/Teledyne%20Technologies%20Inc%20logo%20on%20website-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Teledyne Technologies Incorporated (TDY), headquartered in Thousand Oaks, California, is a leading provider of sophisticated instrumentation. With a market cap of $24.1 billion, the company provides aerospace and defense electronics, digital imaging products and software, monitoring instrumentation for marine and environmental applications, harsh environment interconnect products, and subsystems for satellite communications.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and TDY fits right into that category with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the scientific & technical instruments industry. TDY's diversified product portfolio through strategic acquisition effectively enhances its technological capabilities and market reach. The company’s innovation and investment in R&D, global presence, and long-term contracts has enabled it to maintain a competitive edge over its peers.

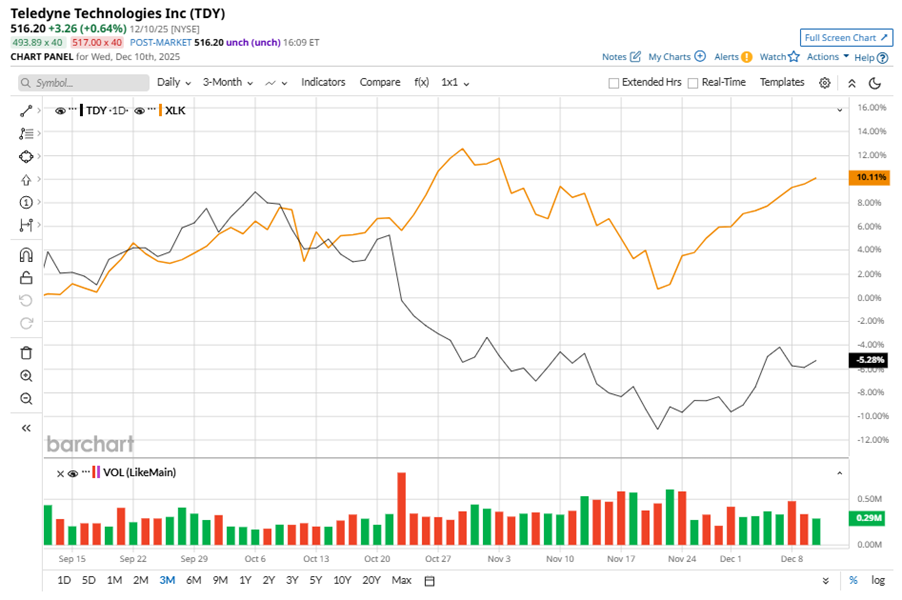

Despite its notable strength, TDY slipped 13.4% from its 52-week high of $595.99, achieved on Oct. 7. Over the past three months, TDY stock declined 5.3%, underperforming the Technology Select Sector SPDR Fund’s (XLK) 10.1% gains during the same time frame.

In the longer term, shares of TDY rose 3.1% on a six-month basis and climbed 9.6% over the past 52 weeks, underperforming XLK’s 23.5% gains on a six-month basis and 26.1% returns over the last year.

To confirm the bearish trend, TDY has been trading below its 200-day moving average since mid-November, with slight fluctuations. The stock has been trading below its 50-day moving average since late October.

On Oct. 22, TDY shares closed down more than 5% after reporting its Q3 results. Its adjusted EPS of $5.57 topped Wall Street expectations of $5.50. The company’s revenue was $1.54 billion, topping Wall Street forecasts of $1.52 billion. The company expects full-year adjusted EPS in the range of $21.45 to $21.60.

In the competitive arena of scientific & technical instruments, Keysight Technologies, Inc. (KEYS) has taken the lead over TDY, showing resilience with a 30.1% uptick on a six-month basis and 26% gains over the past 52 weeks.

Wall Street analysts are reasonably bullish on TDY’s prospects. The stock has a consensus “Moderate Buy” rating from the 11 analysts covering it, and the mean price target of $620.90 suggests a potential upside of 20.3% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)