/Tesla%20charging%20station%20black%20background%20by%20Blomst%20via%20Pixabay.jpg)

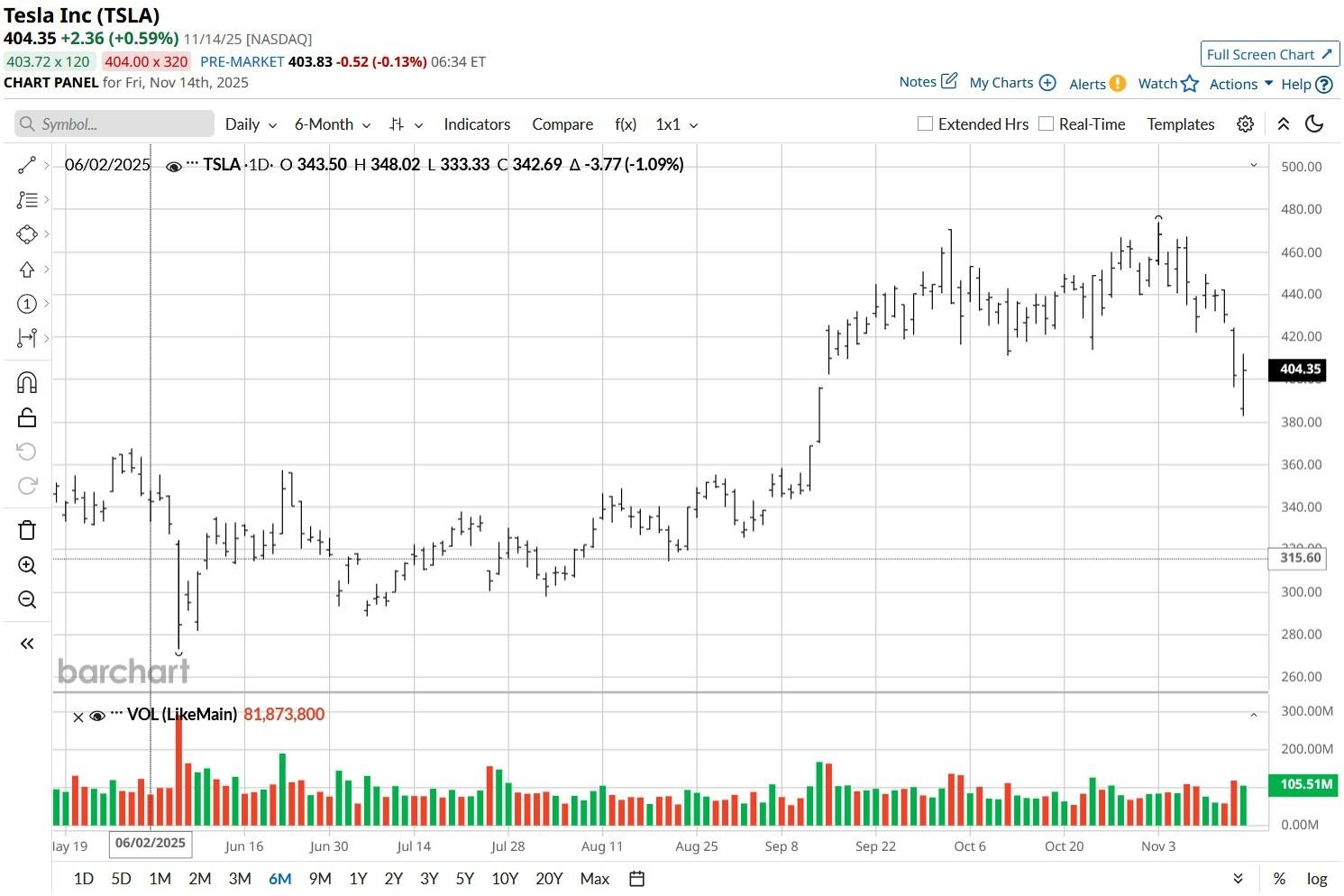

Tesla’s (TSLA) recent plunge amidst broader pressure on artificial intelligence (AI)-focused names has pushed it down nearly 7% over the past five sessions. However, shares are turning around, up just under 3% as of this writing on Monday, Nov. 17.

Despite ongoing weakness, Tesla stock remains up more than 90% versus its year-to-date low.

Options Data Suggests Tesla Stock Could Tumble Further

Options traders seem to be pricing in continued pressure on TSLA stock through the remainder of 2025.

According to Barchart, contracts expiring Feb. 20 currently have the lower bound of the expected move set at about $332, indicating potential for a further decline of nearly 20% over the next three months.

In the near term as well, the expected move through early December is 8.02% - which could push the EV stock down to roughly $378, testing the 100-day moving average support near $377 and accelerating bearish momentum further.

The Bear Case of TSLA Shares Heading into 2026

While Tesla chief executive Elon Musk believes about 80% of the company’s value will eventually come from its AI commitments, especially the Optimus humanoid robot.

However, UBS analysts warn those ambitions are distant for now, and weakness in TSLA’s core electric vehicle segment warrants caution in buying it at current levels.

According to the investment firm, rising costs, partly due to tariffs, and the loss of EV tax credits are among other major challenges for Tesla shares heading into 2026.

These headwinds made the Nasdaq-listed firm come in shy of profit estimates in its latest reported quarter.

How Wall Street Recommends Playing Tesla

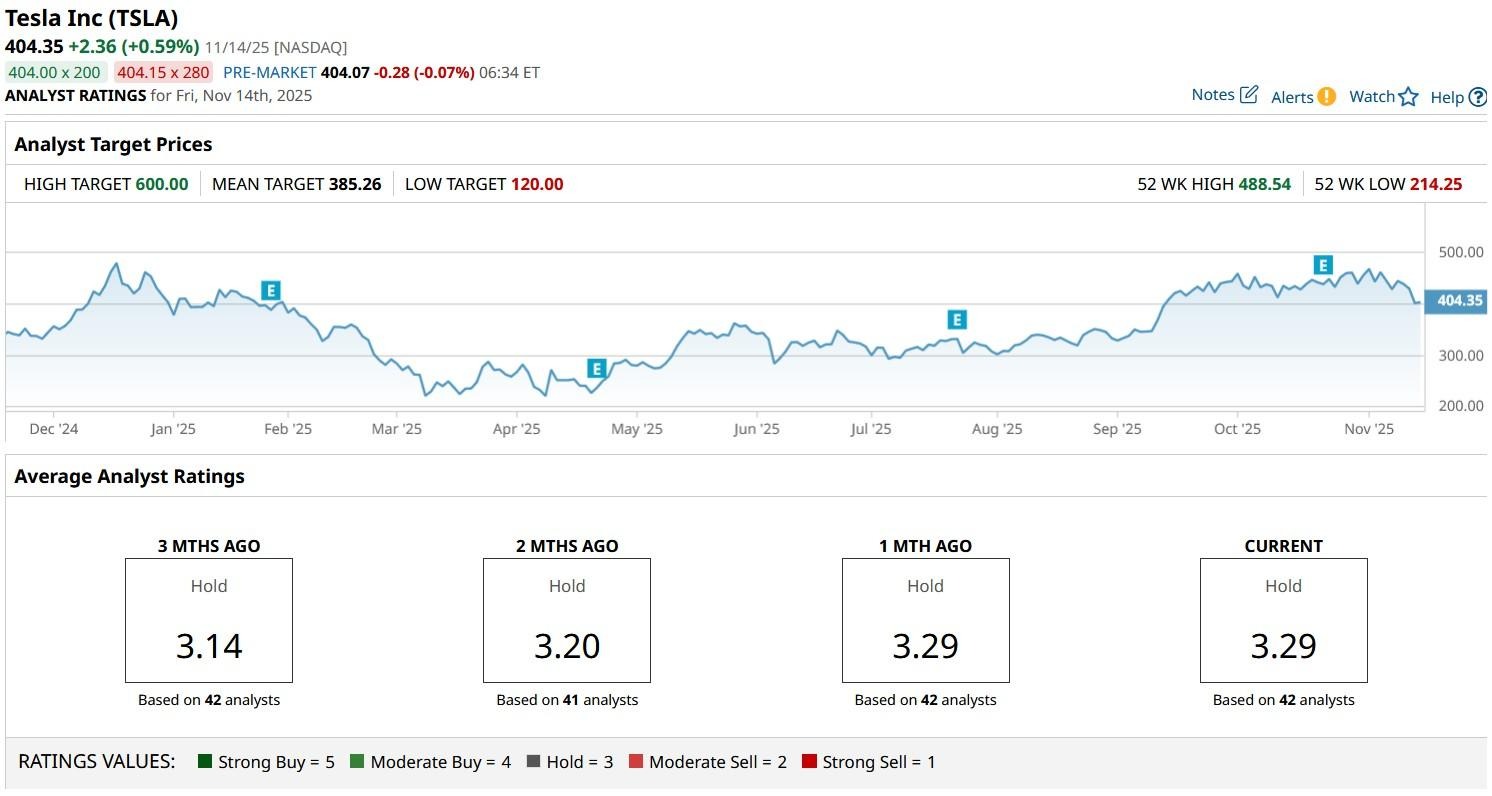

While not as bearish as UBS, Wall Street more broadly views TSLA shares as overvalued at current levels as well.

According to Barchart, the consensus rating on Tesla stock currently sits at “Hold” only, with the mean target of about $385 indicating potential downside of about 7% from here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)