/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

Alphabet (GOOGL) (GOOG) finds itself in the limelight once again with the introduction of two new open-source models, DeepSeek-V3.2 and V3.2-Speciale, by DeepSeek that claim to be on a level with or better than that of some of the best proprietary models available in the market today, such as Gemini 3 Pro.

Of course, this brings about questions regarding whether the leadership role of Google's advancement in the AI field might be called into question. However, shares continue to trade near record levels based on solid fundamentals that reflect a strong demand for its Google Cloud business and a growing adoption of its developments in AI.

Investors have been keenly focused on the positioning of Alphabet regarding its adoption of AI. The recent Q3 earnings announcement made clear that its strategy for AI, which focuses on a fully integrated stack of chips, infrastructure, and models, has begun to gain traction while its business of subscriptions and advertising continues to deliver strong cash flow.

As attitudes towards technology begin to brighten and expenditures for AI infrastructure extend out into 2026, Alphabet continues to be a leading participant in a cycle that appears to be of a long duration.

About Alphabet Stock

Alphabet with headquarters in Mountain View, California, is a holding company for Google. This giant operates in search, online advertising, cloud computing, consumer products, and generative artificial intelligence. This firm ranks among the largest globally based on market capitalization: its total valuation exceeds $3.8 trillion. The technology giant derives revenue primarily from a number of profitable sources: advertisements, cloud computing services, and a diversified offering of AI-driven subscription-based services.

Over the 52-week period, GOOGL has rallied effectively from $140.53 to a current price of $312.55, showing strong investor confidence and outperforming the S&P 500 Index ($SPX). The stock's year-to-date (YTD) performance continues to be strong as a function of increasing adoption of generative AIs and a rapidly growing Google Cloud.

In terms of valuation, the stock has a forward price-to-earnings ratio of 30x, a price/sales ratio of 10.95, and a price/cash flow ratio of 33.54. The valuation parameters are strong for a large-cap tech stock but are in line with its robust revenue growth and increasing profitability. Return on equity stands strong at 35%.

This stock does not trade as one of those dividend-oriented companies with a name that indicates dividend payments.

Alphabet Beats on Earnings

Alphabet reported a strong Q3 2025 with revenue of $102.3 billion, an annual increase of 16%, making this its first-ever $100 billion quarter. Google Cloud reported a phenomenal quarter with 34% growth in revenue. Additionally, Search revenue and YouTube ad revenue grew with more than double digit growth. Operating margin was 30.5%, and 33.9% when adjusted for a fine received.

The encouraging observations made by management regarding overall momentum included Gemini processing 7 billion tokens per minute, with Gemini App exceeding 650 million MAU. The Google Cloud backlog also closed the quarter strong with a backlog of $155 billion. Capital expenditures for 2025 are forecasted in the range of $91 billion to $93 billion.

Also featured in the profits announcement was the promotion of product velocity regarding capabilities such as Overviews and Search with AI Mode. This indicates continued expansion in this region as a means for fast adoption of its AI technology while increasing its position in the cloud.

As for now, no confirmed date for the next earnings announcement has come out from Alphabet for this two-week period ahead. Thus, no additional details about the schedule follow.

What Do Analysts Expect for GOOGL Stock?

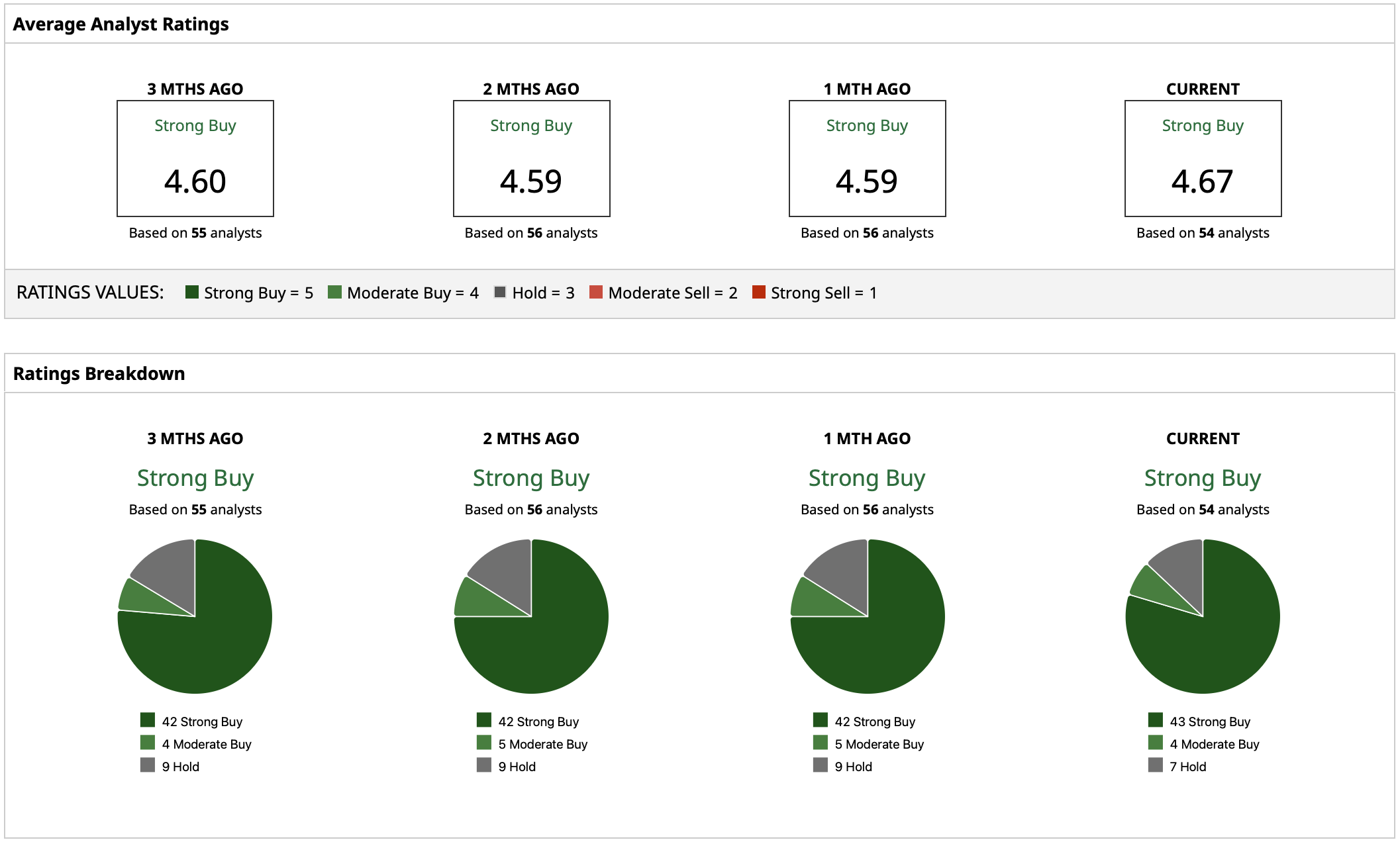

Alphabet earns a “Strong Buy” rating consensus, with most firms considering this stock a long-term compounder in AI. The recent few months have indicated more optimism due to a re-acceleration of growth in Cloud and a more integrated role for AI in Alphabet's lineup of products. A mean price target of $324.88 signifies a modest upside potential of about 4%. Some analysts have a target of $380, a bullish target that signifies strong belief in future AI monetization and infrastructure reach.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)