/Moody's%20Corp_%20phone%20with%20blue%20background-by%20IgorGolovniov%20via%20Shutterstock.jpg)

With a market cap of $83.9 billion, Moody's Corporation (MCO) is a global integrated risk-assessment firm operating through two segments, Moody’s Analytics and Moody’s Investors Service. The company provides credit ratings, data, analytics, and SaaS-based risk-management solutions to financial market participants.

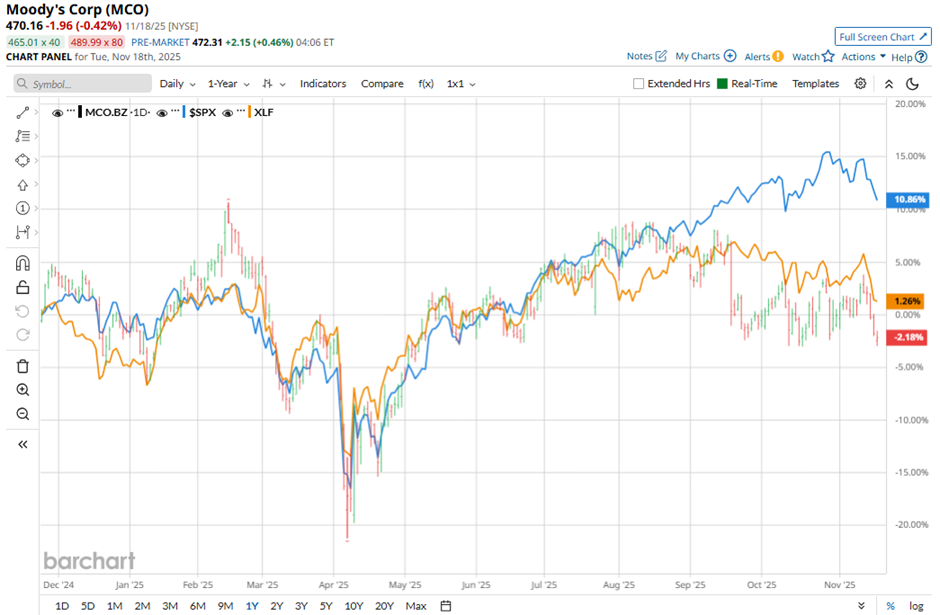

The credit ratings agency's shares have lagged behind the broader market over the past 52 weeks. MCO stock has declined marginally over this time frame, while the broader S&P 500 Index ($SPX) has increased 12.3%. Moreover, shares of the company are slightly down on a YTD basis, compared to SPX’s 12.5% gain.

In addition, shares of the New York-based company have also underperformed the Financial Select Sector SPDR Fund’s (XLF) 2.7% rise over the past 52 weeks.

Moody’s delivered stronger-than-expected Q3 2025 adjusted EPS of $3.92 and revenue of $2.01 billion on Oct. 22. The company raised its full-year outlook, lifting expected adjusted EPS to $14.50 - $14.75 and projecting high-single-digit revenue growth. It also reported strong performance in Moody’s Analytics and an 11% revenue increase in its ratings business, driven by robust bond issuance and tight credit spreads. However, the stock fell 2.5% on that day.

For the fiscal year ending in December 2025, analysts expect Moody's adjusted EPS to grow 17.4% year-over-year to $14.64. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

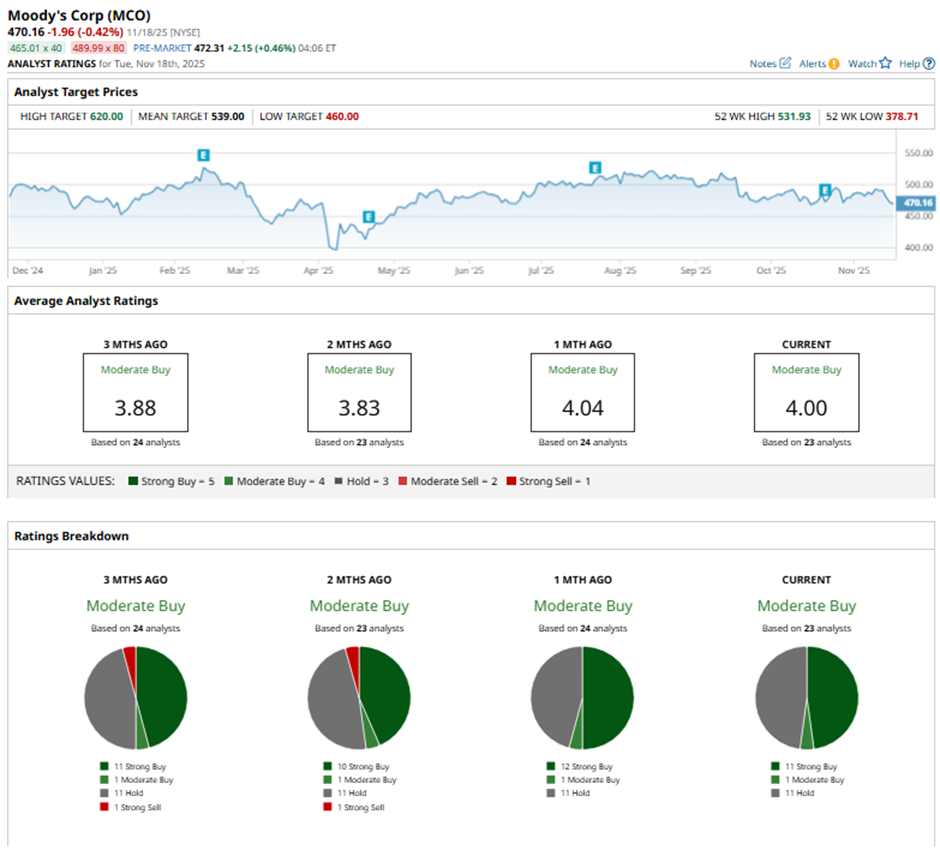

Among the 23 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, one “Moderate Buy,” and 11 “Holds.”

On Oct. 28, Mizuho analyst Sean Kennedy raised Moody’s price target to $550 and maintained a “Neutral” rating.

The mean price target of $539 represents a 14.6% premium to MCO’s current price levels. The Street-high price target of $620 suggests a 31.9% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)