not generated significant revenue. Meanwhile, its total operating expenses increased 43.2% year-over-year (YOY) to $174.80 million. However, this was lower than the $176.10 million that it had recorded in the previous quarter. Adjusted EBITDA loss was $116.10 million. However, Archer Aviation is not short on liquidity, with cash, cash equivalents, and short-term investments totaling $1.64 billion, up 227.1% YOY.

The company is seeking FAA authorization for its Midnight aircraft, but Archer Aviation reported a setback in this process as the recent U.S. government shutdown impacted the FAA. It is preparing for Type Inspection Authorization (TIA) testing as part of the fourth and final phase of Midnight’s certification program. Archer Aviation may be looking at deployments in the U.S. as early as next year.

Wall Street analysts are optimistic about Archer Aviation’s ability to reduce its losses. For the current quarter, losses are expected to decrease 52.8% YOY to $0.25 per share. For the current year, losses are projected to decline 27.5% YOY to $1.03 per share, followed by another 7.8% reduction to $0.95 per share in the following year.

What Do Analysts Think About Archer Aviation Stock?

While analysts at Goldman Sachs initiated coverage of Archer Aviation’s stock with a “Neutral” rating and a $11 price target, they also noted the company’s outsourcing strategy, which has led to lower R&D spending and reduced the time to build an operational aircraft. And, Goldman Sachs analysts pointed out that the company’s aircraft could be the most capable based on takeoff weight and payload metrics.

Last month, analysts at Canaccord Genuity raised their price target on Archer Aviation from $12 to $13, while maintaining a “Buy” rating. The price target increase was driven by the company’s multiple projects, including supplying eVTOL powertrains for the Omen project and participating in a hybrid-electric VTOL project with Anduril.

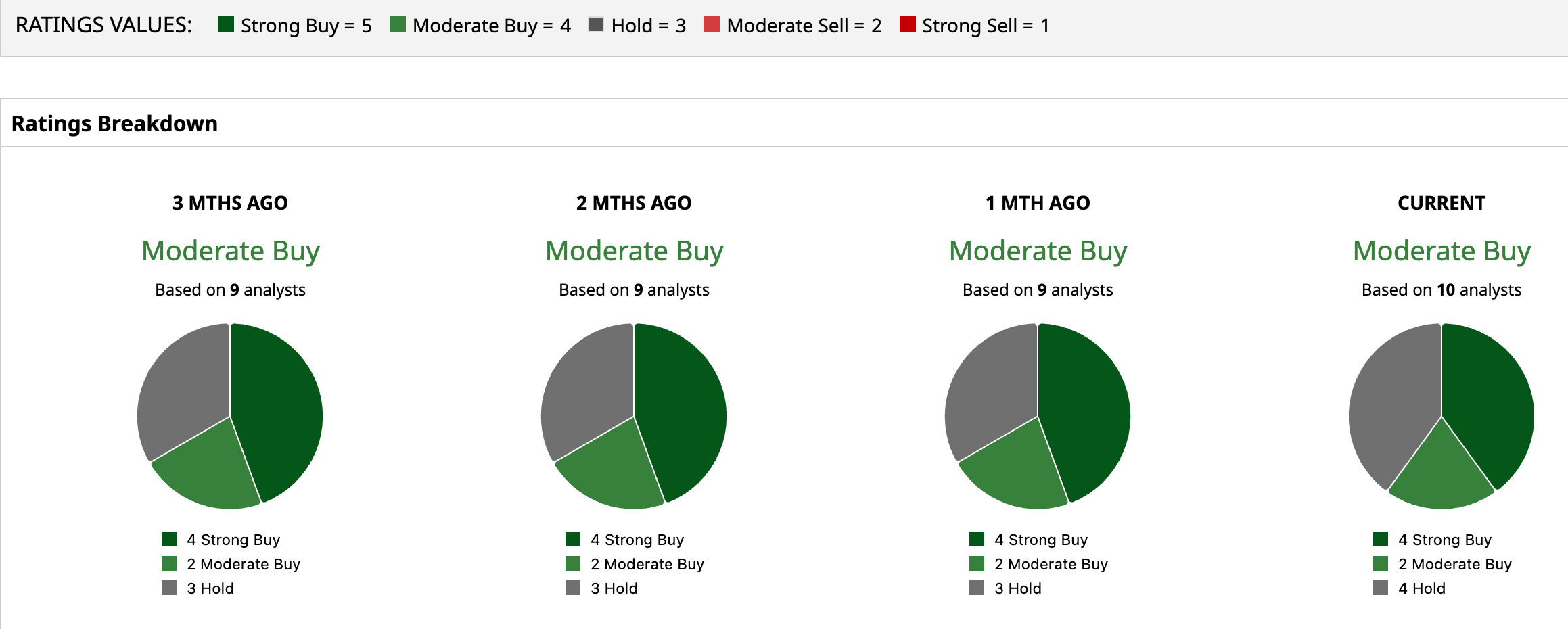

Wall Street analysts are soundly bullish on Archer Aviation’s stock, with analysts awarding it a consensus “Moderate Buy” rating. Of the 10 analysts rating the stock, four analysts have given it a “Strong Buy” rating, two analysts rated it “Moderate Buy,” while four analysts are playing it safe with a “Hold” rating. The consensus price target of $11.61 represents 35.6% upside from current levels. The Street-high price target of $18 represents a 110.3% potential upside.

Key Takeaways

Archer Aviation is laying the groundwork to support its impending commercialization through strategic partnerships and notable asset acquisitions. Therefore, this air-taxi stock might be a sound buy now in its pre-flight stage.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)