On Friday, Nov. 7, investors shifted their focus to Canopy Growth (CGC), a Canada-based global leader in cannabis and cannabinoid-based consumer products, as its stock surged 7.34% after the release of its Q2 fiscal 2026 results.

The company outperformed analyst forecasts, driven by strong momentum in the Canadian adult-use and medical cannabis segments that reinforced its market position. Operational improvements and disciplined cost management helped narrow losses and lift gross margins, reflecting better execution and financial control.

Despite persistent supply chain challenges in Europe, the company’s Canadian operations maintained growth through innovative vape offerings and a steady increase in medical cannabis patients. These results highlight Canopy Growth’s evolving strategy and the resilience of its core markets in a shifting global environment.

For investors, the coming quarters will serve as a test of its ability to sustain margin expansion, strengthen international operations, and solidify medical leadership. The stock’s outlook now rests on consistent execution of these priorities and continued progress toward stable profitability.

About Canopy Growth Stock

The Smiths Falls, Canada-based CGC develops, produces, and distributes cannabis, hemp, and related consumer products. The company commands a market cap of around $287 million and serves both medical and recreational markets.

Its range includes high-THC cannabis flower, infused pre-rolls, advanced CCELL vape technology, and cannabis edibles such as Deep Space gummies. Premium brands like Tweed, 7ACRES, DOJA, Claybourne, and Deep Space represent the company’s flagship portfolio.

Despite the strong product lineup, the stock’s performance has remained under pressure. Over the past 52 weeks, CGC shares have fallen 70.18%, extending their decline with another 14% drop in the last month.

In contrast, the S&P 500 Index ($SPX) posted a 14.4% gain over the same year and a modest rise during the month, underscoring the stock’s struggle to keep pace with broader market momentum.

CGC currently trades at 1.83 times forward sales, a valuation that sits below both its five-year average and the broader industry multiple, suggesting that the stock may be undervalued relative to its peers.

Canopy Growth Surpasses Q2 Earnings

Canopy Growth reported consolidated net revenue of CAD $66.7 million ($47.5 million) for Q2 fiscal 2026, marking a 5.9% year-over-year (YOY) increase and surpassing the consensus estimate of CAD $51.79 million ($36.9 million).

The company recorded a 30.2% rise in Canadian adult-use cannabis sales and a 16.8% gain in Canadian medical cannabis revenue. These domestic gains offset a 39% drop in international cannabis sales caused by supply chain disruptions in Europe.

Gross margin improved sequentially to 33%, supported by stronger domestic sales and higher production efficiency. The company has now formed a specialized team to address its European supply chain challenges and expects those operations to stabilize and improve by the end of fiscal 2026.

Meanwhile, operating loss narrowed by 63.2% to CAD $16.9 million ($12.1 million) as cost management initiatives took hold. Adjusted EBITDA loss contracted 44.6% to CAD $3 million ($2.2 million), while net loss fell sharply to CAD $1.6 million ($1.2 million), representing a 98.7% improvement from the prior year’s period.

Loss per share narrowed 99.3% YOY to CAD $0.01, beating the analyst expectations of CAD $0.13 loss per share. Cash and cash equivalents totaled CAD $298.1 million ($212.2 million). This improvement alleviated earlier market concerns about the company’s financial viability.

Looking ahead, management anticipates that its focused product innovation and closer coordination with cannabis boards and retailers will drive stronger adult-use sales in Canada through the second half of fiscal 2026.

Nevertheless, analysts project that the company’s Q3 2026 loss per share will narrow 96.1% YOY to $-0.03. For full fiscal year 2026, the loss per share is expected to contract 93.3% to $-0.20, while for the next fiscal year, it is forecast to improve by another 80% to $-0.04.

What Do Analysts Expect for Canopy Growth Stock?

The company stands at a pivotal point. Cost discipline, operational refinement, and innovation will decide whether this momentum evolves into a sustained turnaround. Investors watching CGC through the next quarters would look for consistent delivery on these fronts.

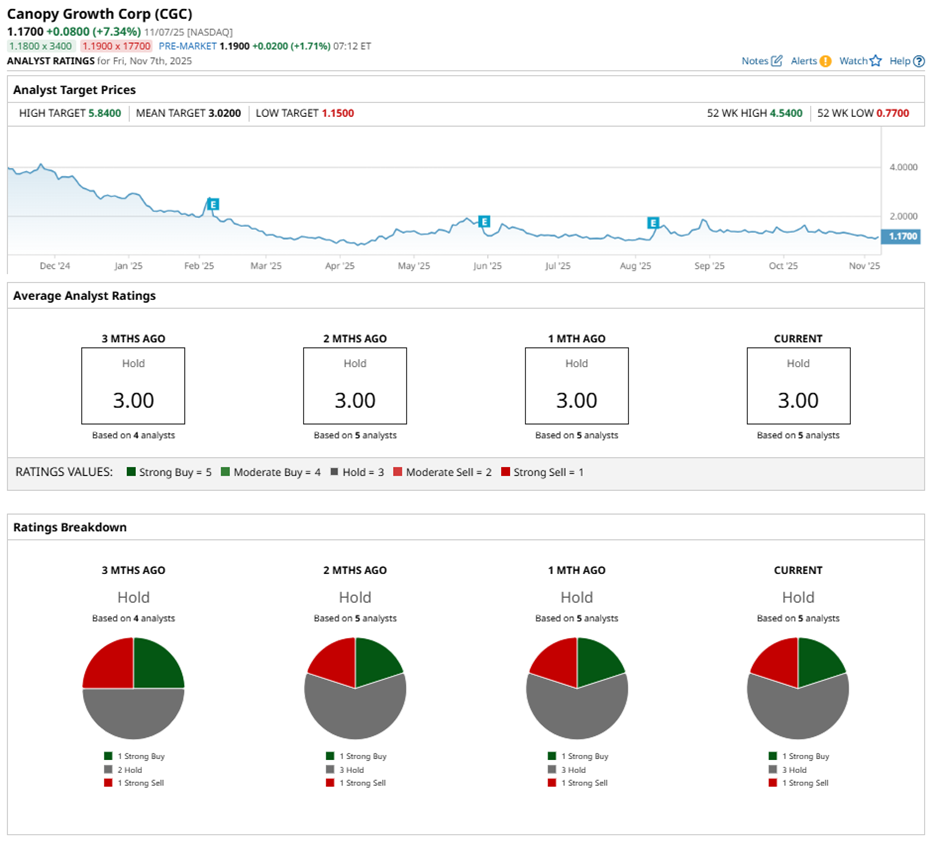

Analysts, for now, are walking the middle path. The consensus rating sits at “Hold,” with one analyst calling CGC a “Strong Buy,” three advising to “Hold,” and one recommending a “Strong Sell.”

CGC’s average price target stands at $2.65, suggesting potential upside of 120.84%. The Street-high target of $5.84 represents an even greater potential gain of 386.67%.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20outside%20building-by%20BING-JHEN_HONG%20via%20iStock.jpg)