Carvana (CVNA) stock is literally back from the dead. In December 2022, the stock was trading in single digits. Three years down the line, CVNA stock trades at $450 with potential for further value creation.

The strong comeback from the brink of bankruptcy continues to gain traction. The latest feather in the cap is the announcement that Carvana will be joining the benchmark S&P 500 ($SPX) list of companies. That’s indeed a big turnaround from being the most heavily shorted stocks.

It goes without saying that things have taken a turn for the better from a fundamental perspective. Additionally, the medium- to long-term outlook for Carvana is positive. However, it makes sense to be cautiously optimistic and accumulate on declines after a rally of 130% year-to-date (YTD).

About Carvana Stock

Carvana is an e-commerce platform for buying and selling used cars. The company’s array of services through a vertically integrated model includes vehicle acquisition, inspection, and reconditioning. Further, the online platform also provides financing options.

Carvana has been on a robust growth trajectory with Q3 2025 revenue growth of 55% on a year-on-year (YoY) basis to $5.65 billion. For the same period, the company reported adjusted EBITDA of $637 million, which implies an adjusted EBITDA margin of 11.3%.

Backed by robust growth coupled with significant improvement in fundamentals, CVNA stock has trended higher by 37% in the last six months.

Ambitious Growth Targets

The big rally in CVNA stock through 2025 has been supported by stellar top-line growth. Importantly, the company’s growth momentum is far from being over.

To put things into perspective, the company is targeting selling 3 million cars annually in the next five to ten years. Wedbush estimates that the target is likely to be achieved by 2033.

Additionally, for Q3 2025, the company’s adjusted EBITDA margin was 11.3%. Once the above target is achieved, Carvana expects its adjusted EBITDA margin to swell to 13.5%. The next few years will therefore be characterized by healthy growth, margin expansion, and robust cash flows.

It’s important to note that Carvana has been able to outperform peers. The company’s vertically integrated operations, coupled with a focus on technology, provide an edge as compared to peers. As an example, Carvana has the capability of offering same-day delivery.

Coming back to the financials, Carvana reported operating cash flow of $606 million for the first nine months of 2025. Considering the growth trajectory, Carvana is positioned for annualized OCF of $1 billion in 2026. This provides ample flexibility to invest in technology, the company’s platform, and boosting customer experience.

What Analysts Say About CVNA Stock

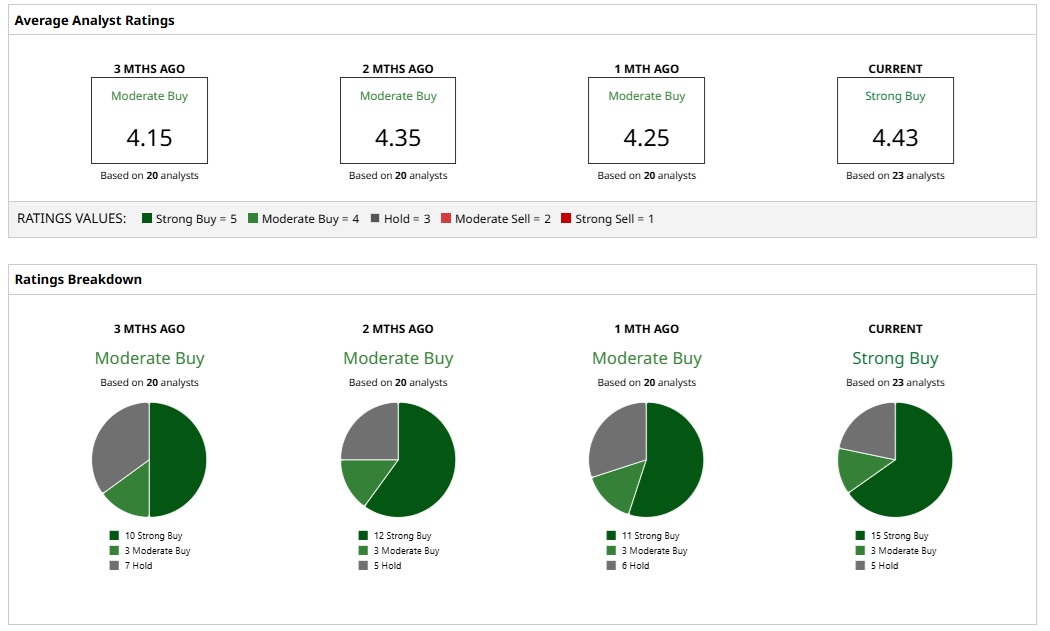

Based on the rating of 23 analysts, CVNA stock is a consensus “Strong Buy.”

While 15 analysts have assigned a “Strong Buy” rating, three and five analysts have a “Moderate Buy” and “Hold” rating, respectively.

Based on these ratings, the analysts have a mean price target of $435.81. This would imply a downside potential of 7%. However, considering the most bullish price target of $500, the upside potential is 7%.

Recently, BofA Securities raised the price target for CVNA stock to $455, considering the upcoming inclusion in the S&P 500. BofA also believes that Carvana will surpass CarMax (KMX) in 2026. At the same time, it’s likely that the company can deliver a 20%-unit CAGR from 2027 to 2032.

Also, UBS initiated coverage on CVNA stock earlier this month with a “Buy” rating and a price target of $450. UBS believes that Carvana, as a “true disruptor in the fragmented used vehicle market,” is positioned to achieve 25% EBITDA CAGR through the remainder of the decade.

It’s important to note that CVNA stock trades at a forward price-earnings ratio of 82.3 and a PEG of 1.44. Therefore, even as the long-term growth outlook is positive, some correction would be a good opportunity to accumulate.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)