/Genuine%20Parts%20Co_%20phone%20and%20website%20by-%20T_Scneider%20via%20Shutterstock.jpg)

Atlanta, Georgia-based Genuine Parts Company (GPC) is a leading global distributor of automotive and industrial replacement parts. Best known for its NAPA Auto Parts brand in North America, the company supplies a wide range of components to repair shops, retailers, and industrial customers. With a market cap of $17.6 billion, Genuine Parts operates over 10,700 locations spread across 17 countries and employs over 60,000 people.

Companies worth $10 billion or more are generally described as "large-cap stocks." Genuine Parts fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the auto parts industry. GPC benefits from consistent demand driven by an aging vehicle fleet and recurring maintenance needs, supporting stable cash flows. Its diversified operations across automotive, industrial, and international markets position it as a steady, defensive player in the distribution sector.

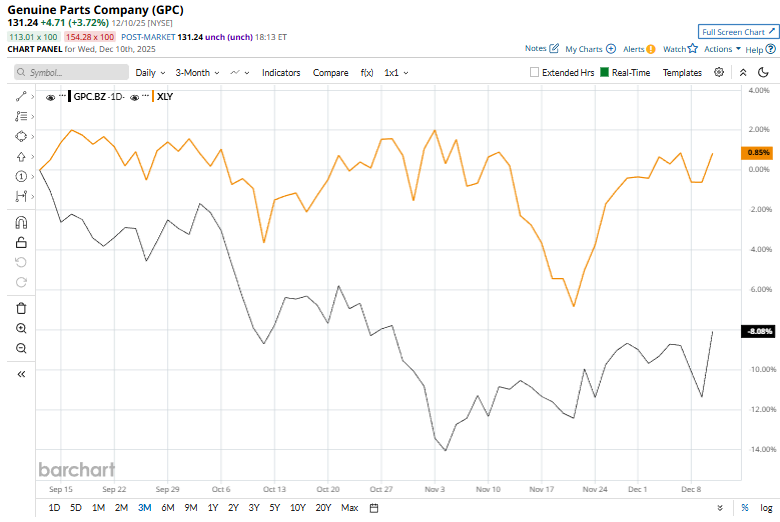

GPC is currently trading 8.5% below its 52-week high of $143.48. Meanwhile, the stock has declined 5.9% over the past three months, underperforming the Consumer Discretionary Select Sector SPDR Fund's (XLY) 2.8% returns during the same time frame.

However, GPC stock has surged 12.4% on a YTD basis and gained 4.7% over the past 52 weeks, outperforming the XLY’s 6.7% gains in 2025 and 3% return over the past year.

While GPC stock has been trading above its 200-day moving average since last month, it has dipped below its 50-day moving average since early October.

On Oct. 21, GPC shares soared 2.1% after the company released its third-quarter earnings. Its sales reached $6.3 billion, up 4.9% year-over-year, driven by comparable sales growth, acquisitions, and favorable foreign-exchange effects. Revenue beat consensus estimates, underscoring resilient demand in both its automotive and industrial segments. Adjusted diluted EPS rose to about $1.98, a 5.3% increase from the prior year. The company also raised its full-year 2025 revenue growth outlook to 3–4% from the prior range, reflecting confidence in ongoing execution despite a challenging macro backdrop.

When compared to its peer, GPC has notably lagged behind Aptiv PLC’s (APTV) 29.9% surge on a YTD basis and 34.5% gains over the past year.

Among the 12 analysts covering the GPC stock, the consensus rating is a “Moderate Buy.” Its mean price target of $147.88 implies a 12.7% upside from current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)